The dawn of the digital age has brought with it a myriad of innovations, with cryptocurrency standing out as one of the most transformative. As digital currencies continue to gain traction, their influence on the global financial landscape is undeniable. This section delves into the meteoric rise of crypto assets and the subsequent challenges that policymakers grapple with in ensuring a stable financial ecosystem.

Rapid growth of Crypto assets and their impact on the Global financial system

In just over a decade, cryptocurrencies have transitioned from being a niche concept to a formidable force in the financial world. The global market capitalization of cryptocurrencies, which was negligible in its early years, has skyrocketed to nearly $2.5 trillion. This staggering growth is not just a testament to the increasing acceptance of digital currencies but also an indication of the potential of the underlying technology, blockchain.

The challenge policymakers face in monitoring risks from the evolving crypto sector

While the crypto boom has been largely celebrated for its innovative strides, it has also presented a unique set of challenges, especially for policymakers. The decentralized nature of cryptocurrencies, combined with their global reach, makes them inherently difficult to regulate. Policymakers are now tasked with the monumental challenge of monitoring a sector that is not only rapidly evolving but also operates largely outside the traditional financial system.

The Economic Value of Crypto Assets

Cryptocurrencies, once dismissed by many as a fleeting trend, have firmly established themselves as a significant economic force. Their value isn’t just reflected in soaring market caps but also in the groundbreaking technology that underpins them.

The significance of the nearly $2.5 trillion market capitalization.

A market capitalization nearing $2.5 trillion is no small feat, especially for an industry as young as cryptocurrency. This colossal figure isn’t just a testament to the popularity of digital currencies but also an indicator of the trust and confidence investors place in them. To put this into perspective, the crypto market’s valuation rivals that of some of the world’s largest companies and even surpasses the GDP of many countries.

This massive market cap signifies several key developments:

Mainstream Adoption: Cryptocurrencies are no longer the domain of tech enthusiasts alone. Institutions, hedge funds, and even traditional banks have started integrating crypto into their portfolios.

Diversification of Assets: With thousands of cryptocurrencies in existence, the market has diversified beyond pioneers like Bitcoin. Altcoins (alternative coins to Bitcoin) have carved out their niches, catering to various use cases and industries.

Global Reach: Cryptocurrencies operate on a global scale, transcending national borders. This universal appeal has played a pivotal role in driving up their collective valuation.

The potential of underlying technological innovations like blockchain.

While the financial value of cryptocurrencies is impressive, the real game-changer is the technology behind them: blockchain. Blockchain is a decentralized ledger system that ensures transparency, security, and immutability of data. Its applications extend far beyond just supporting digital currencies.

- Decentralization: Unlike traditional systems that rely on central authorities, blockchain operates on a peer-to-peer network. This decentralization eliminates intermediaries, reducing costs and increasing efficiency.

- Transparency and Security: Every transaction on a blockchain is recorded on a public ledger, ensuring transparency. Additionally, once data is added to the blockchain, it becomes immutable, ensuring its security against tampering.

- Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. They automate and streamline complex processes, finding applications in industries like real estate, finance, and entertainment.

- Supply Chain Management: Blockchain can track products from their origin to the consumer, ensuring authenticity and reducing fraud.

- Healthcare: Patient data can be stored securely on blockchain, ensuring privacy and easy access when required.

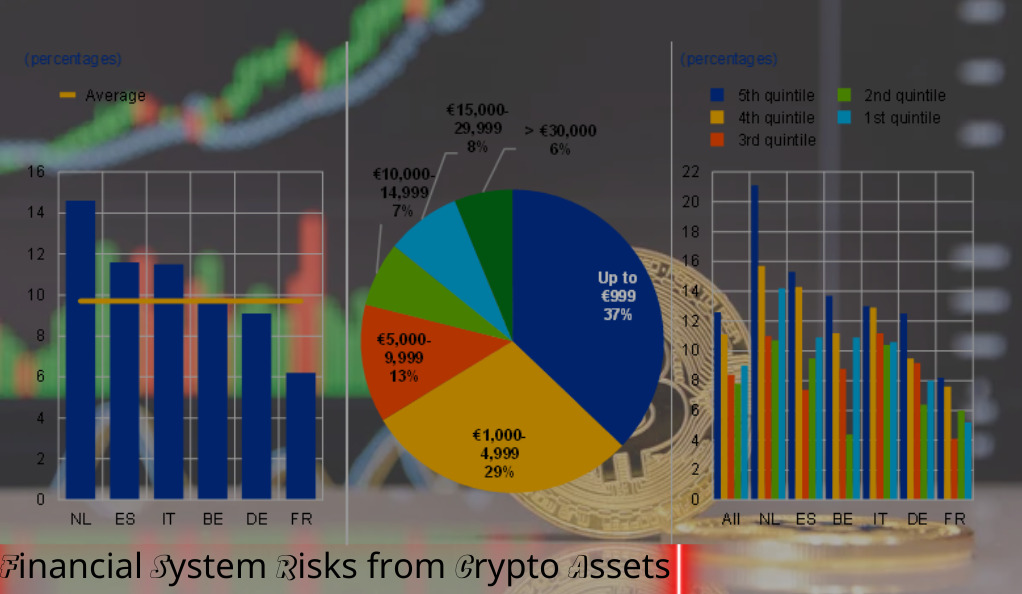

Financial System Risks from Crypto Assets

The meteoric rise of cryptocurrencies and their integration into the global financial fabric has not come without challenges. While they offer unprecedented opportunities for diversification, investment, and technological advancement, crypto assets also introduce a set of risks that can potentially destabilize the financial system.

Challenges in Determining Valuation

One of the most pressing concerns in the crypto ecosystem is the determination of valuation. Unlike traditional assets, which often have tangible backing or are tied to the performance of a particular business or commodity, cryptocurrencies derive their value from a combination of factors:

Speculation: A significant portion of crypto’s value is driven by speculative investment. This can lead to rapid price fluctuations, making the market highly volatile.

Lack of Standardized Valuation Models: Traditional assets have well-established models for determining their value. In contrast, the crypto market lacks a universally accepted method for valuation, leading to discrepancies and uncertainties.

External Influences: Market sentiment can be heavily influenced by external factors, such as regulatory news, technological advancements, or endorsements by influential figures.

Operational and Financial Integrity Risks

The decentralized nature of the crypto world, while being one of its strengths, also introduces risks:

- Exchange Vulnerabilities: Crypto exchanges, platforms where digital currencies are bought and sold, have been targets for hacks and security breaches. These incidents not only result in financial losses for users but also undermine trust in the system.

- Wallet Security: Digital wallets, used to store cryptocurrencies, can be susceptible to hacks if not secured properly. The irreversible nature of crypto transactions means that stolen assets are often irretrievable.

- Fraud and Scams: The crypto landscape has seen its share of fraudulent schemes, from Ponzi setups to fake initial coin offerings (ICOs). Unsuspecting investors can lose significant sums to these malicious actors.

Regulatory and Compliance Concerns

The global and decentralized nature of cryptocurrencies poses significant regulatory challenges:

The lack of uniform regulation across different countries regarding cryptocurrencies, ranging from bans to welcoming environments, can result in regulatory arbitrage, where entities relocate operations to jurisdictions with more favorable regulations. This inconsistency also poses challenges for ensuring consumer protection in the absence of a centralized authority, potentially exposing investors to undue risks. Moreover, the pseudonymous nature of cryptocurrencies raises concerns about their potential use in money laundering and illicit activities, prompting scrutiny from regulatory bodies worldwide.

The Need for Comprehensive International Standards

As the crypto landscape continues to evolve, the absence of a unified regulatory framework becomes increasingly evident. The decentralized and global nature of cryptocurrencies demands a comprehensive set of international standards to ensure stability, foster innovation, and protect investors.

Addressing Risks to the Financial System

The integration of crypto assets into the mainstream financial system brings along a myriad of challenges:

- Financial Stability: The volatility of cryptocurrencies can have ripple effects on the broader financial market. Sudden price crashes or spikes can affect investor confidence and potentially lead to broader market instabilities.

- Systemic Risks: Some countries, especially those with less developed financial systems, might face systemic risks from the rapid adoption of cryptocurrencies. These risks could become significant enough to threaten the entire financial system of a country.

- Operational Risks: The technology underpinning cryptocurrencies, while revolutionary, is still relatively new. Vulnerabilities or flaws in the system can lead to significant operational risks.

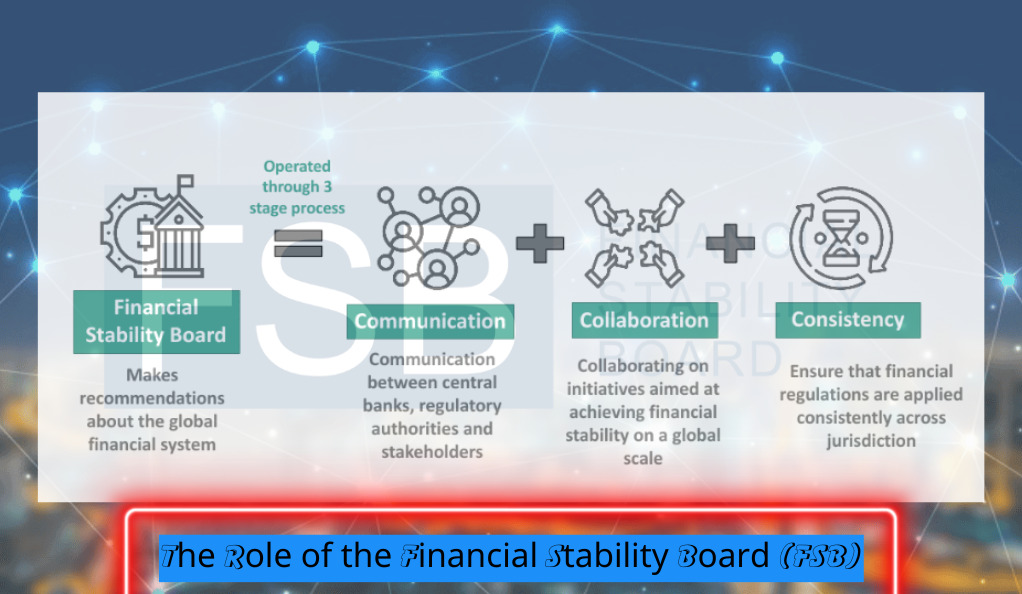

The Role of the Financial Stability Board (FSB)

Given the global nature of the crypto market, international bodies like the Financial Stability Board (FSB) play a crucial role in shaping the regulatory landscape:

The Financial Stability Board (FSB), in its coordinating role, should take the lead in establishing a global framework for crypto assets. This framework should address risks related to financial stability and market conduct while ensuring uniform application across jurisdictions. By doing so, it can help mitigate regulatory arbitrage, where entities exploit regulatory differences between countries, and promote international collaboration by facilitating the sharing of best practices and joint efforts to tackle challenges within the crypto sector.

Embracing the Potential While Mitigating Risks

While the primary focus is often on the risks, it’s essential to recognize the potential of crypto assets and the underlying blockchain technology:

- Enabling Environment: International standards should not stifle innovation. Instead, they should create an environment where beneficial crypto products and applications can thrive.

- Balancing Act: The challenge lies in striking the right balance between regulation and innovation. Overly stringent regulations might hinder growth, while a lax approach could expose the system to undue risks.

- Stakeholder Involvement: Developing comprehensive standards requires the involvement of all stakeholders, from crypto enthusiasts and developers to financial institutions and regulators.

Diverse National Approaches to Crypto Regulation

The global nature of cryptocurrencies, combined with their transformative potential, has led to a patchwork of regulatory responses from nations around the world. As countries grapple with the challenges and opportunities presented by the crypto boom, their approaches to regulation have varied widely, reflecting differing priorities, economic contexts, and visions for the future of finance.

The Spectrum of Regulatory Responses

Countries’ stances on crypto regulation can be broadly categorized into several archetypes:

- Embracing Innovators: Some nations, recognizing the economic potential of the crypto industry, have adopted a welcoming stance. They’ve established clear regulatory frameworks that promote innovation while ensuring consumer protection. Examples include Switzerland and Singapore, which have become hubs for crypto startups and ICOs.

- Cautious Observers: A number of countries are treading carefully, allowing the crypto industry to develop while closely monitoring its growth and impact. They might have some regulations in place but are often waiting to see how the landscape evolves before taking more definitive actions.

- Restrictive Regulators: Concerned about potential risks to their financial systems, certain countries have taken a more restrictive approach. This might involve stringent licensing requirements, heavy taxation, or even outright bans on certain crypto activities. China, for instance, has imposed bans on crypto exchanges and ICOs.

- Undecided Jurisdictions: Some nations have yet to formulate a clear stance on cryptocurrencies, leading to an environment of uncertainty. In these countries, the lack of regulation can be both an opportunity and a challenge for crypto businesses and investors.

Challenges of Cross-Border Crypto Activities

The decentralized and borderless nature of cryptocurrencies presents unique regulatory challenges:

The crypto industry’s jurisdictional overlaps pose challenges to regulatory oversight, as many service providers operate across borders, potentially causing conflicts in regulatory requirements. Regulatory arbitrage, driven by disparities in national regulations, can undermine efforts to enforce consistent standards, with businesses relocating to more favorable regulatory environments. Additionally, tracking and enforcing regulations on decentralized and pseudonymous networks are inherently difficult, making it challenging for authorities to combat illicit activities, particularly when they occur outside their jurisdiction.

The Need for Harmonized Global Standards

Given the global nature of the crypto industry, there’s a growing consensus on the need for harmonized standards:

Collaborative Efforts: International bodies, such as the Financial Stability Board and the International Monetary Fund, can play pivotal roles in fostering collaboration among nations and developing unified regulatory frameworks.

Shared Best Practices: Countries can benefit from sharing their experiences, challenges, and best practices in crypto regulation. This can lead to more informed and effective regulatory approaches.

Balancing Global and Local Needs: While a harmonized approach is essential, it’s also crucial to recognize and accommodate the unique economic, cultural, and technological contexts of individual countries.

Making Regulation Work at the Global Level

The rapid proliferation of cryptocurrencies and their inherent global nature necessitate a coordinated approach to regulation. While individual nations grapple with the nuances of their local contexts, there’s an undeniable need for a unified strategy that addresses the broader challenges and harnesses the opportunities presented by the crypto industry.

Licensing and Authorization Criteria

A foundational step in creating a robust regulatory framework is establishing clear licensing and authorization criteria for crypto-related entities:

- Standardized Requirements: Just as traditional financial institutions undergo rigorous vetting processes, crypto service providers should meet standardized requirements to ensure their operations are transparent, secure, and in line with best practices.

- Scope of Operations: Depending on their functions—whether they’re exchanges, wallet providers, or ICO platforms—entities might face varying levels of scrutiny and different sets of regulations.

- Periodic Review: Given the dynamic nature of the crypto industry, licensing criteria should be periodically reviewed and updated to reflect new developments and emerging risks.

Tailoring Regulations to Crypto Use Cases

Cryptocurrencies and blockchain technologies have a wide array of applications, each with its unique set of challenges and considerations:

Investment vs. Utility: While some cryptocurrencies serve primarily as investment vehicles, others provide utility within specific platforms or ecosystems. Regulations should differentiate between these use cases to ensure appropriate oversight.

Decentralized Finance (DeFi): The rise of DeFi platforms, which aim to recreate traditional financial systems in a decentralized manner, requires a fresh regulatory perspective, balancing innovation with risk management.

Stablecoins: These are cryptocurrencies pegged to stable assets like fiat currencies. Given their potential to be used as mainstream digital cash, they might warrant stricter regulations compared to more volatile digital assets.

Cross-Agency Collaboration and Oversight

The multifaceted nature of the crypto industry often means that its oversight doesn’t fall neatly within the purview of a single regulatory body:

Effective regulation of cryptocurrencies requires inter-agency coordination within countries, as multiple agencies often have a stake in this realm to prevent regulatory gaps or overlaps. Furthermore, there’s a global imperative for regulatory bodies worldwide to collaborate, exchange knowledge, and formulate collective strategies. In addition to this, fostering public-private partnerships with industry stakeholders, spanning from crypto startups to established tech giants, can offer regulators valuable insights while nurturing an atmosphere of mutual trust and cooperation.

The Urgency of Cross-Border Collaboration

Cryptocurrencies, by their very nature, transcend national borders. Their decentralized and global reach presents both opportunities and challenges that cannot be effectively addressed by isolated national efforts. The urgency of cross-border collaboration in the realm of crypto regulation has never been more pronounced, as nations grapple with the complexities of a rapidly evolving digital financial landscape.

Addressing Technological, Legal, and Regulatory Challenges

The global footprint of cryptocurrencies brings to the fore a myriad of challenges:

- Technological Disparities: Different countries have varying levels of technological infrastructure and expertise. Collaborative efforts can help bridge these gaps, ensuring that all nations, regardless of their technological prowess, can effectively regulate and benefit from the crypto industry.

- Legal Ambiguities: The legal status of cryptocurrencies varies widely across countries. Some view them as commodities, others as currencies, and yet others as securities. Harmonizing these definitions can pave the way for more consistent regulatory approaches.

- Regulatory Gaps: Without international collaboration, gaps in regulation can emerge, allowing malicious actors to exploit these loopholes. Joint efforts can ensure a more comprehensive and watertight regulatory framework.

Facilitating Information Exchange and Best Practices

Shared knowledge is a powerful tool in the face of a rapidly evolving industry:

To effectively regulate the dynamic crypto markets, real-time data sharing among nations is crucial for monitoring suspicious activities, tracking illicit transactions, and addressing market anomalies promptly. Hosting regular international workshops and conferences provides a valuable platform for regulators, industry experts, and stakeholders to exchange insights, tackle challenges, and devise solutions collaboratively. Additionally, the development of standardized reporting protocols for crypto activities can streamline regulatory procedures and ensure uniformity in data collection and analysis.

Conclusion

The digital revolution, led by cryptocurrencies and blockchain technology, has transformed the global financial landscape, offering unparalleled investment opportunities and redefining traditional currency concepts. However, this shift brings challenges, notably in regulating these decentralized, borderless assets. While they promise financial freedom, they also pose risks to stability and trust. Diverse global responses underscore the intricacies of navigating this domain, with some nations embracing the potential, while others remain cautious.

The urgency for international collaboration in crypto regulation is evident. As the sector grows, united efforts from countries, global entities, and industry leaders are vital to shape a future balancing cryptocurrency benefits with security. As we stand at this digital crossroads, our collective decisions and partnerships will determine the financial narratives of the future, steering us towards a promising digital horizon.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More