Money laundering, a term that often conjures images of shady dealings and covert operations, is a complex financial process with deep historical roots. At its core, money laundering is the act of disguising the origins of money obtained through illicit means, making it appear as though it came from legitimate sources.

Historical Context

The concept of money laundering isn’t new. Its origins can be traced back to ancient times when merchants would hide their wealth to avoid taxation or confiscation by rulers. However, the term “money laundering” gained prominence during the Prohibition era in the United States in the 1930s. Organized crime syndicates, profiting from the illegal sale of alcohol, needed a way to legitimize their ill-gotten gains. They would invest in seemingly legitimate businesses, like laundromats, to mix the illegal funds with legal earnings, thus “laundering” the money.

Eras and Their Significant Events:

- 1930s: Rise of organized crime during Prohibition in the U.S.

- 1980s: Governments focus on money laundering to combat drug trafficking.

- 2000s: Emphasis on combating terrorism financing post 9/11.

Definition and Significance

In modern times, the definition of money laundering has expanded. It’s not just about concealing the origins of money but also involves a series of actions:

- Placement: Introducing the “dirty” money into the financial system.

- Layering: Complex layers of financial transactions designed to confuse and cloud the paper trail.

- Integration: The “clean” money is then integrated into the economy, making it difficult to distinguish from legitimate business earnings.

The significance of combating money laundering cannot be overstated. It’s not just about preventing criminals from enjoying their ill-gotten gains. Money laundering fuels other illicit activities, from drug trafficking to terrorism. It destabilizes economies, corrupts financial institutions, and even compromises governments.

In the age of digital transactions and global economies, the fight against money laundering has become even more critical. As we delve deeper into the world of cryptocurrencies, like the X11, understanding the intricacies of money laundering becomes paramount.

The Process of Money Laundering

Delving deeper into the world of money laundering, it’s essential to understand the intricate processes that allow illicit funds to appear legitimate. This transformation doesn’t happen overnight; it’s a calculated series of steps designed to obfuscate the origins of the money.

The Three-Step Process

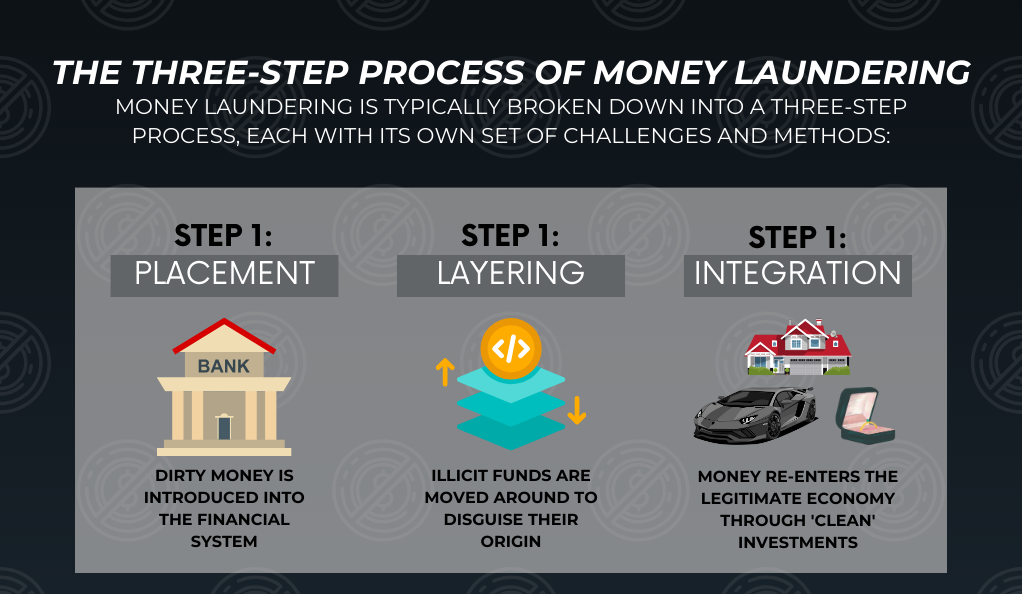

Money laundering is typically broken down into a three-step process, each with its own set of challenges and methods:

- Placement: This is the initial stage where the “dirty money” is first introduced into the financial system. This could be done through methods like bank deposits, purchasing assets, or using the money for gambling.

- Layering: Once the money is in the system, the goal is to confuse any traceable trail. This is achieved by creating a complex series of financial transactions that move the money around, making it challenging to follow. Examples include transferring money between different accounts (often across various banks or even countries), altering the form of the money by buying and selling assets, or simply withdrawing and depositing the money repeatedly.

- Integration: In this final stage, the “clean” money enters the legitimate economy, blending seamlessly with legally earned funds. This integration might involve investing in legal business ventures, buying high-value items, or engaging in other activities that make the money appear legally obtained.

Modern Methods and Techniques

While the three-step process provides a general framework, money launderers continuously evolve their methods to stay ahead of law enforcement. Some modern techniques include:

- Digital Currencies: With the rise of cryptocurrencies, money launderers have a new tool at their disposal. Digital currencies can be traded anonymously, making them an attractive option for those looking to hide the origins of their money.

- Trade-Based Laundering: This involves manipulating invoices to disguise the movement of money. For instance, a money launderer might overstate the value of goods or services on an invoice, funneling the excess money into their own pockets.

- Shell Companies: These are businesses that exist only on paper and have no office or employees. They’re used solely to manage funds and hide who owns the money.

- Offshore Accounts: By moving money to financial institutions in countries with strict bank secrecy laws, money launderers can hide their funds from scrutiny.

Cryptocurrencies and Money Laundering

In the digital age, the financial landscape has undergone a significant transformation, with cryptocurrencies emerging as a revolutionary force. These decentralized digital currencies, operating independently of a central bank, have introduced new opportunities and challenges in the realm of money laundering.

The Rise of Digital Currencies

Cryptocurrencies, spearheaded by Bitcoin, have seen exponential growth over the past decade. Their decentralized nature, combined with the promise of anonymity and the potential for high returns, has made them immensely popular. As of now, there are thousands of different cryptocurrencies available, each with its own unique features and uses.

| Year | Notable Cryptocurrency Events |

|---|---|

| 2009 | Introduction of Bitcoin |

| 2013 | Emergence of altcoins like Litecoin and Ripple |

| 2017 | Bitcoin reaches an all-time high, sparking mainstream interest |

| 2020 | Widespread adoption by institutional investors and businesses |

Challenges and Opportunities in Tracking Illicit Activities

The very features that make cryptocurrencies attractive – decentralization, encryption, and anonymity – also make them a potential tool for money laundering:

- Anonymity: Even though the blockchain, a public ledger, records all cryptocurrency transactions, it encrypts the identities of the involved parties. This encryption challenges anyone trying to determine the real-world identities behind each transaction.

- Cross-border Transactions: People can send and receive cryptocurrencies anywhere globally, completing transactions faster than with traditional banking systems. This vast global accessibility, along with the absence of centralized oversight, complicates the tracking of illicit activities.

- Mixing Services: These are third-party services that mix potentially identifiable cryptocurrency funds with others, making it harder to trace the original source.

- Decentralized Exchanges (DEXs): Unlike centralized exchanges, DEXs operate without a central authority, allowing users to trade directly with one another. This can make it harder for authorities to monitor and regulate transactions.

However, it’s not all bleak. The inherent transparency of the blockchain can be an asset in tracking down illicit activities. Every transaction is permanently recorded, providing a trail that, with the right tools and expertise, can be followed.

Cryptocurrencies: A Double-Edged Sword

While cryptocurrencies offer money launderers new methods to obscure their activities, they also provide law enforcement with new tools. Advanced blockchain analysis tools are being developed to de-anonymize transactions and identify suspicious patterns. Moreover, as regulatory frameworks around cryptocurrencies become more robust, there’s hope that illicit activities can be curtailed.

X11 Cryptocurrency: What You Need to Know

In the vast landscape of cryptocurrencies, X11 stands out as a unique and intriguing algorithm. While it might not have the same mainstream recognition as Bitcoin or Ethereum, it plays a pivotal role in the crypto ecosystem, especially when discussing security and mining efficiency.

Introduction to X11

X11 is not a cryptocurrency in itself but rather a hashing algorithm used by several cryptocurrencies. Designed by Evan Duffield and introduced with Dash (formerly known as Darkcoin), X11 is known for its energy efficiency and enhanced security features.

The “11” in X11 signifies the combination of 11 different cryptographic algorithms. This chained hashing approach ensures a higher degree of security and resistance against potential attacks.

Key Features of X11:

- Energy Efficiency: X11 primarily stands out for its greater energy efficiency over other algorithms. This efficiency leads to more sustainable mining that consumes fewer resources.

- Enhanced Security: The chained hashing approach, combining 11 different algorithms, makes it significantly more challenging for potential attackers to compromise the system.

- ASIC Resistance: Initially, designers created X11 to stand up against Application-Specific Integrated Circuits (ASICs), the specialized hardware for crypto mining. They intended this resistance to stop mining centralization, but developers have since produced ASICs for X11.

- Adaptive Block Times: Some cryptocurrencies using X11 can adjust their block times based on network conditions, ensuring faster transaction processing.

Why it’s a Target for Money Laundering

Given its features, especially the enhanced security and privacy aspects, X11-based cryptocurrencies can be attractive for those looking to move funds discreetly. The combination of algorithms ensures that transactions are not only secure but also relatively private compared to other cryptocurrencies. This can make X11-based coins a potential tool for those looking to launder money, as the increased privacy can, in some cases, make transactions harder to trace.

However, it’s essential to note that like all tools, X11’s features can be used for both legitimate and illicit purposes. The majority of users appreciate X11 for its technical merits, but as with all cryptocurrencies, there’s a potential for misuse.

AML Measures for Cryptocurrencies

As the digital currency landscape continues to evolve, the importance of implementing robust Anti-Money Laundering (AML) measures for cryptocurrencies cannot be overstated. These measures aim to prevent the misuse of digital currencies for illicit activities, ensuring a safer and more transparent financial ecosystem.

Current Regulations and Their Impact

Governments and financial institutions worldwide have recognized the potential risks associated with cryptocurrencies. As a result, many have introduced regulations to ensure that cryptocurrency transactions adhere to AML standards. Some key regulatory measures include:

- Customer Due Diligence (CDD): Cryptocurrency exchanges and wallet providers often verify their users’ identities. In this process, known as Know Your Customer (KYC), they collect personal information to confirm users aren’t participating in illicit activities.

- Transaction Monitoring: Exchanges and other service providers use advanced software to monitor transactions. Suspicious patterns, such as large or rapid transfers, can trigger alerts for further investigation.

- Reporting Obligations: Regulatory authorities might require service providers to report specific transactions, especially those surpassing a certain value. This documentation allows for the tracing of large fund movements when necessary.

- Cooperation with Law Enforcement: When they suspect illegal activities, cryptocurrency service providers often have a mandate to work alongside law enforcement agencies and supply them with user data and transaction details.

The Role of Financial Institutions in Monitoring and Reporting

Traditional financial institutions, such as banks, play a crucial role in the AML framework for cryptocurrencies. As many cryptocurrency transactions eventually interact with the traditional banking system (e.g., buying cryptocurrencies with fiat money), banks are often the first line of defense against money laundering.

Banks have developed sophisticated systems to monitor transactions, and they collaborate closely with regulatory bodies. Any suspicious activity, such as a sudden influx of funds from a cryptocurrency exchange without a clear source, can be flagged for further investigation.

Challenges in Implementing AML Measures

While the intent behind AML regulations is clear, their implementation in the world of cryptocurrencies presents several challenges:

- Decentralization: One of the core principles of many cryptocurrencies is decentralization, meaning no central authority oversees or regulates transactions. This can make it challenging to enforce uniform AML standards.

- Global Nature: Cryptocurrencies operate on a global scale, with users from different countries participating in transactions. Harmonizing AML regulations across borders is a complex task.

- Privacy Coins: Some cryptocurrencies prioritize user privacy, making transactions nearly anonymous. While these coins offer legitimate privacy benefits, they can also be misused for money laundering.

Challenges in Ensuring X11 Cryptocurrency Compliance

The X11 algorithm, with its unique features and enhanced security measures, presents a set of challenges when it comes to ensuring compliance with Anti-Money Laundering (AML) regulations. As regulators and financial institutions grapple with the ever-evolving world of cryptocurrencies, understanding these challenges is crucial for effective oversight.

The Anonymity of Transactions

One of the standout features of the X11 algorithm and the cryptocurrencies that utilize it is the emphasis on transactional privacy. While this privacy is a boon for users seeking discretion, it poses a significant hurdle for regulators. The encrypted identities in X11-based transactions make it difficult to ascertain the real-world individuals or entities behind them.

Key Challenges:

- Pseudonymous Nature: Although a public ledger records transactions, cryptographic addresses, not identifiable names, represent the involved parties. This pseudonymity can make the transaction trail harder to trace.

- Mixing Services: Some X11-based cryptocurrencies offer mixing services, further complicating the task of tracing funds. These services mix multiple transactions together, making it challenging to determine the original source of funds.

- Decentralized Exchanges (DEXs): DEXs allow for direct peer-to-peer trading without the need for an intermediary. Without centralized oversight, monitoring and regulating these exchanges become more complex.

The Global Nature of Cryptocurrency Trading

Cryptocurrencies, including those based on the X11 algorithm, operate on a global scale. This international reach presents challenges in terms of jurisdiction and regulatory harmonization.

- Jurisdictional Differences: Different countries have varying regulations concerning cryptocurrencies. What might be permissible in one country could be illegal in another. Ensuring compliance across multiple jurisdictions is a daunting task.

- Cross-border Transactions: The ease of sending cryptocurrencies across borders challenges a single regulatory body’s ability to effectively monitor and control transactions.

The Evolving Landscape of Cryptocurrencies

The world of cryptocurrencies is in constant flux, with new technologies, features, and coins emerging regularly. This dynamic nature means that regulators must continually adapt and update their approaches to ensure effective oversight.

The Future of AML and Cryptocurrency

As we stand on the cusp of a new era in finance, the intertwining of Anti-Money Laundering (AML) measures and the world of cryptocurrencies will undoubtedly shape the future of global transactions. With rapid technological advancements and shifting regulatory landscapes, predicting the future can be challenging, but certain trends and developments offer a glimpse into what lies ahead.

Predictions and Trends

- Stricter Global Regulations: As cryptocurrencies gain mainstream acceptance, there’s an increasing push for a unified global regulatory framework. International bodies, such as the Financial Action Task Force (FATF), are likely to play a pivotal role in harmonizing AML regulations across countries.

- Advanced Monitoring Tools: The rise of AI and machine learning offers promising solutions for transaction monitoring. These technologies can analyze vast amounts of data in real-time, identifying suspicious patterns and potential money laundering activities with greater accuracy.

- Collaboration Between Traditional and Crypto Financial Systems: As the lines between traditional finance and cryptocurrencies blur, banks, financial institutions, and cryptocurrency platforms will collaborate more. This partnership will play a crucial role in sharing data, intelligence, and best practices.

- Increased Public Awareness: As the general public becomes more informed about cryptocurrencies, there will be a greater emphasis on educating users about the risks and responsibilities associated with digital assets. An informed user base can act as a first line of defense against illicit activities.

The Role of Technology in Enhancing Compliance

Technology will undoubtedly be at the forefront of future AML measures in the cryptocurrency domain:

- Blockchain Analysis: While blockchain offers anonymity, it also provides a transparent and immutable record of all transactions. Advanced blockchain analysis tools will become more sophisticated, allowing for the de-anonymization of transactions and identifying suspicious activities.

- Smart Contracts: These contracts, which encode the terms of an agreement directly into code, can automatically enforce compliance measures, ensuring transactions follow set regulations.

- Decentralized Identity Verification: Future systems might leverage decentralized ledgers to verify user identities securely, ensuring privacy while adhering to KYC norms.

Conclusion: Navigating the Future of Cryptocurrency and AML

In the ever-evolving landscape of cryptocurrencies, staying updated with AML regulations is paramount. The dynamic nature of both the crypto world and its regulatory environment means that individuals and businesses must be proactive to ensure compliance, avoid legal repercussions, and build trust. As we embrace the potential of digital currencies, the balance between innovation and regulation becomes crucial. The fight against money laundering in this digital age is multifaceted, requiring collaboration from governments, financial institutions, technology providers, and the crypto community. Embracing the transformative power of cryptocurrencies while safeguarding against their misuse is the key to a secure and prosperous financial future.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More