In the digital universe of cryptocurrencies, algorithms serve as the foundational bedrock upon which these decentralized currencies stand. But what exactly is an algorithm in this context, and why are they of such paramount importance to cryptocurrencies? Let’s dive deep and explore the role of algorithms, how they differ, and the distinctive features they bring to the table.

What is a Cryptocurrency Algorithm?

At its core, a cryptocurrency algorithm is a set of rules or procedures designed to solve a specific problem or perform certain tasks. In the realm of cryptocurrencies, these algorithms determine how new transactions are added to the blockchain, how consensus is achieved, and how new coins are introduced into the system.

Key Functions of Cryptocurrency Algorithms:

- Transaction Verification: Every cryptocurrency transaction, whether it’s a Bitcoin purchase or a Litecoin transfer, undergoes verification. The algorithm ensures that each transaction is genuine and not a fraudulent attempt.

- Mining Process: Cryptocurrencies use a process called mining where new coins are introduced into the system. The algorithm defines how these new coins are mined – essentially, how complex mathematical problems are solved using computer power to earn new coins.

- Security and Consensus: Algorithms play a pivotal role in ensuring the security of the entire network. They prevent double-spending, ensure transaction integrity, and help achieve consensus across all nodes in the network.

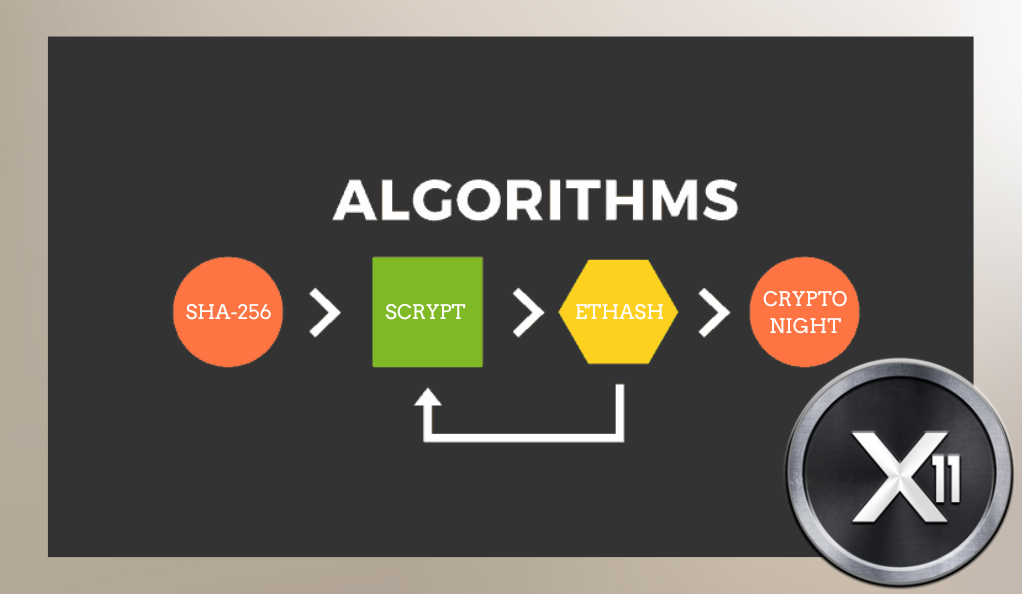

Diversity in Algorithms and Their Implications:

There’s no ‘one-size-fits-all’ when it comes to cryptocurrency algorithms. Just as the animal kingdom thrives in diversity, so does the world of crypto algorithms. From Bitcoin’s SHA-256 to Ethereum’s Ethash, each algorithm brings its unique flair to the table. This diversity has several implications:

- Hardware Requirements: Different algorithms require different types of hardware for optimal mining. While some are designed for standard CPUs, others may require specialized ASICs (Application-Specific Integrated Circuits).

- Energy Consumption: The environmental footprint of mining can vary significantly based on the algorithm. Some are notoriously energy-intensive, while others pride themselves on being eco-friendlier.

- Security: The resilience against potential threats, like the infamous 51% attack, varies among algorithms. Certain algorithms offer multi-layered security protocols, making them more impervious to vulnerabilities.

A Snapshot of Popular Cryptocurrency Algorithms

| Algorithm | Popularly Used By | Hardware Requirement | Energy Consumption | Security Features |

|---|---|---|---|---|

| SHA-256 | Bitcoin | ASICs | High | Resilient to 51% attack with high hash rate |

| Scrypt | Litecoin | ASICs, previously CPUs | Moderate | Adaptive N-factor |

| Ethash | Ethereum | GPUs | High | ASIC-resistant |

| CryptoNight | Monero | CPUs | Moderate | Privacy-focused, ASIC-resistant |

| X11 | Dash | ASICs, previously GPUs | Low to Moderate | Chain of 11 hashing functions |

In essence, the algorithm a cryptocurrency adopts dictates its DNA – shaping everything from its mining efficiency and security measures to transaction speed and even energy consumption.

The Genesis of X11 Algorithm

Cryptocurrencies have always been a hotbed for innovation, with various projects constantly aiming to outdo each other in terms of features, security, and efficiency. Among these myriad algorithms that underpin different cryptocurrencies, the X11 algorithm emerged as a distinctive player, boasting a unique combination of efficiency and security. But what led to the birth of X11, and why did it garner attention in the ever-evolving crypto landscape?

Historical Context and Creation

In the early days of cryptocurrencies, Bitcoin, powered by the SHA-256 algorithm, dominated the scene. However, as ASIC miners became more prevalent, concerns about centralization and the environmental impact of Bitcoin mining started to mount. This provided an opportunity for new algorithms to emerge that addressed these concerns.

Enter the X11 algorithm. Conceived and introduced by Evan Duffield in January 2014 as the backbone of Dash (originally known as XCoin, then Darkcoin), X11 was designed with the future in mind. It took a unique approach by chaining 11 different scientific hashing algorithms, giving it its name “X11”.

Why Eleven Hash Functions?

The decision to integrate 11 separate hashing functions wasn’t just an arbitrary choice. Each function has its own strengths, and when combined, they offer:

- Enhanced Security: The multi-layered approach means that even if one function is found vulnerable, the remaining functions continue to provide robust security.

- ASIC Resistance (initially): By making the mining process more complex, it became less feasible for ASICs to dominate, promoting more decentralization in the early days.

- Energy Efficiency: X11 was notably more energy-efficient compared to SHA-256, leading to less heat generation and longer hardware lifespan.

Dash: The Pioneer of X11

Dash, the first cryptocurrency to implement the X11 algorithm, positioned itself not just as another digital currency but as ‘digital cash’. Its key features included:

- InstantSend: For near-instant transactions, something Bitcoin struggled with.

- PrivateSend: Allowing users more privacy in their transactions, akin to the anonymity of cash transactions.

- Decentralized Governance: Ensuring decisions could be made without central authority, aligning with the ethos of decentralization.

Adoption and Evolution

The promise of better security, energy efficiency, and ASIC resistance (at least initially) made X11 a choice for several other cryptocurrency projects. However, as with all technologies, evolution is inevitable. Over time, ASICs developed for X11, leading to debates within the community about the future direction of coins using the algorithm and the broader implications for the crypto space.

Unique Features of X11

The cryptocurrency ecosystem is often defined by its continuous strive for innovation. Each algorithm presents its individual recipe of features aiming to address challenges, reduce vulnerabilities, and offer something new to the community. In this landscape, X11 stands out with its unique design choices. Let’s dissect what makes X11 tick and why these features matter in the broader context of cryptocurrencies.

Chain of 11 Different Hashing Functions

Perhaps the most defining feature of the X11 algorithm is its ensemble of 11 distinct hashing functions. This lineup includes: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

Advantages of this design include:

- Security Redundancy: By employing multiple functions, the algorithm ensures that even if one or two become compromised, the overall system remains secure. It’s like having multiple layers of security walls.

- Diverse Computational Processes: Each hashing function processes data differently. This diversity ensures that miners don’t get too comfortable with a singular computation, promoting a balanced network.

Power Efficiency and Temperature Reductions

X11 was heralded for its efficiency, especially when compared to algorithms like SHA-256.

Why does efficiency matter?

- Longevity of Mining Hardware: Reduced heat ensures that mining rigs have a longer operational life. This translates to cost savings for miners in the long run.

- Environmentally Conscious: With growing concerns about the carbon footprint of cryptocurrencies, especially Bitcoin, X11’s efficiency presented a more sustainable alternative.

ASIC Resistance and Decentralization Motives

While the initial design of X11 aimed at resisting ASICs, this wasn’t a permanent feature. ASIC resistance ensures:

- Democratization of Mining: By making it feasible for individuals with standard hardware to participate in mining, it ensures that control doesn’t rest in the hands of a few powerful entities with specialized equipment.

- Reduced Risk of 51% Attacks: A more decentralized network inherently reduces the risk of a single entity gaining majority control, thus lowering the chances of a 51% attack.

However, it’s crucial to note that with time, ASICs specifically designed for X11 did emerge. This evolution sparked discussions on whether the algorithm still held to its original principles and what this meant for its future.

Flexibility and Adaptability

A lesser-discussed but equally vital feature of X11 is its adaptability. Because of its multi-hash design, if one function becomes obsolete or compromised, it can be swapped out, ensuring the algorithm remains up-to-date and secure.

Other Notable Cryptocurrency Algorithms

In our journey through the world of cryptocurrency algorithms, understanding the broader ecosystem is paramount. Beyond X11, several other algorithms have made significant impacts, each with their unique features, advantages, and challenges. This section offers a brief but insightful exploration into some of these notable algorithms, laying the groundwork for a thorough comparative analysis.

SHA-256 (Used by Bitcoin)

The SHA-256, or Secure Hash Algorithm 256-bit, is a cryptographic hash function that consistently produces a 256-bit length output. It’s the powerhouse behind Bitcoin, the inaugural and most recognized cryptocurrency. This algorithm is lauded for its formidable security, making it a go-to choice for numerous digital currencies. However, when it comes to mining, SHA-256 demands potent and specialized hardware, specifically ASICs. This necessity has sparked debates about potential centralization and raised concerns over its environmental footprint.

Scrypt (Used by Litecoin)

Introduced by Litecoin, Scrypt was designed with the intention of being a more memory-intensive algorithm. This design aimed to prevent the dominance of ASICs, thus promoting more decentralized mining. Beyond its structural attributes, Scrypt offers robust security, which carries the added advantage of being more accessible to individual miners. While it initially supported mining with standard CPUs and GPUs, the landscape evolved as ASICs tailored for Scrypt were eventually developed.

Ethash (Used by Ethereum)

Ethash, the algorithm employed by Ethereum, is specifically crafted to counteract the dominance of powerful ASIC miners, thereby fostering a more decentralized environment. Given Ethereum’s standing in the cryptocurrency world, there’s a continuous emphasis on fortifying its security, leading to regular updates and refinements. Furthermore, Ethash is tailored to be optimized for GPU mining, leveling the playing field and making mining more approachable for individual participants.

CryptoNight (Used by Monero)

CryptoNight, employed by Monero and other privacy-centric cryptocurrencies, stands as a testament to the emphasis on privacy and anonymity in the digital currency realm. Bolstered by robust security features, this algorithm ensures these core tenets are upheld. When it comes to mining, CryptoNight is distinctively designed to be compatible with standard CPUs. This intentional design choice champions the principles of decentralization and accessibility, allowing a broader audience to engage in the mining process.

Equihash (Used by ZCash)

Equihash, prominently utilized by ZCash, stands out as an ASIC-resistant algorithm crafted for efficient mining on conventional consumer hardware. Beyond its mining-friendly design, Equihash places a high emphasis on security and privacy. It incorporates features that bolster transaction confidentiality, ensuring a secure environment for users. Additionally, its optimization for general-purpose hardware, as opposed to specialized mining equipment, underscores its commitment to fostering decentralization in the crypto space.

Comparing Algorithm Attributes

The table below encapsulates some key features of these algorithms, setting the stage for more detailed comparisons in the subsequent sections.

Comparative Analysis of Cryptocurrency Algorithms

| Algorithm | Cryptocurrency | ASIC Resistance | Mining Hardware | Security Features |

|---|---|---|---|---|

| SHA-256 | Bitcoin | No | ASICs | High Security |

| Scrypt | Litecoin | Initially | ASICs, CPUs, GPUs | High Security |

| Ethash | Ethereum | Yes | GPUs | High Security |

| CryptoNight | Monero | Yes | CPUs | High Security & Privacy |

| X11 | Dash | Initially | ASICs, GPUs | Chain of 11 Hash Functions |

Comparative Analysis: X11 vs. Other Cryptocurrency Algorithms

With an understanding of the diverse algorithms that influence the cryptocurrency space, it’s crucial to juxtapose X11 with its counterparts. By doing so, we can gauge the strengths, weaknesses, and distinctive characteristics that each brings to the table. In this section, we will perform a comparative analysis, setting X11 against other prominent algorithms.

X11 vs. SHA-256 (Bitcoin’s Algorithm)

- Complexity: While SHA-256 has a straightforward approach with a single hash function, X11 boasts 11 chained hash functions, making it inherently more complex.

- Energy Efficiency: X11 is known for being more energy-efficient, leading to cooler devices and less environmental impact compared to the energy-intensive SHA-256.

- Centralization vs. Decentralization: SHA-256’s heavy reliance on ASICs has led to concerns about mining centralization. Although X11 initially resisted ASICs, they eventually penetrated the X11 mining scene.

X11 vs. Scrypt (Litecoin’s Algorithm)

- Memory Use: Scrypt is memory-intensive, designed to resist ASIC dominance. X11, on the other hand, emphasized a chain of hash functions for added security and complexity.

- ASIC Evolution: Both algorithms were initially seen as alternatives to ASIC-heavy SHA-256. However, over time, ASICs were developed for both, challenging their decentralization goals.

- Efficiency: While both algorithms are more energy-efficient than SHA-256, X11 has a slight edge due to its diverse hashing processes.

X11 vs. Ethash (Ethereum’s Algorithm)

- Purpose & Philosophy: Ethereum’s Ethash focuses on ensuring smart contract functionality and a move towards proof-of-stake. X11, while also emphasizing decentralization, primarily aimed for enhanced security and efficiency.

- Mining Hardware: Both were tailored for GPU mining, but as with other algorithms, ASICs eventually emerged for X11.

- Upgrades & Evolution: Ethereum has had a roadmap with multiple upgrades, aiming to transition to Ethereum 2.0 with a proof-of-stake consensus. X11, while adaptable, hasn’t seen such a significant shift in direction.

X11 vs. CryptoNight (Monero’s Algorithm)

- Privacy Focus: While X11 brought features like PrivateSend, CryptoNight, and Monero prioritize privacy and untraceability at their core.

- Mining Accessibility: Both algorithms emphasized decentralized mining. However, while X11 leaned more towards GPUs (and later ASICs), CryptoNight was optimized for CPU mining.

- Complexity: CryptoNight is a singular but sophisticated hash function with a privacy emphasis. X11, with its chained 11 functions, provides security redundancy.

X11 vs. Equihash (ZCash’s Algorithm)

- Privacy Elements: Both Dash (using X11) and ZCash (using Equihash) offer privacy features, but ZCash’s zk-SNARKs offer a different approach to transaction confidentiality.

- Algorithm Philosophy: While X11’s chaining of multiple hash functions enhances security, Equihash’s puzzle-solving approach prioritizes memory usage over raw computational power.

- Mining Dynamics: Initial ASIC resistance was a feature in both, but ASICs for both algorithms have since emerged, steering discussions about their decentralization ideals.

Impact on the Mining Community

The emergence and evolution of algorithms don’t just impact the technical underpinnings of cryptocurrencies; they have real-world implications, especially for the mining community. This section delves into how X11 and its counterparts have influenced miners, their choices, and the broader mining ecosystem.

Mining Hardware Evolution and Investment

The cryptocurrency landscape is significantly shaped by algorithms like X11, with direct implications for the mining community. These algorithms influence miners’ hardware choices, offering a variety from ASICs to CPUs. Notably, X11’s energy efficiency prolongs hardware life by minimizing overheating. However, the introduction of ASICs for previously “ASIC-resistant” algorithms raises concerns about centralization, as larger entities can overshadow individual miners. This shift has prompted some crypto projects to adjust their algorithms, seeking to preserve the decentralized spirit of the domain.

Decentralization and the Small Miner

Decentralization is a key concern for small miners, especially with the rise of ASICs for algorithms like X11 and Scrypt. These advanced machines favor larger entities, intensifying centralization debates. To counteract this, some crypto projects adjust their algorithms or introduce “forks” to retain ASIC resistance. Consequently, smaller miners often band together in mining pools, enhancing their chances of earning rewards amidst a landscape increasingly dominated by larger players.

Profitability and Algorithm Switching

Miners continually adapt to the cryptocurrency market’s shifts, especially GPU users who switch between algorithms for profitability. Modern tools aid in automating this process for better returns. Moreover, electricity costs play a role in these decisions, with energy-efficient algorithms like X11 enhancing profit margins, especially in high-cost regions.

Community Support and Algorithm Loyalty

The mining community often finds itself fragmented, aligning with specific algorithms that resonate with their priorities. While many champion the security and efficiency of X11, others lean towards the ASIC resistance offered by Ethash or the privacy-centric features of CryptoNight. This division isn’t merely superficial; it has palpable impacts on the trajectory of cryptocurrency projects. Active and engaged mining communities wield significant influence on the developmental roadmap of these projects. In several instances, impassioned feedback from these communities has prompted pivotal algorithmic adjustments or complete overhauls in response to their collective voice.

Environmental Concerns

The environmental repercussions of cryptocurrency mining have come under increasing scrutiny. Specifically, the carbon footprint associated with such activities has sparked widespread concern. However, algorithms, notably X11, which are designed to be less power-intensive, offer a silver lining by considerably reducing this footprint. In tandem with this, the rising tide of environmental consciousness is catalyzing a shift towards more sustainable mining practices. Recognizing the need for greener alternatives, several cryptocurrency projects are now exploring avenues such as renewable energy integration and carbon offset initiatives to further mitigate environmental impact.

Looking to the Future: The Evolution of Algorithms

As we reflect on the influence and implications of algorithms on the mining community, it’s equally vital to look ahead. The crypto space is dynamic, with technological advancements, market forces, and community decisions steering its path. Algorithms will inevitably evolve, adapt, and perhaps even be replaced. Whether it’s the pursuit of quantum resistance, further emphasis on sustainability, or a shift towards proof-of-stake models, the only certainty is change. As we continue to witness this evolution, the core principles of decentralization, security, and efficiency will remain paramount in guiding the future of cryptocurrency algorithms.

Quantum Computing: The Next Challenge for Cryptocurrency Algorithms

Cryptocurrencies, with their digital nature and cryptographic foundations, face a looming challenge on the horizon: quantum computing. As this nascent technology progresses, its potential implications for current crypto algorithms become increasingly pertinent. Here’s how quantum computers might shape the future of algorithms like X11 and its peers.

Understanding Quantum Computing

- Basics: Traditional computers utilize bits (0s and 1s) for computing. In contrast, quantum computers use qubits, which can represent both 0 and 1 simultaneously due to superposition. This property allows quantum computers to potentially solve specific complex problems more efficiently than classical computers.

- Quantum Speedup: Quantum computers can theoretically break certain cryptographic systems much faster than today’s best classical computers.

Implications for Cryptocurrencies

- Public Key Cryptography: A significant portion of cryptographic methods used by cryptocurrencies relies on the difficulty of factoring large numbers, a task manageable for quantum computers. This poses risks to public key infrastructure, where quantum computers might derive private keys from public ones.

- Hash Functions: Algorithms like SHA-256 and X11 rely on cryptographic hash functions. While quantum computers can speed up hash function inversions, they don’t render them entirely insecure. However, the level of security effectively halves. For instance, SHA-256’s security would be akin to SHA-128 against a quantum attack.

Proactive Approaches

- Post-Quantum Cryptography: Research is ongoing into cryptographic methods resistant to quantum attacks. Incorporating these into future iterations of cryptocurrency algorithms can ensure longevity and security.

- Algorithm Upgrades: Cryptocurrencies can transition to quantum-resistant algorithms through forks or updates. Some projects are already investigating such possibilities.

Potential Transition to Quantum Blockchains

- Native Quantum Resistance: Future cryptocurrencies could be built from the ground up to be quantum-resistant, incorporating quantum-safe algorithms and protocols.

- Quantum Key Distribution (QKD): Utilizing the principles of quantum mechanics, QKD offers a method of transmitting cryptographic keys with inherent security. Any attempt to eavesdrop on a key transmission disturbs the quantum state, alerting the parties involved and ensuring perfect secrecy.

Challenges Ahead

- Implementation and Transition: Shifting to quantum-resistant algorithms isn’t just a technical challenge; it requires consensus within the crypto community. Smooth transitions without causing market disruptions will be paramount.

- Hardware Limitations: Quantum computers capable of breaking current crypto algorithms are still in their infancy. Large-scale, fault-tolerant quantum machines are required, and their realization might still be a decade or more away.

Conclusion:

The realm of cryptocurrency algorithms, from X11 to SHA-256 and beyond, is a testament to the innovative spirit of the crypto community. These algorithms, with their unique characteristics and objectives, form the bedrock upon which the world of decentralized finance is built. As we’ve navigated through their intricacies, from their inception to the challenges posed by quantum computing, one thing becomes clear: adaptability is key.

As the landscape of technology and finance continues to shift, so will the algorithms that power our favorite cryptocurrencies. Embracing change, championing innovation, and prioritizing security will ensure that these digital currencies remain relevant, robust, and ready for whatever the future holds.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More