Decentralized Finance, commonly referred to as DeFi, represents a revolutionary shift in the world of finance. Unlike traditional financial systems that rely on centralized institutions like banks, brokerages, and exchanges, DeFi operates on a decentralized model, eliminating the need for intermediaries. At its core, DeFi aims to democratize access to financial services, ensuring that they are available to anyone, anywhere, without the constraints of borders or centralized control.

What is DeFi?

DeFi is a fusion of traditional banking services with blockchain technology. It offers a range of financial instruments that operate without the need for a central authority. This means that activities, such as lending, borrowing, trading, and insuring, can be conducted on a peer-to-peer basis.

| Traditional Finance | Decentralized Finance (DeFi) |

|---|---|

| Centralized institutions (e.g., banks) | Blockchain-based platforms |

| Requires intermediaries | Peer-to-peer transactions |

| Limited accessibility | Universal access |

| Often involves fees | Reduced or no fees |

| Regulated by central authorities | Self-regulated through smart contracts |

The Role of Smart Contracts and Blockchain in DeFi

The backbone of DeFi is the blockchain, a decentralized ledger that records all transactions across a network of computers. What makes DeFi unique and powerful is the use of smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute the terms of a contract when certain conditions are met, ensuring transparency, security, and efficiency.

For instance, if Alice wants to lend money to Bob using a DeFi platform, they would agree on terms such as interest rate and loan duration. A smart contract would then be created, stipulating these terms. Once Bob repays the loan, the smart contract would automatically release the funds back to Alice, along with the agreed-upon interest.

In essence, smart contracts act as trustless intermediaries, ensuring that all parties adhere to the agreed terms without the need for a third party.

Why DeFi Matters

The implications of DeFi are profound. It promises a more inclusive financial system where services are universally accessible. With DeFi, individuals in regions without robust banking infrastructures can access financial services using just a smartphone. Moreover, by eliminating intermediaries, transactions become faster, cheaper, and more efficient.

Understanding the X11 Algorithm

In the vast landscape of cryptocurrencies and blockchain technologies, the X11 algorithm stands out as a unique and innovative cryptographic algorithm. But what exactly is X11, and why is it relevant in the context of DeFi and interoperability?

What is X11?

X11 is a chained hashing algorithm used for the proof-of-work consensus mechanism in various cryptocurrencies, most notably Dash. Unlike other algorithms that use a single hash function, X11 employs 11 different cryptographic hash functions in a chained sequence. This design enhances the security and resistance of the network against potential attacks.

The name “X11” is derived from the combination of these 11 hash functions: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

Relevance of X11 in the Crypto World

The multi-layered approach of X11 offers several advantages:

- Security: By utilizing 11 different hash functions, X11 provides a higher degree of security. Even if one or two of these functions were found to be vulnerable, the entire algorithm would remain secure due to the remaining functions.

- Energy Efficiency: X11 is known for being more energy-efficient compared to other algorithms like SHA-256 (used by Bitcoin). This makes mining operations using X11 more sustainable in the long run.

- ASIC Resistance: Initially, X11 was designed to resist the development of Application-Specific Integrated Circuits (ASICs) for mining, promoting a more decentralized mining landscape. However, over time, ASICs for X11 have been developed, but the algorithm still offers a more level playing field compared to others.

Benefits and Challenges of the X11 Algorithm

Benefits:

- Versatility: The chained hashing approach makes X11 adaptable. If a vulnerability is detected in one of the hash functions, it can be replaced without affecting the entire algorithm.

- Cooler Hardware: Due to its energy efficiency, hardware running the X11 algorithm tends to remain cooler, extending the lifespan of mining equipment.

- Decentralization: The initial resistance to ASICs encouraged a more diverse group of miners, fostering decentralization.

Challenges:

- ASIC Development: Over time, the development of ASICs for X11 has somewhat centralized mining operations, moving away from its original intent.

- Complexity: Managing 11 hash functions increases the complexity of the algorithm, which can be a barrier for new entrants or developers.

In the broader context of DeFi and interoperability, understanding the intricacies of algorithms like X11 is crucial. As DeFi platforms seek to bridge various blockchain ecosystems, the underlying algorithms play a pivotal role in ensuring secure, efficient, and seamless integrations.

The Need for Interoperability in DeFi

As the DeFi landscape continues to expand, the importance of interoperability becomes increasingly evident. But what exactly is interoperability, and why is it so crucial for the future of decentralized finance?

Defining Interoperability

In the context of blockchain and DeFi, interoperability refers to the ability of different blockchain platforms and protocols to communicate and interact seamlessly with one another. This means that a user on one blockchain can execute transactions and access data on another blockchain without having to go through cumbersome processes or conversions.

Challenges Faced by Isolated Blockchain Ecosystems

- Limited Liquidity: Each blockchain operating in isolation has its own user base, which can lead to fragmented liquidity pools. This can hinder the growth of DeFi platforms and limit opportunities for users.

- Restricted Access: Users on one blockchain might not be able to access innovative DeFi products or services developed on another blockchain.

- Inefficient Capital Utilization: Funds locked in one blockchain cannot be easily moved or utilized in another ecosystem, leading to inefficiencies in capital allocation.

- Duplication of Efforts: Developers might end up building similar solutions on different blockchains, leading to redundancy and wasted resources.

The Potential of Interconnected Financial Platforms

Imagine a world where assets on Ethereum can be seamlessly used as collateral on a DeFi platform built on Binance Smart Chain or where a user on the Polkadot network can easily participate in a liquidity pool on the Avalanche ecosystem. This is the vision that interoperability aims to achieve.

- Enhanced Liquidity: By connecting multiple blockchains, the combined liquidity can lead to more robust and stable financial platforms.

- Broader Access: Users can access a wider range of DeFi products and services, irrespective of the blockchain they originate from.

- Optimized Capital Allocation: Funds can flow seamlessly across ecosystems, ensuring that capital is utilized where it’s most needed.

- Innovation and Collaboration: Developers across different blockchains can collaborate, leading to more innovative solutions and faster adoption of new technologies.

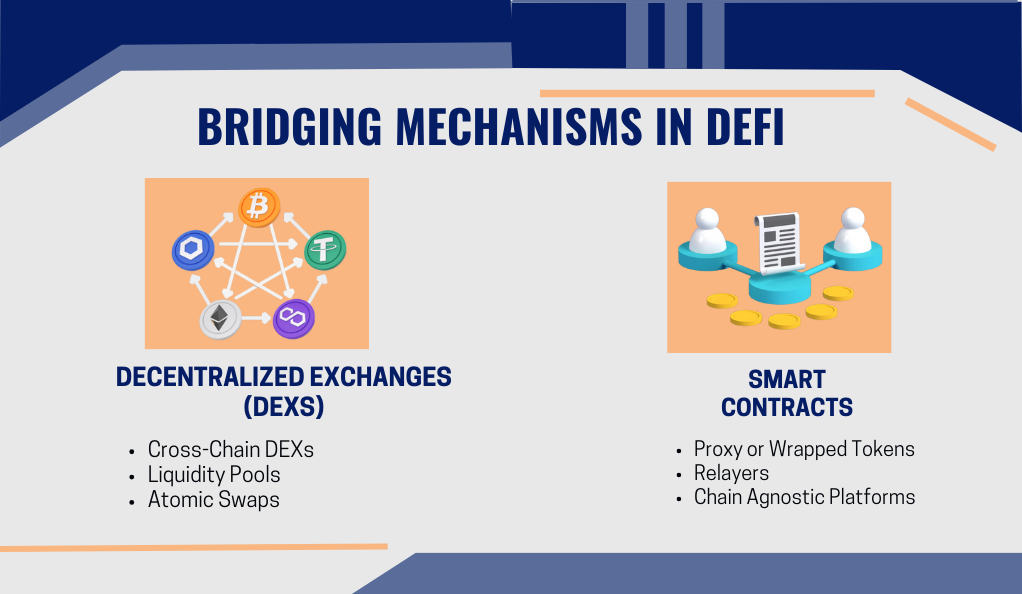

Bridging Mechanisms in DeFi

The dream of a seamlessly interconnected DeFi world hinges on the development and implementation of effective bridging mechanisms. These bridges facilitate the smooth transfer of information, assets, and value between different blockchain ecosystems. Let’s delve into the intricacies of these bridging mechanisms and their role in achieving interoperability.

Decentralized Exchanges (DEXs) and Their Role in Interoperability

Decentralized Exchanges, or DEXs, have emerged as one of the primary tools facilitating cross-chain interactions. Unlike centralized exchanges, which act as intermediaries, DEXs allow users to trade assets directly from their wallets.

- Cross-Chain DEXs: Some DEXs are designed to facilitate trades between assets from different blockchains. These DEXs use various mechanisms, such as wrapped tokens or pegged assets, to represent the value of one asset on another blockchain.

- Liquidity Pools: DEXs often rely on liquidity pools, where users lock up their assets to facilitate trading. In cross-chain DEXs, these pools can contain assets from multiple blockchains, further promoting interoperability.

- Atomic Swaps: This is a technology that enables the direct and trustless exchange of assets from different blockchains. It ensures that the swap either happens for both parties or doesn’t happen at all, eliminating the need for intermediaries.

Smart Contracts as Connectors Between Different Blockchains

Smart contracts play a pivotal role in bridging different ecosystems. They can be programmed to recognize and verify transactions from other blockchains, acting as a bridge between two separate networks.

- Proxy or Wrapped Tokens: One common method involves creating a proxy or wrapped version of a token on another blockchain. For instance, Wrapped Bitcoin (WBTC) on Ethereum represents Bitcoin and is backed 1:1 with actual Bitcoin. This allows Bitcoin to be used within the Ethereum ecosystem.

- Relayers: These are entities or nodes that share information between blockchains. They listen for events or transactions on one blockchain and relay that information to a smart contract on another blockchain.

- Chain Agnostic Platforms: Some platforms are designed to be chain agnostic from the ground up, meaning they can operate on multiple blockchains simultaneously. These platforms use advanced smart contract mechanisms to ensure consistency and security across all supported chains.

The Growing Ecosystem of Interoperable Platforms

Several projects in the crypto space are dedicated to achieving true interoperability. Platforms like Polkadot, Cosmos, and Avalanche are pioneering efforts to connect different blockchains into a cohesive network. By providing a framework for different blockchains to communicate, these platforms are laying the foundation for the next generation of DeFi applications.

Real-world Applications of Interoperability

The theoretical benefits of interoperability are evident, but its real value shines through in practical applications. Across the DeFi landscape, numerous projects are leveraging interoperability to offer innovative solutions, enhance user experience, and drive the adoption of decentralized finance. Let’s explore some of these real-world applications.

Cross-Chain Lending and Borrowing Platforms

One of the foundational pillars of DeFi is the ability to lend and borrow assets. With interoperability, platforms can now tap into liquidity from multiple blockchains. Users can collateralize assets from one blockchain and borrow assets from another, all within a single platform. This not only increases the available liquidity but also offers users a broader range of assets to interact with.

Multi-Chain Asset Management

Asset management platforms are evolving to support assets across various blockchains. Users can now manage their entire crypto portfolio, spanning multiple blockchains, from a single interface. This simplifies the management process and provides users with a holistic view of their investments.

Interoperable DeFi Aggregators

Aggregators source the best yields or trading rates from various DeFi platforms. Interoperable aggregators take this a step further by sourcing opportunities across multiple blockchains. This ensures users get the best possible returns on their investments, irrespective of which blockchain the opportunity resides on.

Cross-Chain NFT Platforms

The Non-Fungible Token (NFT) market has witnessed exponential growth. Interoperability is now allowing users to mint, trade, and showcase NFTs from different blockchains on a single platform. This not only broadens the market for NFT creators and collectors but also paves the way for innovative use-cases, like cross-chain NFT games or virtual galleries.

Decentralized Identity and Data Verification

Interoperable platforms are emerging that allow users to verify their identity or data on one blockchain and use that verification across multiple chains. This has profound implications for sectors like decentralized identity verification, credit scoring, and more.

Risks and Challenges in Bridging Ecosystems

While the promise of interoperability in DeFi is undeniably transformative, it doesn’t come without its set of challenges and risks. Bridging multiple blockchain ecosystems introduces complexities that can lead to vulnerabilities if not addressed properly. Let’s delve into some of these challenges and the potential risks they pose.

Coding Errors and Vulnerabilities

The very nature of interoperability requires intricate coding and the integration of multiple systems. This complexity can introduce coding errors or unforeseen vulnerabilities.

- Smart Contract Bugs: Given that many bridging mechanisms rely on smart contracts, any flaw in the contract’s code can lead to significant losses or system malfunctions.

- Chain Reorganizations: When one blockchain undergoes a reorganization, it can affect the state of assets or data on another chain, leading to inconsistencies.

Centralization Concerns

Ironically, some bridging solutions can reintroduce centralization into the decentralized world.

- Reliance on Validators or Relayers: Some interoperability solutions depend on a set of validators or relayers to transmit information between chains. If this group is limited or can be easily compromised, it poses a centralization risk.

- Custodial Solutions: Some bridges operate by holding assets in custody while their equivalent is used on another chain. This custodial approach is antithetical to the ethos of decentralization and introduces trust concerns.

Liquidity Fragmentation

While interoperability aims to pool liquidity from various ecosystems, there’s a risk of liquidity fragmentation if not executed correctly. Users might spread their assets across multiple chains, leading to diluted liquidity on individual platforms.

Regulatory Concerns

As DeFi platforms bridge multiple ecosystems, they might inadvertently breach regulatory boundaries. Different blockchains might operate under different jurisdictions, and a unified platform could face regulatory challenges.

Economic Incentive Misalignment

For interoperability to work seamlessly, there needs to be a proper alignment of economic incentives across chains. If one chain offers significantly higher rewards or incentives, it might drain resources or users from another, leading to imbalances.

Conclusion

As the decentralized finance (DeFi) landscape continues to evolve, the importance of interoperability becomes paramount. The vision of a seamlessly interconnected financial ecosystem, where assets and data flow effortlessly across diverse blockchains, holds the promise of reshaping the very fabric of global finance. Through bridging mechanisms, innovative platforms, and cryptographic algorithms like X11, the DeFi community is pioneering a movement towards a more inclusive, efficient, and transparent financial future.

However, with great innovation comes great responsibility. The challenges and risks associated with bridging disparate blockchain ecosystems are real and multifaceted. It’s imperative for developers, stakeholders, and users to approach these challenges with caution, collaboration, and a commitment to continuous learning. As we stand on the cusp of this new era in finance, the collective efforts of the DeFi community will determine the trajectory of this revolution, ensuring that the benefits of interoperability are realized while safeguarding the principles of decentralization.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More