Decentralized Finance, commonly known as DeFi, is a groundbreaking innovation in the world of finance. It represents a shift from traditional, centralized financial systems to protocols and platforms that operate without intermediaries. By leveraging blockchain technology, DeFi offers a range of financial services – from lending and borrowing to trading and investing – all in a decentralized manner.

What is DeFi?

DeFi stands for “Decentralized Finance”. At its core, it’s a set of blockchain-based financial services that aim to bypass traditional intermediaries like banks. Instead of a central authority, smart contracts on blockchains like Ethereum manage the operations. These smart contracts are self-executing contracts with the terms of the agreement directly written into code, ensuring trust and transparency.

Tutorials: Getting Started with DeFi

Setting Up a Wallet: Before diving into DeFi, one needs a digital wallet to store and manage their assets. Wallets like MetaMask or Trust Wallet are popular choices.

Connecting to a DeFi Platform: Once the wallet is set up, users can connect to platforms like Uniswap or Compound to start their DeFi journey.

Understanding Gas Fees: Transactions on blockchain networks require fees. It’s essential to understand how these work to avoid unexpected costs.

Use Cases of DeFi

- Lending and Borrowing: Platforms like Aave or MakerDAO allow users to lend their assets and earn interest or borrow against their crypto holdings.

- Decentralized Exchanges (DEXs): Unlike traditional exchanges, DEXs like Uniswap or SushiSwap allow peer-to-peer trading without a central authority.

- Yield Farming: A more advanced DeFi strategy where users provide liquidity or participate in a platform’s ecosystem to earn rewards.

Popular DeFi Platforms

- Uniswap: A decentralized exchange for swapping various cryptocurrencies.

- Compound: A platform where users can lend or borrow assets.

- Yearn.Finance: A suite of products in DeFi that provides lending aggregation, yield generation, and insurance.

X11 is a hashing algorithm used by certain cryptocurrencies, most notably Dash. While X11-based cryptocurrencies aren’t as commonly integrated into mainstream DeFi platforms as Ethereum or Binance Smart Chain tokens, there’s growing interest in bridging this gap.

The Mechanics of Blockchain in Cross-Border Payments

The world of finance has been revolutionized by the advent of blockchain technology, especially in the realm of cross-border payments. Traditional systems, often riddled with delays, high fees, and a lack of transparency, are now being challenged by the decentralized and efficient nature of blockchain. This section delves into the mechanics of how blockchain technology is reshaping cross-border payments.

Understanding Blockchain in Payments

At its core, a blockchain is a decentralized ledger of transactions distributed across a network of computers. Each transaction is grouped with others in a block, and these blocks are chained together in a linear, chronological order. The decentralized nature of this system ensures that no single entity has control, and all transactions are transparent and immutable.

Tutorials: Blockchain in Cross-Border Transactions

- Setting Up a Blockchain Wallet: Before making cross-border payments, one needs a digital wallet compatible with the blockchain platform they intend to use. Wallets like MetaMask for Ethereum or Electrum for Bitcoin are popular choices.

- Initiating a Cross-Border Transaction: Once the wallet is set up, users can send funds to any recipient worldwide, provided they have their blockchain address.

- Tracking the Transaction: Blockchain’s transparent nature allows users to track their transaction in real-time using blockchain explorers.

Use Cases of Blockchain in Cross-Border Payments

Remittances: Migrant workers sending money back home can benefit from the reduced fees and faster transaction times offered by blockchain.

Trade Finance: Blockchain can simplify the complex web of intermediaries in international trade, making transactions smoother.

Foreign Investments: Investors can use blockchain to invest in assets in other countries without the need for currency conversion or traditional banking systems.

Popular Platforms Facilitating Blockchain Cross-Border Payments

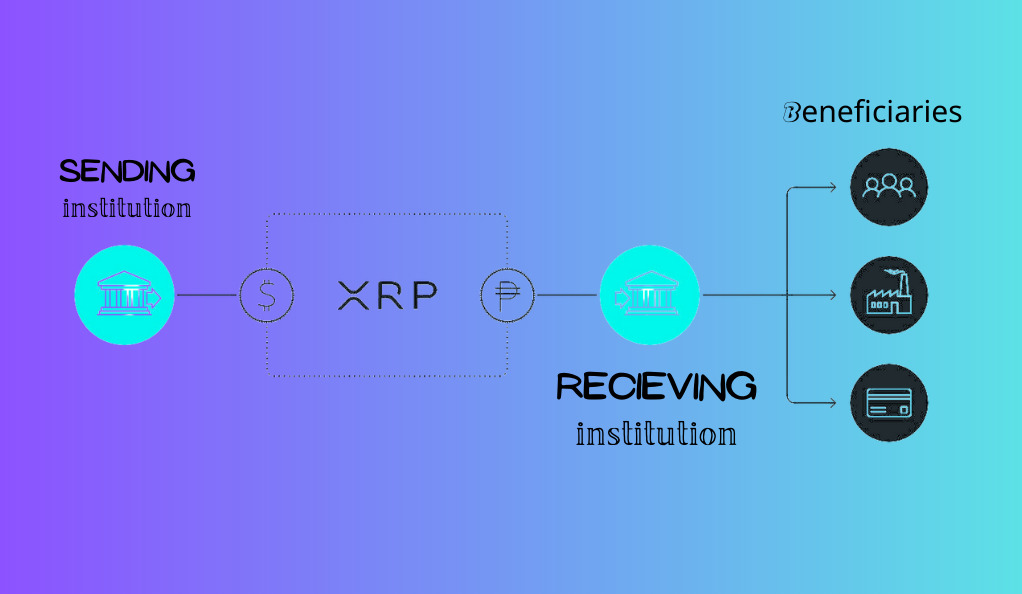

Ripple (XRP)

Specifically designed for cross-border payments, Ripple offers fast and low-cost international transactions.

Stellar (XLM)

Stellar’s network connects banks, payment systems, and people, facilitating low-cost cross-border transfers.

Ethereum

While not specifically designed for cross-border payments, Ethereum’s smart contracts can be tailored for this purpose, offering flexibility and automation.

X11, primarily associated with the cryptocurrency Dash, is a hashing algorithm. While not as mainstream in the DeFi space as Ethereum or Bitcoin, there’s potential for integration. Dash, for instance, has already made strides in establishing itself as a viable option for cross-border payments, especially in regions with unstable local currencies.

Advantages of Blockchain-Enabled Cross-Border Payments

The financial landscape is undergoing a seismic shift with the integration of blockchain technology, especially in the domain of cross-border payments. Traditional banking systems, often characterized by their inefficiencies, high costs, and time-consuming processes, are now being outperformed by blockchain-enabled solutions. This section explores the manifold advantages of utilizing blockchain for cross-border transactions.

Why Blockchain for Cross-Border Payments?

Blockchain, at its essence, is a decentralized and distributed ledger system that records transactions across multiple computers in a way that ensures the data is secure, transparent, and immutable. When applied to cross-border payments, this technology offers a plethora of benefits over conventional methods.

Tutorials: Leveraging Blockchain for Cross-Border Transactions

- Choosing the Right Blockchain Platform: Depending on the nature of the transaction, platforms like Ripple or Stellar might be more suitable than, say, Ethereum or Bitcoin.

- Understanding Transaction Fees: While blockchain transactions can be cheaper, it’s essential to understand the associated fees, especially during network congestion.

- Ensuring Security: Learn how to use hardware wallets and employ two-factor authentication to secure your cross-border transactions.

Use Cases Highlighting the Advantages

Instant Remittances: Migrant workers can send money back home almost instantly, a process that could take days with traditional banks.

Trade and Commerce: Businesses can make international payments for goods and services with reduced fees and without the need for currency conversion.

Financial Inclusion: People in regions without access to traditional banking can participate in the global economy through blockchain-enabled payments.

Key Advantages of Blockchain-Enabled Cross-Border Payments

- Speed: Transactions are processed almost instantly, irrespective of the geographical distance, as opposed to the days or even weeks in traditional systems.

- Cost-Effective: By eliminating intermediaries, blockchain transactions often have lower fees.

- Transparency: Every transaction is recorded on a public ledger, ensuring transparency and traceability.

- Security: The decentralized nature of blockchain, combined with cryptographic techniques, ensures that transactions are secure and tamper-proof.

- Accessibility: Blockchain platforms are accessible to anyone with an internet connection, democratizing access to financial systems.

While X11, most notably associated with Dash, is not as mainstream in the DeFi space as some other algorithms, its potential for cross-border payments is significant. Dash, for instance, offers InstantSend and PrivateSend features, ensuring quick and private transactions, making it a viable option for cross-border payments.

Types of Blockchain Cross-Border Payments

The integration of blockchain technology into the financial sector has brought about a plethora of innovative solutions, especially in the realm of cross-border payments. Unlike the traditional banking systems, which are often cumbersome and riddled with intermediaries, blockchain offers a streamlined approach to international transactions. This section delves into the various types of blockchain cross-border payments within the decentralized finance (DeFi) ecosystem.

Understanding the Blockchain Landscape

Before diving into the types, it’s essential to grasp the fundamental nature of blockchain. It’s a decentralized ledger system that records transactions across multiple nodes, ensuring data integrity, transparency, and security. When applied to cross-border payments, blockchain offers various mechanisms to facilitate international transactions.

Tutorials: Navigating Different Blockchain Payment Types

Choosing the Right Type: Depending on your needs, whether it’s business-to-business or person-to-person, different blockchain payment types might be more suitable.

Understanding Transaction Costs: Each type of blockchain payment might have different associated fees. It’s crucial to be aware of these before initiating a transaction.

Ensuring Security and Compliance: Depending on the type and platform, there might be different security measures and regulatory compliances to consider.

Types of Blockchain Cross-Border Payments

- Business-to-Business (B2B) Payments:

- These are transactions that occur between businesses in different countries using blockchain technology.

- Platforms like Ripple and Stellar are often used for these types of payments, offering solutions like frictionless high-value institutional settlements.

- Person-to-Person (P2P) Payments:

- These transactions occur between individuals across borders.

- Centralized and decentralized exchanges (CEXs and DEXs) often facilitate these transactions, allowing individuals to send and receive funds directly without intermediaries.

- Stablecoin-Based Payments:

- Stablecoins are cryptocurrencies pegged to stable assets like the US Dollar.

- They offer the advantage of cryptocurrency transactions without the volatility, making them ideal for cross-border payments where stability is crucial.

- Cryptocurrency Payments:

- Direct transactions using cryptocurrencies like Bitcoin, Ethereum, or Dash.

- While they offer the advantage of decentralization and often lower fees, they can be subject to market volatility.

- Smart Contract-Based Payments:

- These are automated, self-executing contracts with the terms directly written into code.

- They can be set up to facilitate cross-border transactions when certain conditions are met, ensuring trust and automation in the process.

X11, primarily linked with Dash, offers unique features suitable for cross-border payments. Dash’s InstantSend, for instance, ensures rapid transactions, making it a strong contender for international payments.

Major Players in Blockchain Cross-Border Payments

The transformative potential of blockchain in the financial sector, particularly in cross-border payments, has led to the emergence of several key players. These entities are pioneering the way for a decentralized financial future, offering solutions that are faster, more transparent, and often more cost-effective than traditional banking systems. This section provides an overview of the major players in the blockchain cross-border payments arena within the decentralized finance (DeFi) landscape.

Understanding the DeFi Landscape in Cross-Border Payments

Decentralized finance, or DeFi, is the umbrella term for financial services on blockchain, devoid of traditional intermediaries. Within this realm, cross-border payments have seen significant innovation, with various platforms offering unique solutions to age-old challenges.

Tutorials: Engaging with Major Blockchain Payment Platforms

- Platform Selection: Understand the unique offerings of each platform to select the one that aligns with your needs.

- Transaction Costs: Familiarize yourself with the fee structures of different platforms.

- Security Protocols: Each platform has its security measures. Ensure you’re well-acquainted with them before initiating transactions.

Major Players in Blockchain Cross-Border Payments

Ripple (XRP):

- Overview: Ripple is designed explicitly for cross-border payments, offering solutions that are both fast and cost-effective.

- Unique Selling Point: RippleNet, Ripple’s network, connects banks and payment providers, enabling real-time settlements and end-to-end visibility over transactions.

Stellar (XLM):

- Overview: Stellar connects financial institutions and facilitates low-cost cross-border transfers.

- Unique Selling Point: Stellar’s consensus protocol ensures transactions are swift, and its native asset, Lumens (XLM), acts as a bridge for multi-currency transactions.

Ethereum:

- Overview: While Ethereum is not explicitly designed for cross-border payments, its smart contract functionality can be tailored for this purpose.

- Unique Selling Point: Ethereum’s vast ecosystem of decentralized applications (dApps) and its flexibility make it a potential platform for innovative cross-border payment solutions.

JPMorgan’s Onyx:

- Overview: Onyx is JPMorgan’s dedicated blockchain initiative, aiming to improve wholesale payment transactions.

- Unique Selling Point: Leveraging JPMorgan’s financial expertise, Onyx offers solutions like Liink and Onyx Digital Assets for efficient cross-border payments.

Circle (USDC):

- Overview: Circle offers USDC, a stablecoin pegged to the US Dollar, facilitating cross-border transactions without the volatility of traditional cryptocurrencies.

- Unique Selling Point: Being a stablecoin, USDC offers the benefits of blockchain transactions with the stability of fiat currency.

Dash, the most prominent cryptocurrency using the X11 algorithm, has features tailored for cross-border payments, such as InstantSend. While not as integrated into the broader DeFi platforms as other cryptocurrencies, Dash’s potential in cross-border payments is noteworthy.

Safety and Security in Cross-Border Payments

In the rapidly evolving world of decentralized finance (DeFi), cross-border payments have emerged as a significant application of blockchain technology. While the advantages of speed, transparency, and cost-effectiveness are evident, safety and security remain paramount concerns for users. This section delves into the measures and best practices to ensure the utmost security in blockchain-enabled cross-border transactions.

The Importance of Security in DeFi Transactions

With the global nature of cross-border payments, transactions often involve significant sums and sensitive information. Ensuring the safety of funds and the privacy of data is crucial to foster trust and widespread adoption of DeFi solutions for international payments.

Tutorials: Enhancing Security in Cross-Border Transactions

- Selecting Secure Wallets: Understand the differences between hot and cold wallets, and choose wallets with robust security features.

- Using Two-Factor Authentication (2FA): Always enable 2FA for any platform or wallet involved in cross-border transactions.

- Recognizing and Avoiding Phishing Attempts: Learn to identify suspicious emails or websites that aim to steal your credentials.

Safety Measures in Blockchain Cross-Border Payments

Decentralization: One of blockchain’s core features, decentralization ensures that there’s no single point of failure. This distributed nature makes the system more resilient against attacks.

Cryptography: Blockchain employs advanced cryptographic techniques to secure data. This ensures that transactions are tamper-proof and identities remain private.

Consensus Mechanisms: Protocols like Proof of Work (PoW) and Proof of Stake (PoS) validate and verify transactions, preventing double-spending and ensuring the integrity of the network.

Smart Contract Audits: Before deploying, smart contracts used in cross-border payments are often audited for vulnerabilities, ensuring they operate as intended without any security flaws.

Transparency and Immutability: All transactions on a blockchain are recorded on a public ledger, ensuring transparency. Once added, these records cannot be altered, ensuring data integrity.

Dash, the primary cryptocurrency utilizing the X11 algorithm, places a strong emphasis on security. Features like ChainLocks and InstantSend not only enhance transaction speed but also bolster security against potential attacks like 51% attacks.

The Future of DeFi in Global Finance

Decentralized Finance, or DeFi, has emerged as one of the most transformative forces in the financial sector. By offering a decentralized alternative to traditional financial systems, DeFi promises to democratize access to financial services and reshape the global financial landscape. This section delves into the potential future of DeFi in global finance, its challenges, opportunities, and its synergy with X11-based cryptocurrencies.

DeFi’s Role in the Evolving Financial Ecosystem

The traditional financial system, with its centralized institutions and intermediaries, has long been the backbone of global finance. However, with the advent of blockchain technology and the principles of decentralization, DeFi offers a new paradigm, one that is more inclusive, transparent, and efficient.

Tutorials: Navigating the Future Landscape of DeFi

Staying Updated: With the rapid evolution of DeFi, it’s crucial to stay updated with the latest platforms, tools, and protocols.

Risk Management: As with any financial system, DeFi comes with its risks. Learn how to manage and mitigate these risks effectively.

Exploring New Platforms: As DeFi grows, new platforms will emerge. Understand how to evaluate and engage with these platforms safely.

Potential Developments in DeFi’s Future

- Mainstream Adoption: As DeFi platforms become more user-friendly and regulatory clarity improves, mainstream adoption is likely to surge.

- Interoperability: The future will likely see increased interoperability between different blockchains, allowing for a more cohesive and integrated DeFi ecosystem.

- Advanced Financial Instruments: Beyond the current offerings, DeFi will introduce more sophisticated financial instruments, such as decentralized insurance, derivative markets, and more.

- Regulatory Evolution: As DeFi gains prominence, regulatory bodies worldwide will develop frameworks to ensure consumer protection while fostering innovation.

- Enhanced Security Protocols: With the growth of DeFi, security will remain paramount. Advanced protocols and mechanisms will emerge to safeguard users and their assets.

Dash, the primary representative of X11-based cryptocurrencies, has features tailored for fast and secure transactions. As DeFi expands its horizons, there’s potential for greater integration of X11-based assets.

Conclusion

Decentralized finance (DeFi) stands as a beacon of innovation in the modern financial landscape, offering a transformative shift from traditional centralized systems. Through its myriad of platforms and tools, DeFi democratizes access to financial services, ensuring transparency, efficiency, and inclusivity. The integration of diverse technologies, including the unique features of X11-based cryptocurrencies, further enriches this ecosystem. As we navigate the future of global finance, DeFi, with its promise and potential, undoubtedly charts the course towards a more equitable and interconnected financial world.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More