Decentralized Finance, commonly known as DeFi, represents a paradigm shift in the world of finance. It aims to recreate traditional financial systems, such as lending, borrowing, and trading, but without the need for intermediaries like banks or brokers. Instead, DeFi leverages blockchain technology to ensure transparency, security, and accessibility.

Tutorials: Getting Started with DeFi

For those new to DeFi, the journey begins with understanding the basics:

- Setting up a Digital Wallet: Before diving into DeFi, one needs a digital wallet to store and manage their assets. Popular options include MetaMask, Trust Wallet, and Coinbase Wallet.

- Interacting with DeFi Platforms: Platforms like Uniswap, Aave, and Compound have user-friendly interfaces that allow users to lend, borrow, or trade assets.

- Understanding Smart Contracts: At the heart of DeFi are smart contracts, self-executing contracts with the terms of the agreement directly written into code.

Use Cases: Where DeFi Makes a Difference

Lending and Borrowing: Platforms like Aave and Compound allow users to earn interest on their assets or borrow against them without the need for credit checks.

Decentralized Exchanges (DEXs): Uniswap and SushiSwap are examples where users can trade assets directly without a centralized authority.

Yield Farming: A strategy where users lock up their assets in a DeFi protocol to earn rewards, often in the form of additional tokens.

DeFi Platforms: The Building Blocks

There’s a plethora of platforms in the DeFi space, each offering unique features:

- Uniswap: A decentralized exchange allowing for token swaps.

- Aave: A lending and borrowing platform with unique features like flash loans.

- MakerDAO: A platform that allows users to mint the stablecoin DAI using collateral.

Understanding the Environmental Concerns

The Digital Footprint of Decentralized Finance

In the age of digital transformation, Decentralized Finance (DeFi) has emerged as a beacon of innovation, promising a world where financial transactions are transparent, accessible, and free from intermediaries. However, as with any technological advancement, it comes with its set of challenges, and in the case of DeFi, the environmental concerns are paramount.

Blockchain and Energy Consumption

At the heart of DeFi is blockchain technology. While it offers unparalleled security and transparency, it’s also energy-intensive. Blockchains, especially those using the Proof of Work (PoW) consensus mechanism, require significant computational power. Miners compete to solve complex mathematical problems, and in doing so, consume vast amounts of electricity. This energy consumption, in many cases, rivals that of small countries.

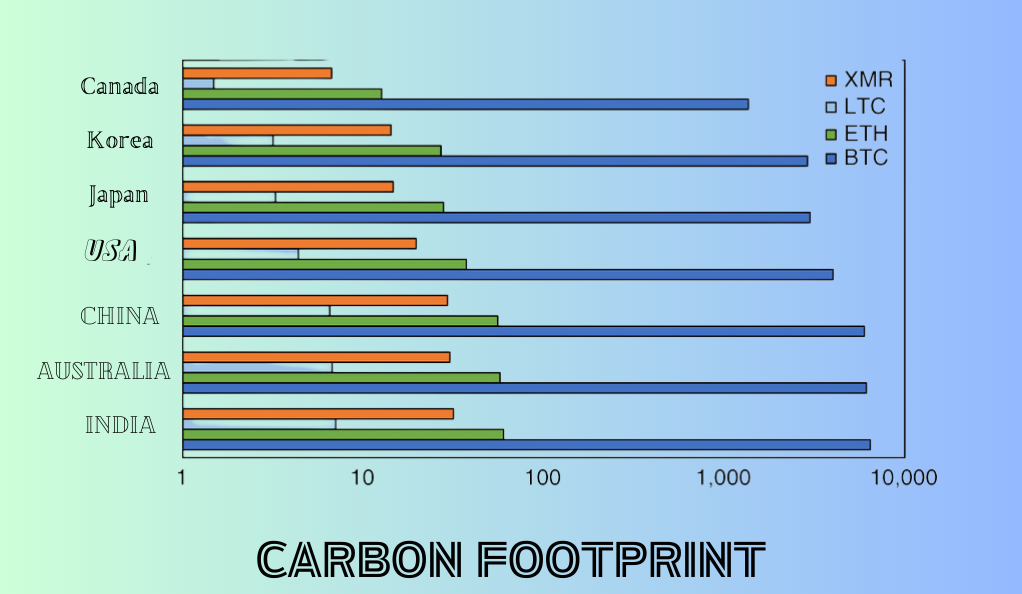

Carbon Footprint of Cryptocurrencies

Cryptocurrencies, the lifeblood of DeFi, have a notable carbon footprint. Bitcoin, the most well-known crypto, has faced criticism for its environmental impact. The energy required to mine Bitcoin often comes from non-renewable sources, leading to substantial CO2 emissions.

DeFi Platforms and Their Environmental Cost

While DeFi platforms offer innovative financial solutions, they operate on these energy-intensive blockchains. As the number of transactions and users on these platforms grows, so does their environmental impact.

Towards a Greener DeFi

The DeFi community is not blind to these concerns. Efforts are underway to transition to more energy-efficient consensus mechanisms like Proof of Stake (PoS). Additionally, Layer 2 solutions, which process transactions off-chain, are being explored to reduce the load on energy-intensive main blockchains.

DeFi’s Contribution to the Environmental Impact

The Double-Edged Sword of Financial Decentralization

Decentralized Finance (DeFi) has been hailed as a groundbreaking innovation, reshaping the contours of the financial world. By offering decentralized solutions for lending, borrowing, trading, and more, DeFi has democratized access to financial services. However, as its popularity surges, so do concerns about its environmental footprint.

Blockchain’s Energy Appetite

The foundation of DeFi is blockchain technology. While blockchains ensure transparency and security, they are notoriously energy-hungry. This is especially true for blockchains that rely on the Proof of Work (PoW) consensus mechanism, where miners compete to validate transactions. This competition requires vast computational resources, leading to significant energy consumption.

Cryptocurrencies and Carbon Emissions

Cryptocurrencies, integral to DeFi operations, contribute to the environmental dilemma. For instance, the mining process of Bitcoin, a pioneer in the crypto realm, is known to consume as much energy as some nations. This energy often comes from non-renewable sources, leading to considerable carbon emissions.

DeFi’s Growing Demand and Environmental Strain

As DeFi platforms proliferate, they bring along an increase in transactions on their respective blockchains. More transactions mean more validation, leading to higher energy consumption. Platforms like Uniswap, Compound, and Aave, while revolutionizing financial transactions, also add to the energy demand due to their reliance on energy-intensive blockchains.

Green Initiatives in the Blockchain Era

The Quest for a Sustainable Blockchain Future

The blockchain revolution, spearheaded by cryptocurrencies and decentralized finance (DeFi), has brought about transformative changes in the financial landscape. However, the environmental concerns associated with blockchain’s energy consumption cannot be ignored. As the world grapples with climate change, the blockchain community is stepping up with green initiatives to ensure a sustainable future.

Transitioning Away from Energy-Intensive Protocols

One of the primary culprits behind blockchain’s hefty energy consumption is the Proof of Work (PoW) consensus mechanism. Recognizing this, many projects are transitioning to more energy-efficient protocols:

- Proof of Stake (PoS): Unlike PoW, PoS doesn’t require miners to solve complex mathematical problems, drastically reducing energy consumption.

- Delegated Proof of Stake (DPoS): A variation of PoS, where a select group of trusted nodes validate transactions, further optimizing energy use.

Layer 2 Solutions: Off-Chain Scalability

Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, are gaining traction in the DeFi space. By processing transactions off-chain and settling them on-chain, these solutions not only enhance scalability but also reduce the energy demands on the primary blockchain.

Carbon Offsetting and Renewable Energy

Several blockchain projects and platforms are investing in carbon offset initiatives. By allocating a portion of their profits to eco-friendly projects like reforestation or renewable energy ventures, they aim to counterbalance their carbon footprint.

Integration with Energy-Efficient Algorithms

The X11 hashing algorithm, known for its energy efficiency, presents an opportunity for DeFi platforms. By integrating with X11-based cryptocurrencies, DeFi can potentially reduce its environmental impact, combining the best of both worlds: decentralized finance and energy efficiency.

Community-Driven Green Initiatives

The blockchain and DeFi community are at the forefront of driving sustainable practices:

- Eco-Friendly Mining: Encouraging miners to use renewable energy sources.

- Green Tokens: Tokens that represent a commitment to environmental sustainability, incentivizing green practices within the community.

Community-Led Efforts Towards Sustainability

Harnessing Collective Power for a Greener Future

The decentralized nature of blockchain and Decentralized Finance (DeFi) is not just a technological feature; it’s a testament to the power of community. As environmental concerns associated with blockchain technology come to the fore, it’s this very community that’s leading the charge towards a sustainable future.

Grassroots Movements for Green Blockchain

Across the globe, blockchain enthusiasts, developers, and users are coming together to advocate for eco-friendly practices:

- Eco-Friendly Mining Pools: Communities are forming mining pools that exclusively use renewable energy sources, reducing the carbon footprint of blockchain validation.

- Green Token Initiatives: Tokens representing a commitment to sustainability are being minted. Holding or trading these tokens often supports environmental projects or research.

DeFi Platforms and Community Governance

Many DeFi platforms operate under community governance models, where token holders have a say in the platform’s direction. Leveraging this, communities are voting for:

- Transition to Green Protocols: Advocating for shifts from energy-intensive PoW to more efficient consensus mechanisms.

- Investment in Carbon Offsetting: Allocating platform revenues towards carbon offset projects to neutralize the environmental impact.

Educational Drives and Workshops

Knowledge is power. Recognizing this, the DeFi community is organizing:

- Webinars and Tutorials: Educating users about the environmental implications of their blockchain interactions and how they can make greener choices.

- Hackathons: Encouraging developers to create innovative, eco-friendly blockchain solutions.

Integration with Sustainable Algorithms

The community’s push for sustainability has also led to interest in energy-efficient algorithms like X11. By advocating for and supporting platforms that integrate with X11-based cryptocurrencies, the community is driving the adoption of more sustainable blockchain practices.

Collaborative Research and Development

Open-source ethos runs deep in the blockchain community. Developers globally collaborate to:

- Optimize Existing Protocols: Refining current blockchain protocols to reduce their energy consumption.

- Innovate New Solutions: Researching and developing entirely new methods that prioritize sustainability from the ground up.

Education and Awareness: A Key Pillar

Empowering the Masses in the Age of Decentralized Finance

In the rapidly evolving world of Decentralized Finance (DeFi), knowledge is not just power—it’s a necessity. As DeFi platforms and blockchain technologies continue to reshape the financial landscape, the importance of education and awareness cannot be overstated. Ensuring that users, developers, and stakeholders are well-informed is crucial for the sustainable growth of the DeFi ecosystem.

The Need for DeFi Education

- Complexity of Technologies: DeFi platforms, with their smart contracts and various consensus mechanisms, can be intricate. A solid understanding is vital to navigate this space effectively.

- Risk Management: Like any financial system, DeFi comes with its set of risks. Educated users can make informed decisions, minimizing potential pitfalls.

Tutorials: Breaking Down the Complex

A range of tutorials cater to both beginners and advanced users:

Setting Up Digital Wallets: Guiding users on securely storing and managing their assets.

Interacting with DeFi Platforms: Step-by-step guides on using platforms like Uniswap, Aave, and Compound.

Smart Contract Basics: Introducing the concept and workings of self-executing contracts.

Workshops and Webinars

Live sessions offer real-time insights:

- DeFi Use Cases: Exploring real-world applications of decentralized finance.

- Integration with X11-based Cryptocurrencies: Highlighting the benefits and methods of integrating energy-efficient X11 algorithms with DeFi platforms.

Awareness Campaigns: Highlighting the Environmental Aspect

With growing concerns about the environmental impact of blockchain technologies, awareness campaigns focus on:

Blockchain’s Carbon Footprint: Educating the community about the energy consumption of different consensus mechanisms.

Green Blockchain Initiatives: Promoting eco-friendly blockchain practices and platforms.

Collaborative Learning Platforms

The spirit of decentralization extends to education:

- Community Forums: Platforms like Reddit and Discord where users share knowledge, discuss challenges, and collaboratively find solutions.

- Open-Source Repositories: GitHub repositories dedicated to DeFi education, offering resources, research papers, and more.

Conclusion

In the dynamic realm of decentralized finance (DeFi), the fusion of innovative financial solutions with blockchain technology has revolutionized the way we perceive and interact with the financial world. As we navigate this transformative landscape, the importance of education, community-driven sustainability efforts, and the integration of energy-efficient algorithms like X11 becomes paramount. These elements not only ensure the robust growth of DeFi but also underscore its commitment to a sustainable and inclusive financial future for all.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More