Stablecoins are a type of cryptocurrency designed to have a stable value, as opposed to the significant volatility seen in cryptocurrencies like Bitcoin and Ethereum. They achieve this stability by being pegged to a reserve or basket of goods, often traditional fiat currencies like the US Dollar, Euro, or Gold.

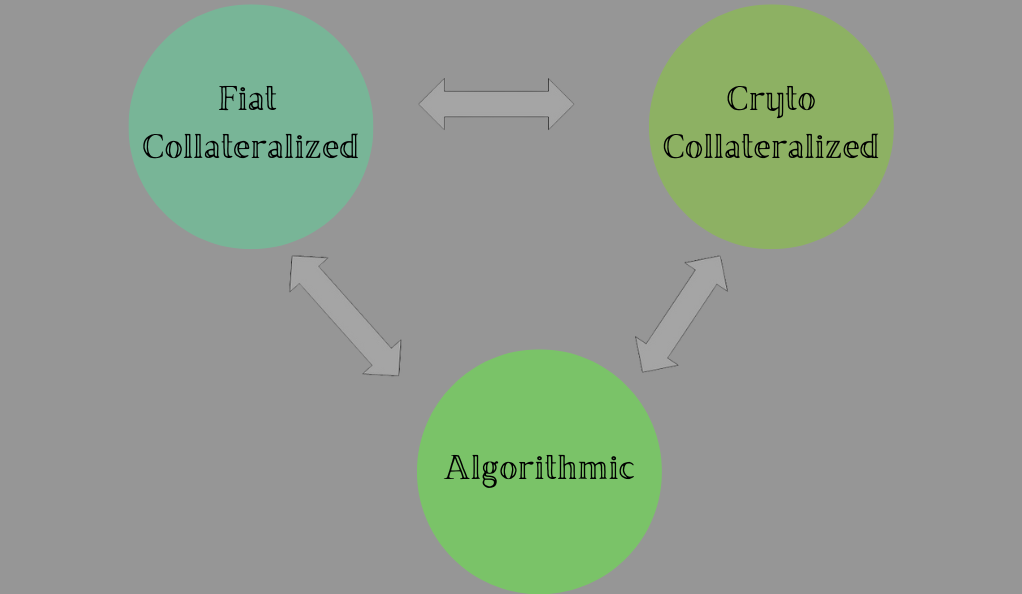

Types of Stablecoins

| Type | Description | Examples |

|---|---|---|

| Fiat-collateralized | Backed by a reserve of traditional fiat currencies. For every stablecoin issued, there’s a corresponding unit of currency held in reserve. | Tether (USDT), USD Coin (USDC) |

| Crypto-collateralized | Backed by a reserve of other cryptocurrencies. These systems use smart contracts to ensure the stablecoin’s value remains pegged. | DAI, sUSD |

| Algorithmic | Not backed by any reserve but uses algorithms to automatically adjust the stablecoin’s supply based on its demand, aiming to keep its price stable. | Ampleforth, Terra |

Why Stablecoins?

Stablecoins have emerged as a significant innovation in the world of digital finance. The primary purpose of stablecoins is to bridge the gap between the fast-paced digital world of cryptocurrencies and the more traditional financial system. By offering a stable value, they address some of the volatility concerns associated with other cryptocurrencies. Here’s why their stable value makes them so indispensable:

Trading and Liquidity:

In the realm of cryptocurrency trading, stablecoins serve as a crucial anchor. They provide a stable medium of exchange on cryptocurrency trading platforms, particularly when traders need to move funds swiftly in and out of more volatile assets. This stability ensures that traders can hedge against extreme market fluctuations.

Payments:

The world of commerce is rapidly evolving, and stablecoins are at the forefront of this change. Their consistent value makes them an excellent choice for everyday transactions, both in online marketplaces and traditional brick-and-mortar stores. Merchants can accept stablecoins with the confidence that their value won’t drastically change overnight.

Remittances:

For those who send money across borders, stablecoins offer a revolutionary solution. They can be used for cross-border transactions without the exorbitant fees or lengthy time constraints typically associated with traditional banking systems. This makes international transfers faster, cheaper, and more efficient.

Decentralized Finance (DeFi):

The DeFi sector is booming, and stablecoins are at its core. They play a pivotal role in various DeFi platforms, from lending and borrowing to yield farming. Their stability ensures that users can earn consistent returns without the fear of sudden value drops, making them a preferred choice for many DeFi applications.

Comparison Table: Stablecoins vs. Traditional Cryptocurrencies

| Criteria | Stablecoins | Traditional Cryptocurrencies |

|---|---|---|

| Value Stability | High (pegged to stable assets) | Low (subject to market volatility) |

| Use Case | Trading, payments, remittances, DeFi | Investment, speculation, some niche payments |

| Underlying Asset | Fiat currencies, other cryptocurrencies, algorithms | None (value derived from market demand) |

| Supply Mechanism | Fixed by the reserve or algorithm | Often limited (e.g., Bitcoin’s 21 million cap) |

Challenges and Criticisms:

While stablecoins offer many advantages, they’re not without challenges:

- Centralization Concerns: Fiat-collateralized stablecoins are often managed by centralized entities, leading to concerns about transparency and trustworthiness.

- Collateral Volatility: Crypto-collateralized stablecoins are backed by volatile assets, which can pose risks if the collateral’s value drops significantly.

- Regulatory Uncertainty: As stablecoins grow in popularity, they face increasing scrutiny from regulators worldwide.

Stablecoins in the Spotlight

In recent years, the cryptocurrency landscape has witnessed a surge in the popularity and adoption of stablecoins. As these digital assets continue to gain traction, they’ve become a focal point for both enthusiasts and skeptics alike. This section delves into the rapid growth of stablecoins, their increasing global use cases, and the potential financial risks they introduce.

Rapid Growth and Increasing Global Use Cases

Stablecoins have been at the forefront of the cryptocurrency revolution, witnessing exponential growth in both market capitalization and daily transaction volumes. Their rise can be attributed to several key factors:

Trading and Arbitrage:

Stablecoins have become an essential tool for traders in the cryptocurrency market. They offer a quick and efficient means to transfer value between different cryptocurrency exchanges. This facilitates arbitrage opportunities, allowing traders to capitalize on price differences between exchanges, and ensures liquidity in the market.

Cross-border Transactions:

The global nature of business today requires efficient and cost-effective means of transferring funds across borders. Stablecoins, with their ability to bypass traditional banking systems, have emerged as a preferred choice for remittances and international trade. This is especially true in regions where local currencies are unstable or where there are stringent capital controls in place.

Integration in Decentralized Finance (DeFi):

The DeFi sector has seen a surge in popularity and adoption in recent years. Stablecoins have become an integral part of this ecosystem, serving as the backbone for a myriad of applications. From lending and borrowing platforms to yield farming and decentralized exchanges, stablecoins ensure stability and trust in the DeFi space.

Mainstream Adoption:

The potential of stablecoins hasn’t gone unnoticed by the traditional financial sector. Major financial institutions, payment platforms, and even governments are beginning to integrate stablecoins into their operations. They recognize the immense potential these digital assets have in streamlining operations, reducing transaction costs, and offering a more inclusive financial system.

Table: Growth of Major Stablecoins (2019-2023)

| Stablecoin | 2019 Market Cap | 2023 Market Cap | Growth Rate |

|---|---|---|---|

| Tether (USDT) | $4 billion | $70 billion | 1650% |

| USD Coin (USDC) | $500 million | $30 billion | 5900% |

| DAI | $100 million | $5 billion | 4900% |

Potential Financial Risk Contagion Channels

The rise of stablecoins in the digital finance landscape brings with it both opportunities and challenges. While they offer numerous benefits, there are also potential systemic risks that could impact the global financial system:

Over-reliance on Reserves:

Fiat-collateralized stablecoins often tout their reserves as a guarantee of their value. They claim to have reserves equivalent to, or even exceeding, their circulating supply. However, any discrepancy in these reserves, or a lack of transparency regarding their holdings, can lead to a significant crisis of confidence. Such an event could destabilize not just the stablecoin in question but also have ripple effects throughout the broader cryptocurrency market.

Interconnectedness with Traditional Finance:

Stablecoins are increasingly finding their way into mainstream financial systems. As they become more integrated with traditional finance, any disruption or instability in the stablecoin market could have cascading effects, potentially destabilizing global financial markets and institutions.

Lack of Regulatory Oversight:

The world of stablecoins is still relatively new, and regulatory frameworks are still in their infancy. The absence of a standardized and robust regulatory oversight can lead to potential malpractices. This increases the risk of financial contagion, where issues in the stablecoin market could spill over into the broader financial system.

Market Concentration:

The stablecoin market, while diverse, is dominated by a few major players. These dominant stablecoins have a significant influence on the market dynamics. Any operational, financial, or regulatory issue with these major stablecoins could have disproportionate and far-reaching effects on the entire cryptocurrency and digital finance ecosystem.

Stablecoins’ Role within the Crypto-Asset Ecosystem

Stablecoins, once a peripheral player in the crypto-asset ecosystem, have now cemented their position as a cornerstone of the digital economy. Their journey from being merely a “parking space” for traders to becoming an indispensable tool in the crypto world is nothing short of remarkable. This section explores the evolution of stablecoins within the crypto-asset ecosystem and their growing significance in decentralized finance (DeFi).

Evolution from a “Parking Space” to a Critical Component in Crypto Trading

In the early days of cryptocurrency trading, volatility was (and still is) a significant concern. Traders needed a safe haven to “park” their assets during turbulent market conditions without converting back to fiat, which could be costly and time-consuming. Enter stablecoins.

- Safety Amidst Volatility: Stablecoins provided traders with a refuge from the wild price swings of cryptocurrencies like Bitcoin and Ethereum. They could quickly move their assets into stablecoins, preserving their value during market downturns.

- Efficient Value Transfer: Beyond just a safe haven, stablecoins offered a seamless way to transfer value across exchanges, enabling traders to capitalize on arbitrage opportunities without the delays of traditional banking systems.

- Liquidity Provision: As more traders adopted stablecoins, their liquidity on exchanges increased, making them a preferred trading pair over direct fiat-to-crypto pairs.

The Rise of Decentralized Finance (DeFi) and New Use Cases for Stablecoins

DeFi, or decentralized finance, represents a paradigm shift in the world of finance, aiming to recreate traditional financial systems (like lending, borrowing, and trading) on blockchain without intermediaries. Stablecoins have become the lifeblood of this burgeoning ecosystem.

- Collateral in DeFi Platforms: On platforms like MakerDAO, users can lock up their assets (like ETH) to mint stablecoins (like DAI). These stablecoins can then be used for various purposes, from trading to earning interest.

- Yield Farming: Stablecoins are at the heart of the yield farming phenomenon, where users provide liquidity in the form of stablecoins to earn rewards. This has led to innovative financial products and strategies, further integrating stablecoins into the DeFi landscape.

- Decentralized Exchanges (DEXs): DEXs like Uniswap or Sushiswap rely heavily on stablecoin pairs for trading, offering users a decentralized platform to swap assets without the need for traditional intermediaries.

- Payment Systems: Beyond just trading and finance, stablecoins are now being used in decentralized payment systems, enabling peer-to-peer transactions without the volatility of traditional cryptocurrencies.

Table: Key Stablecoins in DeFi

| Stablecoin | Primary Use Case in DeFi | Backing Mechanism |

|---|---|---|

| DAI | Collateral, Yield Farming | Crypto-collateralized |

| USDC | Trading, Payments | Fiat-collateralized |

| sUSD | Trading, Lending | Crypto-collateralized |

Technical Challenges and Comparisons with Traditional Payment Systems

The adoption of stablecoins as a mainstream means of payment isn’t without hurdles. Here are some of the technical challenges they face, juxtaposed against traditional payment systems:

Transaction Speed:

- Stablecoins: Depending on the blockchain they’re built on, stablecoin transactions can sometimes face congestion, leading to delays.

- Traditional Systems: Systems like credit card networks can handle thousands of transactions per second, offering near-instant payment confirmations.

Interoperability:

- Stablecoins: Different stablecoins exist on various blockchains, leading to interoperability issues. Transferring value between these can be cumbersome.

- Traditional Systems: Established networks like SWIFT facilitate seamless international transfers between banks globally.

Scalability:

- Stablecoins: Blockchains like Ethereum face scalability issues, which can increase transaction costs (gas fees) during peak times.

- Traditional Systems: Centralized systems can scale their infrastructure based on demand, ensuring consistent transaction fees.

Regulatory and Compliance:

- Stablecoins: The regulatory landscape for stablecoins is still evolving, leading to uncertainties.

- Traditional Systems: Traditional payment systems operate within well-defined regulatory frameworks, ensuring compliance.

The Potential and Limitations of Blockchain Technology for Payments

Potential:

- Decentralization: Blockchain offers a decentralized payment infrastructure, reducing the need for intermediaries and potentially lowering costs.

- Transparency and Security: Transactions on a blockchain are transparent and immutable, enhancing security and reducing fraud.

- Global Reach: Stablecoins can facilitate cross-border transactions efficiently, bypassing traditional banking systems and their associated fees.

- Financial Inclusion: For regions with limited banking infrastructure, stablecoins can offer an accessible means of payment and store of value.

Limitations:

- Volatility (for non-stable cryptocurrencies): While stablecoins aim to mitigate volatility, other cryptocurrencies can be highly volatile, making them less suitable as a means of payment.

- Energy Consumption: Blockchains like Bitcoin have been criticized for their high energy consumption, raising environmental concerns.

- Adoption Barriers: For many, the learning curve associated with using cryptocurrencies and managing cryptographic keys can be a deterrent.

- Regulatory Uncertainties: The evolving regulatory landscape can pose challenges for businesses and users looking to adopt stablecoins for payments.

Potential Risks to Financial Stability

The rise of stablecoins has brought with it a plethora of opportunities for the financial world. However, like all innovations, they come with their own set of challenges and potential risks. Particularly, the integration of stablecoins into the broader financial system raises concerns about their implications for global financial stability. This section delves into the contagion channels associated with stablecoins, their potential repercussions, and the critical role of reserve asset management and transparency.

Contagion Channels and Their Implications

Stablecoins, especially those with significant market capitalization, can introduce systemic risks through various contagion channels:

Run on Reserves:

- If users begin doubting the solvency of a stablecoin issuer or the backing of the stablecoin, it can trigger a “run” where users rush to redeem their stablecoins. This can strain the reserves and potentially lead to a collapse if the issuer cannot meet the demand.

- Implication: Such an event can have cascading effects on other financial markets, especially if the stablecoin in question plays a significant role in trading and liquidity provision.

Interconnectedness with Traditional Finance:

- As stablecoins become more integrated with mainstream financial systems, any disruption in their operations could ripple through other markets.

- Implication: A failure or regulatory crackdown on a major stablecoin could impact its institutional partners, leading to broader financial instability.

Market Concentration:

- A significant portion of the stablecoin market is dominated by a few major players. Any issue with these dominant stablecoins could have disproportionate effects.

- Implication: The failure of a dominant stablecoin could lead to a loss of confidence in other stablecoins and the broader crypto market, triggering widespread sell-offs.

The Importance of Reserve Asset Management and Transparency

To mitigate the risks posed by stablecoins to financial stability, two key areas need to be addressed:

Reserve Asset Management:

- Robust Management: Issuers must ensure that the reserves backing the stablecoin are managed prudently. This includes diversifying the assets held as reserves and ensuring they are of high quality and liquidity.

- Regular Audits: Periodic third-party audits should be conducted to verify the existence and adequacy of the reserves. This can help in building trust and confidence among users.

Transparency:

- Open Communication: Issuers should maintain open channels of communication with their users, updating them about any changes in the reserve composition or the stablecoin’s operations.

- Regulatory Reporting: Complying with regulatory reporting requirements can ensure that issuers are held accountable and that there’s oversight over their operations.

Recent Developments and Market Dynamics

The crypto landscape is ever-evolving, with new developments and market dynamics shaping the trajectory of various assets, including stablecoins. Recent events, such as the crash of TerraUSD and the temporary de-pegging of Tether, have brought to light the vulnerabilities and intricacies of the stablecoin market. This section delves into these case studies, exploring the market reactions and the subsequent behaviors of investors.

Case Studies:

The Crash of TerraUSD (UST):

- Background: TerraUSD (UST) is an algorithmic stablecoin that aims to maintain its peg to the US dollar. Unlike fiat-collateralized stablecoins, UST relies on a mechanism where it adjusts its supply based on demand to maintain its peg.

- The Crash: Due to a combination of external market pressures and internal protocol dynamics, UST temporarily lost its peg, trading significantly below $1.

- Market Reaction: The deviation from its peg led to panic selling by some investors, further exacerbating the price drop. However, the Terra protocol’s mechanisms eventually kicked in, and UST was able to regain its peg after some time.

- Investor Behavior: The event highlighted the risks associated with algorithmic stablecoins, leading to discussions about their long-term viability and prompting some investors to move towards more traditional fiat-collateralized stablecoins.

The Temporary De-pegging of Tether (USDT):

- Background: Tether (USDT) is one of the most widely used fiat-collateralized stablecoins, claiming to have a 1:1 peg with the US dollar.

- De-pegging Incident: Amidst concerns about the actual reserves backing USDT and regulatory scrutiny, Tether temporarily traded below its $1 peg.

- Market Reaction: Given Tether’s dominant position in the market, its de-pegging sent shockwaves across the crypto ecosystem, leading to significant price volatility for various assets.

- Investor Behavior: The incident spurred debates about the transparency and reliability of Tether’s reserve claims. Many investors diversified their holdings into other stablecoins like USDC, seeking perceived safety and transparency.

Market Reactions and Investor Behaviors:

- Flight to Safety: Incidents like the ones mentioned above often lead to a flight to safety, with investors moving their assets to more established or perceived “safer” stablecoins or even out of the crypto market temporarily.

- Increased Scrutiny: Such events bring stablecoins under the microscope, leading to increased scrutiny from both the crypto community and regulators. Discussions about the need for more transparent audits and regulatory oversight gain traction.

- Diversification: To hedge against the risks associated with any single stablecoin, investors often diversify their holdings across multiple stablecoins, reducing potential exposure.

- Educated Decision-making: As the market matures, investors are becoming more educated. They’re more likely to research the mechanisms and backing of their chosen stablecoins, making informed decisions based on their risk tolerance.

Regulating Stablecoins for a Safer Future

The meteoric rise of stablecoins in the financial ecosystem has brought with it a myriad of opportunities, but also challenges and potential risks. As these digital assets become more integrated into the global economy, the call for robust regulatory frameworks grows louder. This section delves into the pressing need for a global regulatory approach to stablecoins, highlighting current steps taken and offering recommendations for future regulations.

The Need for a Global Regulatory Approach

- Cross-border Nature: Stablecoins, by their very design, are borderless. They facilitate transactions across countries, making it challenging for any single nation’s regulatory framework to effectively oversee their operations.

- Systemic Risks: Given the potential of stablecoins to introduce systemic risks to the global financial system, a fragmented regulatory approach could leave gaps that might be exploited, leading to financial instability.

- Uniform Standards: A global approach ensures that stablecoin issuers adhere to a consistent set of standards, fostering trust among users and reducing the potential for regulatory arbitrage.

- Promoting Innovation: While regulation is essential for safety, it’s equally crucial that it doesn’t stifle innovation. A coordinated global approach can ensure that regulations are balanced, promoting both safety and innovation.

Current Steps and Recommendations for Stablecoin Regulations

Current Steps:

- Increased Scrutiny: Regulatory bodies across the globe, from the U.S. SEC to the European Central Bank, have increased their scrutiny of stablecoins, seeking to understand their operations and potential implications better.

- Guidelines and Frameworks: Some countries have started to release guidelines for stablecoin issuers, focusing on areas like reserve management, transparency, and anti-money laundering (AML) measures.

- Collaborative Discussions: International forums like the G20 and the Financial Stability Board (FSB) have initiated discussions on the global implications of stablecoins and the need for coordinated regulatory efforts.

Recommendations:

- Transparent Reserve Audits: Regulatory frameworks should mandate regular and transparent third-party audits of stablecoin reserves, ensuring that issuers maintain the claimed backing.

- Consumer Protection: Regulations should emphasize the protection of stablecoin users, ensuring they have recourse in case of disputes and are adequately informed about potential risks.

- Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT): Given the potential for stablecoins to be used in illicit activities, robust AML and CFT measures should be a cornerstone of any regulatory framework.

- Interoperability Standards: As the stablecoin ecosystem grows, ensuring interoperability between different stablecoins and traditional financial systems can foster more seamless integration and adoption.

- Engage with Industry Stakeholders: Regulators should maintain open channels of communication with stablecoin issuers, crypto exchanges, and other stakeholders, ensuring that regulations are both effective and balanced.

Conclusion

Stablecoins, as a transformative force in the digital financial realm, have undeniably reshaped how transactions are conducted across borders. Their potential to streamline operations, enhance liquidity, and bridge the traditional and digital economies is immense. However, with these advantages come challenges that necessitate a well-thought-out regulatory framework. As the world grapples with the intricacies of integrating stablecoins into the broader financial ecosystem, a harmonized global approach to regulation emerges as the linchpin. Such an approach not only ensures the safety and trust of users but also paves the way for innovation, fostering a future where digital and traditional finance coalesce seamlessly. As we move forward, the balance between harnessing the potential of stablecoins and ensuring financial stability will be paramount, setting the stage for the next chapter in global finance.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More