Stablecoins have emerged as a significant innovation in the cryptocurrency landscape, offering a bridge between the volatility of traditional cryptocurrencies and the stability of fiat currencies. Let’s delve deep into the world of stablecoins, understanding their mechanics, types, and significance in the broader financial ecosystem.

What are Stablecoins?

Stablecoins are a type of cryptocurrency designed to have a stable value, as opposed to the significant volatility seen in cryptocurrencies like Bitcoin and Ethereum. They achieve this stability by being pegged to a reserve or basket of assets, typically fiat currencies like the US dollar or commodities like gold.

Why Were Stablecoins Created?

The primary motivation behind the creation of stablecoins was to address the volatility issues associated with cryptocurrencies. This volatility can be problematic for everyday transactions and for traders who might experience significant losses due to rapid price fluctuations.

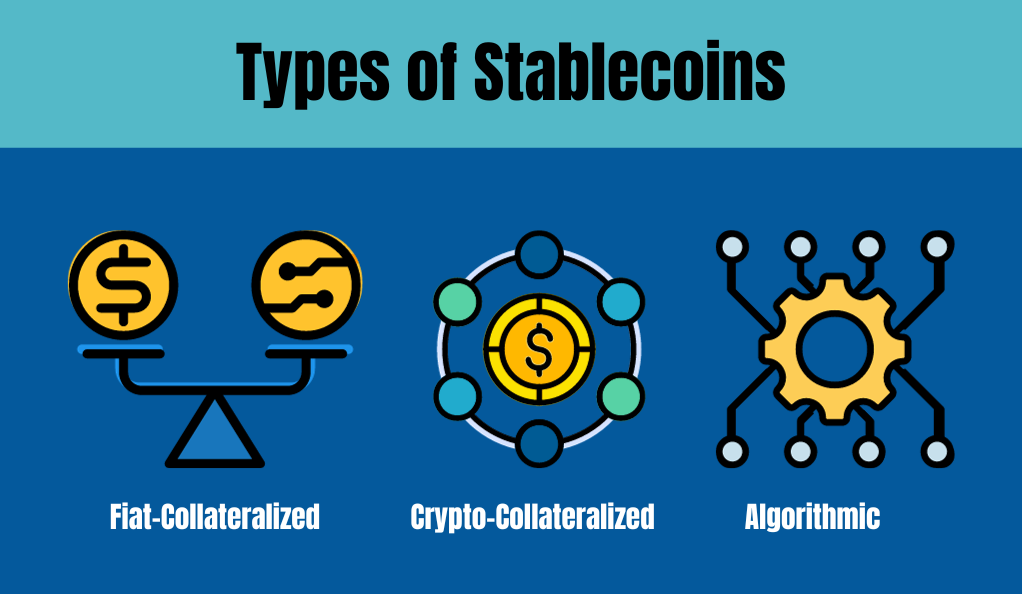

Types of Stablecoins

There are primarily three types of stablecoins based on the underlying assets or mechanisms they use for stabilization:

a. Fiat-Collateralized Stablecoins:

These are backed by a reserve of fiat currency, typically at a 1:1 ratio. For every stablecoin issued, there’s an equivalent amount of fiat currency held in a bank or vault.

b. Crypto-Collateralized Stablecoins:

These are backed by other cryptocurrencies, like Ethereum. They are over-collateralized to account for the volatility of the backing cryptocurrency.

c. Algorithmic Stablecoins:

These aren’t backed by any collateral. Instead, they use algorithms and smart contracts to automatically increase or decrease the supply of the stablecoin, maintaining its price stability.

| Type | Backing | Examples | Pros | Cons |

|---|---|---|---|---|

| Fiat-Collateralized | Fiat currency (e.g., USD, EUR) | USDC, USDT | High stability, easy to understand | Centralized, requires trust in issuers |

| Crypto-Collateralized | Cryptocurrencies (e.g., Ethereum) | DAI | Decentralized, transparent smart contracts | Complex mechanisms, over-collateralization required |

| Algorithmic | None (algorithm-driven) | Terra | Fully decentralized, no collateral required | Newer, less tested, potential for instability |

Benefits of Stablecoins

- Stability: As the name suggests, they offer a stable value, making them suitable for everyday transactions.

- Transparency: Especially for crypto-collateralized and algorithmic stablecoins, the underlying smart contracts provide transparency.

- Fast and Cheap Transactions: They leverage blockchain technology, ensuring quick and cost-effective transactions.

- Interoperability: They can be easily integrated into various decentralized applications (DApps) and platforms.

Concerns and Criticisms

Centralization: Fiat-collateralized stablecoins are often criticized for their centralized nature, as they require trust in the issuing organization.

Regulatory Scrutiny: Due to their link with traditional financial systems, they often come under the radar of regulators.

Collateral Issues: The backing assets, especially for crypto-collateralized stablecoins, can sometimes face liquidity issues.

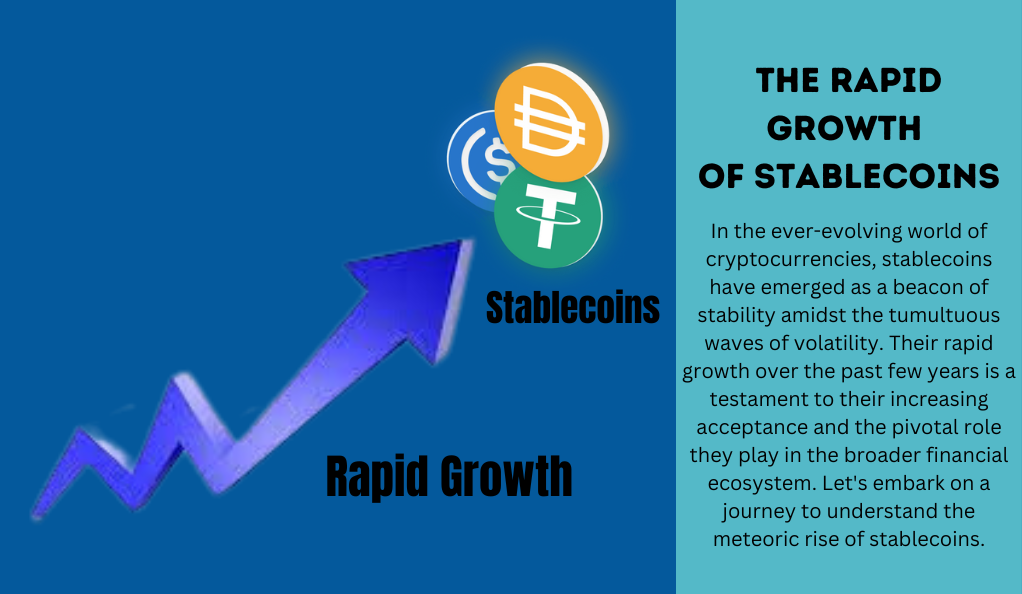

The Rapid Growth of Stablecoins

In the ever-evolving world of cryptocurrencies, stablecoins have emerged as a beacon of stability amidst the tumultuous waves of volatility. Their rapid growth over the past few years is a testament to their increasing acceptance and the pivotal role they play in the broader financial ecosystem. Let’s embark on a journey to understand the meteoric rise of stablecoins.

The Genesis of Stablecoins

Stablecoins, as the name suggests, were conceived to bring stability to the crypto market. Their inception can be traced back to the need for a digital asset that could be used for everyday transactions without the fear of sudden price drops or spikes.

Factors Driving the Growth

Several factors have contributed to the rapid growth of stablecoins:

a. Volatility of Traditional Cryptocurrencies:

The unpredictable nature of cryptocurrencies like Bitcoin and Ethereum made them unsuitable for everyday transactions. Stablecoins, with their peg to stable assets, filled this void.

b. Rise of Decentralized Finance (DeFi):

DeFi platforms, which offer financial services without intermediaries, needed a stable medium of exchange. Stablecoins fit the bill perfectly.

c. Cross-border Transactions:

With their ability to facilitate quick and cost-effective international transactions, stablecoins have become a preferred choice for many businesses and individuals.

d. Regulatory Clarity:

As regulatory bodies started providing clearer guidelines around stablecoins, it instilled confidence in institutional and retail investors.

Growth Metrics

To truly appreciate the growth of stablecoins, let’s look at some numbers:

- Market Capitalization:From a modest beginning, the total market cap of stablecoins has surged to billions of dollars, withTether (USDT) leading the pack.

- Daily Transaction Volume:Stablecoins now rival the daily transaction volumes of major cryptocurrencies, indicating their widespread use.

- Adoption in Mainstream Finance:Major financial institutions and payment gateways have started integrating stablecoins into their operations, further boosting their credibility and use.

Challenges and Criticisms

Despite their growth, stablecoins encounter several challenges. Firstly, there’s an over-reliance on Tether, which gives rise to worries about centralization. The potential ramifications of any problems associated with USDT on the wider stablecoin market are concerning. Secondly, there are regulatory concerns. While there has been some clarity, stablecoins are also facing heightened scrutiny from regulatory bodies worldwide. This increased attention is due to the potential impact of stablecoins on overall financial stability. Lastly, there are collateralization issues. It’s of paramount importance to ensure that stablecoins remain fully collateralized. Any discrepancies in this aspect can erode trust and even trigger market disruptions.

Stablecoins as the DeFi Currency

The decentralized finance (DeFi) ecosystem has witnessed exponential growth, and at its core lies the pivotal role of stablecoins. Serving as the primary medium of exchange within DeFi platforms, stablecoins have become the de facto currency of this decentralized world. Let’s delve deep into understanding why and how stablecoins have earned this esteemed position.

DeFi Explained

Before diving into stablecoins, it’s essential to understand DeFi. DeFi, or decentralized finance, refers to financial services that operate without traditional intermediaries like banks. Instead, they run on blockchain networks, primarily Ethereum, using smart contracts.

Why Stablecoins in DeFi?

Stablecoins offer several advantages that make them ideal for DeFi:

a. Stability:

The primary allure of stablecoins is their stability, making them suitable for transactions, lending, and borrowing in DeFi platforms without the risk of significant price fluctuations.

b. Liquidity:

Stablecoins provide the necessary liquidity to DeFi platforms, ensuring smooth operations and facilitating large volumes of transactions.

c. Interoperability:

Being on blockchain networks, stablecoins can seamlessly interact with various DeFi protocols and applications.

Popular Use Cases of Stablecoins in DeFi

a. Yield Farming:

Investors “farm” rewards by lending their stablecoins on DeFi platforms, earning interest and sometimes additional tokens.

b. Collateralized Loans:

Users can deposit stablecoins as collateral to borrow other assets or even more stablecoins.

c. Decentralized Exchanges (DEXs):

Stablecoins are frequently traded on DEXs, offering users a way to switch between assets without moving to traditional fiat currencies.

d. Payment Systems:

Some DeFi platforms use stablecoins to facilitate payments, benefiting from their quick transaction times and low fees.

Risks and Challenges

- Collateralization Concerns: Ensuring that stablecoins are fully backed is crucial. Any doubts can lead to panic and potential market crashes.

- Regulatory Scrutiny: Given their growing importance, stablecoins in DeFi are attracting regulatory attention, which could shape their future trajectory.

- Smart Contract Vulnerabilities: Being on blockchain networks, stablecoins rely on smart contracts, which, if not coded perfectly, can be exploited.

Regulatory Landscape and Challenges

The world of digital assets, including cryptocurrencies and stablecoins, has grown exponentially over the past decade. With this growth comes the inevitable intersection of innovation and regulation. The regulatory landscape surrounding these assets is complex, evolving, and presents a myriad of challenges. Let’s navigate through this intricate terrain step by step.

The Need for Regulation

The rise of digital assets has brought forth several concerns:

a. Consumer Protection:

To prevent fraud, scams, and ensure the safety of investors’ funds.

b. Financial Stability:

To ensure that the broader financial system remains stable, especially as digital assets grow in size and influence.

c. Preventing Illicit Activities:

To curb money laundering, terrorist financing, and other illegal activities facilitated through digital assets.

Global Regulatory Approaches

Different countries have adopted varied approaches to digital asset regulation:

Some nations, such as Switzerland and Singapore, have chosen to embrace these assets. They have implemented proactive strategies that foster innovation within the industry, all the while maintaining a strong focus on safety and security.

On the other hand, countries like the United States and the United Kingdom have adopted a cautious stance. They are carefully navigating the landscape of digital assets, striving to strike a delicate balance between encouraging innovation and implementing rigorous regulatory measures.

In contrast, there are nations like China and India that have, at certain points, taken restrictive positions. These countries have either outright banned digital assets or imposed stringent regulations to exert control over their usage and trading.

| Country | Approach | Key Regulations | Remarks |

|---|---|---|---|

| Switzerland | Embracing | FINMA guidelines | Known for its crypto-friendly stance. |

| USA | Cautious | SEC guidelines, FinCEN rules | Complex regulatory landscape with multiple agencies involved. |

| China | Restrictive | Ban on ICOs, crypto exchanges | Despite restrictions, remains a key player in the crypto mining industry. |

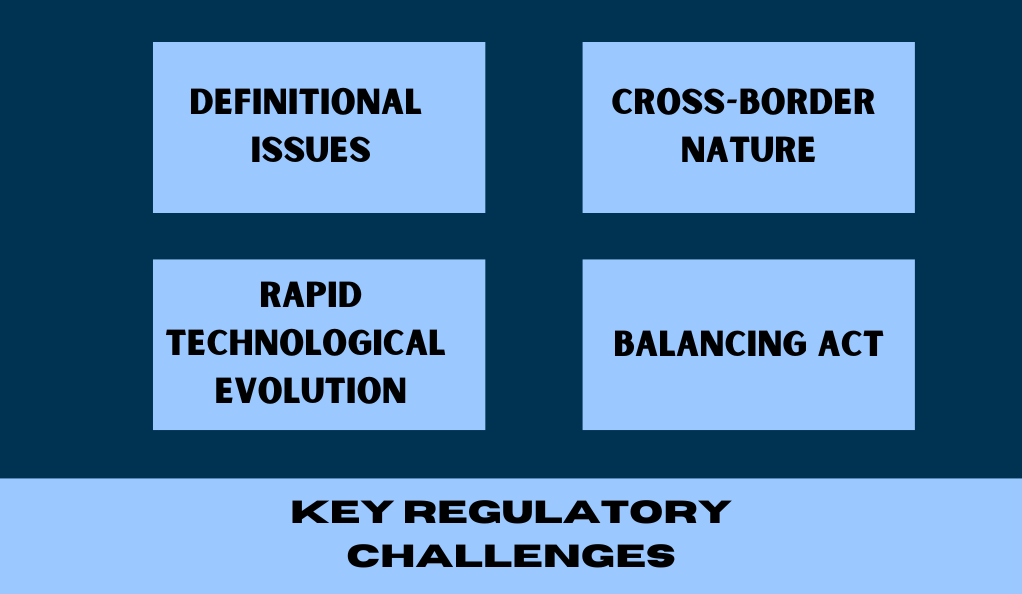

Key Regulatory Challenges

- Definitional Issues: Is a digital asset a currency, commodity, security, or something else? The answer varies by jurisdiction and has significant regulatory implications.

- Cross-border Nature: Digital assets operate globally, making it challenging for any single country to regulate them effectively.

- Rapid Technological Evolution: The pace of innovation in the digital asset space often outstrips the speed at which regulations can be formulated.

- Balancing Act: Regulators must strike a balance between fostering innovation and ensuring consumer protection and financial stability.

Stablecoins and Regulation

The increasing prominence of stablecoins has garnered substantial regulatory scrutiny, primarily focused on several key aspects. Firstly, there’s a strong emphasis on verifying the backing and reserve claims made by stablecoin issuers, with regulators striving to guarantee the promised 1:1 pegging to a reserve. Secondly, due to the significant size and integration of major stablecoins within the financial landscape, concerns have arisen regarding potential systemic risks they might pose to the broader financial system. Lastly, ensuring the transparency, reliability, and adherence to financial best practices of stablecoin issuers remains a critical regulatory concern.

Risks and Concerns

In any venture, understanding the potential risks and concerns is paramount. Whether it’s the world of finance, technology, or any other domain, being aware of the pitfalls allows for better decision-making and risk mitigation. Let’s methodically explore the various risks and concerns that individuals, businesses, and societies might encounter across different spheres.

Financial Risks

Financial risks pertain to the potential loss of money. They can arise due to various factors:

a. Market Risk:

The possibility of an investment’s value decreasing due to macroeconomic factors or broader market movements.

b. Credit Risk:

The risk that a borrower might default on their obligations.

c. Liquidity Risk:

The risk of not being able to quickly convert assets into cash without a significant loss in value.

d. Operational Risk:

Losses that arise from inadequate or failed internal processes, systems, or external events.

Technological Risks

With the rapid advancement of technology, new risks emerge:

Cybersecurity Threats:

The risk of unauthorized access, data breaches, and other malicious cyber activities.

Software Vulnerabilities:

Flaws or weaknesses in software that can be exploited, leading to unauthorized access or data loss.

Hardware Failures:

Physical devices malfunctioning, leading to data loss or operational disruptions.

Technological Obsolescence:

The risk of current technology becoming outdated, requiring upgrades or replacements.

Environmental Risks

Environmental concerns have taken center stage in recent years:

- Climate Change: The long-term alteration of temperature and typical weather patterns in a place, leading to unpredictable weather events.

- Pollution: The introduction of harmful materials into the environment, affecting air, water, and land.

- Resource Depletion: The consumption of resources faster than they can be replenished.

- Biodiversity Loss: The extinction of species and the habitats they rely on.

| Domain | Key Risks | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Financial | Market, Credit, Liquidity | Loss of capital, bankruptcy | Diversification, insurance, due diligence |

| Technological | Cybersecurity, Software vulnerabilities | Data breaches, operational disruptions | Regular updates, security protocols, backups |

| Environmental | Climate change, Pollution | Natural disasters, health issues | Sustainable practices, conservation efforts |

Social and Political Risks

Societal structures and political landscapes contribute to a range of potential risks. Firstly, there’s the possibility of social unrest, which involves the threat of public upheaval or civil disorder stemming from underlying societal grievances. Additionally, political instability poses a significant risk, arising when governments undergo changes, policies shift, or geopolitical tensions escalate, potentially affecting the stability of businesses and organizations. Another concern is regulatory changes, as new laws or regulations can emerge that impact the way operations are conducted and ultimately influence profitability. Lastly, there’s the crucial factor of reputational risk, wherein an organization faces the potential for loss due to harm inflicted upon its reputation, underscoring the need for careful management of public perception and image.

Health and Pandemic Risks

Recent events have highlighted the significance of health-related risks:

- a. Disease Outbreaks: The rapid spread of diseases that can lead to global health crises.

- b. Medical Infrastructure: The risk of healthcare systems being overwhelmed or inadequate.

- c. Drug Resistance: The evolution of strains of diseases resistant to current treatments.

- d. Mental Health Concerns: The rising prevalence of mental health issues and the societal and economic impacts they bring.

The Future of Stablecoins in DeFi

The decentralized finance (DeFi) ecosystem has been a game-changer in the world of finance, and stablecoins have been at the forefront of this revolution. As we look ahead, the trajectory of stablecoins within DeFi is poised to be both transformative and dynamic. Let’s embark on a journey to explore the potential future of stablecoins in the DeFi landscape.

The Current Role of Stablecoins in DeFi

To understand the future, it’s essential first to recognize the present:

a. Medium of Exchange:

Stablecoins are widely used for transactions within DeFi platforms due to their stability.

b. Collateral:

Many DeFi platforms allow users to deposit stablecoins as collateral for loans or other financial products.

c. Yield Generation:

Stablecoins are often lent out on DeFi platforms, generating yield for the lender.

Innovations on the Horizon

The realm of DeFi thrives on rapid innovation, and stablecoins are poised to uphold this tradition. Potential advancements include the emergence of multi-collateral stablecoins, diversifying asset backing for heightened stability; the prospect of future stablecoins seamlessly spanning multiple blockchains, amplifying their utility within a multi-chain DeFi ecosystem; and the anticipated rise of privacy-focused stablecoins, offering inherent confidentiality to users in their transactions.

Regulatory Evolution and Stablecoins

As stablecoins grow in prominence, they will undoubtedly attract more regulatory attention:

- Clearer Guidelines: Regulators might provide more explicit guidelines on the issuance, operation, and management of stablecoins.

- Compliance Integration: Future DeFi platforms might integrate compliance tools to ensure that stablecoin transactions adhere to regulatory standards.

- Central Bank Digital Currencies (CBDCs): The introduction of CBDCs might influence the role of stablecoins in DeFi, either complementing them or competing with them.

| Aspect | Current | Potential Future |

|---|---|---|

| Collateral | Primarily single asset-backed | Multi-collateral, diversified backing |

| Interoperability | Limited to specific blockchains | Cross-chain functionality |

| Privacy | Transparent, public ledgers | Enhanced privacy features |

| Regulatory | Emerging regulations | Clearer guidelines, integrated compliance |

Challenges and Opportunities

a. Scalability:

As DeFi grows, the need for scalable stablecoin solutions will become paramount. Layer 2 solutions and other scalability enhancements will be crucial.

b. Stability Mechanisms:

Innovative mechanisms to ensure the stability of stablecoins, beyond traditional collateral, might emerge.

c. Market Dynamics:

The interplay between stablecoins, traditional cryptocurrencies, and CBDCs will shape the DeFi landscape, presenting both challenges and opportunities.

The Broader Financial Ecosystem

Stablecoins in DeFi might influence the broader financial world:

- a. Mainstream Adoption: Stablecoins could become a standard feature in traditional financial products and services.

- b. Financial Inclusion: DeFi and stablecoins together could bring financial services to underserved populations, bridging the financial divide.

- c. Evolution of Financial Products: New financial products, built around stablecoins, might emerge, blending the lines between traditional finance and DeFi.

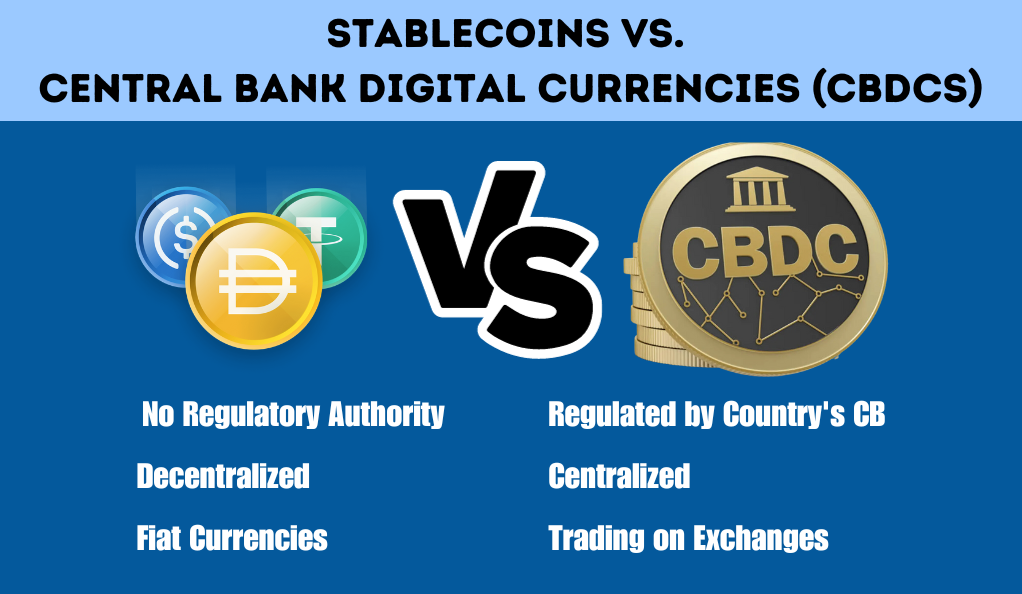

Stablecoins vs. Central Bank Digital Currencies (CBDCs)

In the rapidly evolving digital financial landscape, two prominent contenders have emerged: Stablecoins and Central Bank Digital Currencies (CBDCs). Both aim to offer the benefits of digital currencies but come from different origins and serve varied purposes. Let’s dissect these two digital assets, comparing their features, objectives, and potential impacts on the global financial system.

Definitions and Origins

Stablecoins

Stablecoins are digital or virtual currencies whose value is pegged to a stable asset, such as a specific amount of a commodity or fiat currency like the US dollar. They emerged from the private sector, primarily to address the volatility issues associated with cryptocurrencies like Bitcoin.

CBDCs

Central Bank Digital Currencies are digital forms of a country’s sovereign currency, issued and backed by the nation’s central bank. They represent a digital equivalent of the country’s paper currency and are a direct liability of the central bank.

Key Objectives

a. Stablecoins:

Provide stability in the cryptocurrency market.

Facilitate transactions, especially in the DeFi ecosystem.

Offer a decentralized alternative to traditional banking systems.

b. CBDCs:

- Modernize the country’s financial infrastructure.

- Enhance payment efficiency and reduce transaction costs.

- Maintain monetary sovereignty in the face of rising digital assets.

Features and Technical Aspects

a. Stablecoins:

Operate on public blockchains like Ethereum or Binance Smart Chain.

Can be collateralized by fiat, other cryptocurrencies, or algorithms.

Typically decentralized, though some have central managing entities.

b. CBDCs:

- Might operate on a central bank’s private blockchain or distributed ledger.

- Directly represents the country’s fiat currency in a digital form.

- Centralized and regulated by the country’s monetary authority.

| Aspect | Stablecoins | CBDCs |

|---|---|---|

| Origin | Private sector | Central banks |

| Backed By | Fiat, crypto, algorithms | Sovereign currency |

| Decentralization | Typically decentralized | Centralized |

| Accessibility | Global, anyone with internet | Citizens, based on country’s regulations |

| Use Cases | DeFi, remittances, trading | Payments, monetary policy |

| Regulation | Varies by jurisdiction | Strictly regulated by issuing country |

Potential Impacts

Stablecoins have the potential to promote financial inclusion by extending services to the unbanked population and could also reshape the conventional banking landscape by presenting alternative financial avenues, albeit accompanied by regulatory complexities stemming from their decentralized nature. On a parallel note, Central Bank Digital Currencies (CBDCs) stand to revolutionize monetary policy strategies while enhancing the efficiency of cross-border transactions. However, the centralized control associated with CBDCs raises valid concerns regarding privacy and surveillance implications.

Consumer Protection and Transparency

In an era where consumers are more empowered than ever, the principles of consumer protection and transparency have become paramount. These principles ensure that consumers are treated fairly, are well-informed, and can make decisions that are in their best interest. Let’s delve deep into the world of consumer protection and the pivotal role of transparency in this domain.

Understanding Consumer Protection

Consumer protection refers to the practices and policies in place to ensure the rights of consumers are upheld and that they are shielded from fraudulent and unfair business practices.

a. Rights of Consumers:

- Right to safety

- Right to be informed

- Right to choose

- Right to be heard

b. Importance:

- Ensures fair trade and competition.

- Protects consumers from potential hazards.

- Builds trust between consumers and businesses.

The Role of Transparency

Transparency is the practice of being open, honest, and straightforward about business practices, policies, and operations.

Benefits to Consumers: Ensuring accuracy and transparency empowers informed choices, fostering confidence in brands and countering fraud, thereby creating trust among consumers and businesses.

Benefits to Businesses: Prioritizing accuracy and transparency offers substantial benefits, enhancing reputation, fostering loyalty, and minimizing legal risks for individuals, businesses, and institutions.

Regulatory Frameworks

Governments and international bodies have established regulations to ensure consumer protection and promote transparency:

a. Consumer Protection Laws:

These laws are designed to prevent businesses from engaging in fraud or unfair practices, thereby ensuring consumers are not exploited.

b. Disclosure Requirements:

Businesses may be required to disclose detailed information about products, especially if they could affect health, safety, or finances.

c. Data Protection and Privacy:

With the rise of digital platforms, regulations like the GDPR (General Data Protection Regulation) in Europe have been established to protect consumer data and ensure transparency about its use.

Challenges and the Way Forward

- Digital Age Challenges: The rise of e-commerce, digital platforms, and online transactions has introduced new challenges in ensuring consumer protection and transparency.

- Globalization: With businesses operating globally, ensuring consistent consumer protection and transparency standards across borders can be challenging.

- Educating Consumers: While regulations can protect consumers, it’s equally crucial to educate them about their rights and how to recognize transparent practices.

Conclusion

In the realm of academic and professional writing, a conclusion serves as a critical bridge, synthesizing the content presented while offering a final perspective on the topic. It’s not merely a summary; instead, it encapsulates the essence of the discussion, reaffirms the main points, and often provides a forward-looking statement or a call to action. A well-crafted conclusion leaves the reader with a sense of closure and a deeper understanding of the subject’s significance, ensuring that the content resonates long after the reading has ended.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More