In the vast and ever-evolving world of cryptocurrencies, the X11 algorithm stands out as a unique and innovative hashing solution. While Bitcoin and many other cryptocurrencies rely on a single hashing function, X11 boasts eleven different cryptographic algorithms, hence its name. This multi-pronged approach not only enhances security but also makes it more energy-efficient, a concern that has been at the forefront of many discussions about Bitcoin’s energy consumption.

But as with any cryptocurrency, the value and utility of X11-based coins are closely tied to the platforms that support their trade. The right trading platform can offer not only liquidity but also security, user-friendly interfaces, and reasonable fees. Conversely, a poorly chosen platform can expose traders to unnecessary risks and even financial losses.

In this section, we’ll provide a brief overview of X11-based cryptocurrencies and delve into the importance of selecting the right trading platform. Whether you’re a seasoned trader or a newcomer to the world of cryptocurrency, understanding the landscape of X11 and the platforms that support it is crucial.

| Feature | Description |

|---|---|

| Hashing Functions | 11 different cryptographic algorithms |

| Popular Coins | Dash, CannabisCoin, StartCoin, DigitalPrice |

| Energy Efficiency | More energy-efficient compared to single-hash algorithms like Bitcoin’s SHA-256 |

| ASIC Resistance | Initially designed to resist ASIC mining, though ASICs for X11 have since been developed |

| Security | Multi-hash approach provides a higher degree of security against potential vulnerabilities |

As the table indicates, X11’s unique approach offers several advantages, especially in terms of energy efficiency and security. But to truly harness the potential of X11-based cryptocurrencies, one must navigate the world of trading platforms with care and precision. The subsequent sections will guide you through this landscape, offering insights into the top platforms that cater to X11-based cryptocurrencies and helping you make informed decisions in your trading endeavors.

What are X11-based Cryptocurrencies?

The term “X11” might sound like something out of a science fiction novel, but in the realm of cryptocurrencies, it represents a sophisticated and multi-layered hashing algorithm. Let’s break down what this means and why it’s significant.

The X11 Algorithm Explained

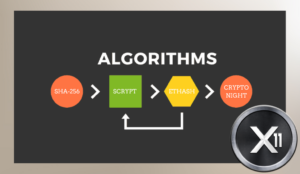

At its core, a hashing algorithm is a function that converts an input (or ‘message’) into a fixed-length string of bytes. In the world of cryptocurrencies, these algorithms are used to verify data integrity and produce the cryptographic equivalents of a digital signature.

What sets X11 apart is its use of not one, but eleven distinct cryptographic algorithms chained together. This chaining is sequential, meaning that the output of one algorithm becomes the input for the next. The eleven algorithms in question are: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

The multi-algorithm approach of X11 offers several advantages:

- Enhanced Security: By relying on multiple algorithms, X11 reduces the risk of vulnerabilities. Even if one algorithm were compromised, the others would still provide layers of protection.

- Energy Efficiency: X11 is known for being more energy-efficient than algorithms like Bitcoin’s SHA-256. This is particularly appealing in the context of environmental concerns surrounding cryptocurrency mining.

- ASIC Resistance: While X11 was initially designed to resist specialized mining hardware known as ASICs (Application-Specific Integrated Circuits), ASICs tailored for X11 have since emerged. However, the multi-hash nature of X11 still provides a level of resistance, ensuring a broader distribution of mining power and reducing centralization risks.

Popular X11-based Cryptocurrencies

While numerous cryptocurrencies utilize the X11 algorithm, some have gained more traction and popularity than others:

- Dash: Originally known as XCoin and later Darkcoin, Dash is perhaps the most well-known X11 cryptocurrency. It offers features like InstantSend and PrivateSend, emphasizing both speed and privacy.

- CannabisCoin: Tailored for the cannabis industry, this coin aims to facilitate transactions in medical marijuana dispensaries.

- StartCoin: A digital currency designed to promote and support crowdfunding campaigns.

- DigitalPrice: Emphasizing fast transactions and low fees, DigitalPrice is another notable X11-based coin.

These are just a few examples, and the landscape of X11-based cryptocurrencies continues to evolve. As with all investments, it’s essential to conduct thorough research and understand the unique features and value propositions of each coin.

Criteria for Evaluating Trading Platforms

In the dynamic world of cryptocurrency trading, not all platforms are created equal. Whether you’re trading X11-based cryptocurrencies or any other digital assets, the platform you choose can significantly impact your trading experience. Here, we’ll outline the essential criteria to consider when evaluating trading platforms.

Security Measures and Protocols

- Two-Factor Authentication (2FA): A basic yet crucial feature, 2FA adds an extra layer of security by requiring two types of identification before granting access.

- Cold Storage: Platforms that store a significant portion of their assets in offline, cold storage reduce the risk of large-scale hacks.

- Encryption: Ensure the platform uses high-level encryption techniques to safeguard your data and funds.

- History of Security Breaches: While past performance isn’t always indicative of future results, platforms with a history of breaches might warrant extra caution.

User Experience and Interface

- Intuitive Design: The platform should be easy to navigate, even for beginners.

- Mobile App: A user-friendly mobile app can be invaluable for traders on the go.

- Customer Support: Efficient and responsive customer support can make a world of difference, especially in the fast-paced crypto environment.

Fees and Transaction Costs

- Trading Fees: These can vary widely between platforms. Some might offer tiered fee structures based on trading volume, while others might have flat rates.

- Deposit and Withdrawal Fees: Be wary of platforms that charge exorbitant fees for depositing or withdrawing funds.

- Hidden Costs: Always read the fine print. Some platforms might have hidden costs or conditions attached to certain transactions.

Supported Cryptocurrencies

- Range of X11-based Cryptocurrencies: Since our focus is on X11-based coins, ensure the platform supports a broad range of these.

- Other Altcoins: Even if your primary interest is in X11-based coins, having access to a diverse range of altcoins can offer more trading opportunities.

Mobile Capabilities and Accessibility

- Mobile Trading: A robust mobile application is essential for those who wish to trade on the move.

- Platform Uptime: Ensure the platform has a good track record of uptime, especially during peak trading hours.

Choosing the right trading platform is a blend of personal preference and objective criteria. While some traders might prioritize low fees, others might value security or user experience above all else. By understanding and considering the criteria outlined above, you’ll be better equipped to find a platform that aligns with your trading goals and strategies.

Top Platforms for Trading X11-based Cryptocurrencies

In this section, we’ll delve into some of the leading platforms that support the trading of X11-based cryptocurrencies. Each platform will be evaluated based on the criteria discussed in the previous section.

Kraken

- Overview and Features: Founded in 2011, Kraken is one of the oldest and most reputable cryptocurrency exchanges. It offers a wide range of cryptocurrencies, including several X11-based coins.

- Security Measures: Kraken places a strong emphasis on security, with features like 2FA, cold storage, and encrypted databases. The platform also boasts a clean record with no history of significant breaches.

- Pros:

- Wide range of supported cryptocurrencies.

- Robust security measures.

- Competitive fee structure.

- Cons:

- The user interface might be a bit complex for beginners.

- Limited options for fiat currency deposits depending on the region.

Coinbase

- Overview and Features: As one of the most popular cryptocurrency exchanges globally, Coinbase offers a user-friendly platform suitable for both beginners and seasoned traders.

- Security Measures: Coinbase uses a combination of cold storage and encrypted hot wallets. It also offers 2FA and insurance for funds held online.

- Pros:

- Intuitive user interface.

- Mobile app available.

- Insured deposits.

- Cons:

- Higher fees compared to some other platforms.

- Limited range of altcoins.

Crypto.com

- Overview and Features: Crypto.com aims to accelerate the world’s transition to cryptocurrency. Their platform offers a wide range of services, from trading to a crypto debit card.

- Mobile App Capabilities: The Crypto.com app is sleek and offers a full range of features, making trading on the go a breeze.

- Pros:

- Versatile mobile app.

- Competitive fee structure.

- Regular promotions and staking options.

- Cons:

- A smaller range of supported cryptocurrencies compared to larger exchanges.

- Some users report slow customer support response times.

Gemini

- Overview and Features: Founded by the Winklevoss twins, Gemini is a platform that emphasizes both security and regulatory compliance.

- Emphasis on Security: Gemini offers top-notch security features, including cold storage, multi-signature transactions, and 2FA.

- Pros:

- Strong security measures.

- User-friendly interface.

- Regulated by the New York State Department of Financial Services (NYSDFS).

- Cons:

- Limited range of supported altcoins.

- Fee structure can be high for low-volume traders.

BitMart Exchange

- Overview and Features: BitMart is a global digital asset trading platform that offers diverse cryptocurrency pairs. Its mission is to drive the integration of blockchain technology into daily life.

- Security Measures: BitMart employs advanced technologies such as distributed system framework, multi-signature cryptocurrency wallets, and cold storage to ensure the utmost security of user assets.

- Pros:

- Offers a wide range of cryptocurrencies.

- User-friendly interface suitable for both beginners and professionals.

- Competitive trading fees.

- Cons:

- Customer support might be slow during peak times.

- The mobile app can be glitchy on some devices.

Cash App

- Overview and Features: Originally designed as a peer-to-peer money transfer app, Cash App has expanded its features to include Bitcoin trading. While its cryptocurrency offerings are limited compared to other platforms, its simplicity attracts many users.

- Focus on Bitcoin Trading: Cash App primarily caters to Bitcoin traders, making it less suitable for those interested in a broader range of cryptocurrencies.

- Pros:

- Simple and intuitive interface.

- Quick and easy setup process.

- Allows users to withdraw Bitcoin to personal wallets.

- Cons:

- Limited to Bitcoin trading.

- Fees can be high compared to dedicated cryptocurrency exchanges.

Bisq (Decentralized Exchange)

- Overview and Features: Bisq stands out as a decentralized cryptocurrency exchange, meaning it operates without a central authority. This design prioritizes privacy and security.

- Emphasis on Privacy and Decentralization: Users don’t need to reveal personal details, making trades more private. Funds are also stored in multisig wallets, adding an extra layer of security.

- Pros:

- High level of privacy.

- No need for registration or identity verification.

- Supports a wide range of payment methods.

- Cons:

- Might be confusing for beginners.

- Trade volumes can be lower than centralized exchanges.

- Disputes can take time to resolve due to the decentralized nature.

While the platforms listed above are among the most renowned in the industry, it’s essential to remember that the best platform for one trader might not be the best for another. Factors such as trading volume, preferred cryptocurrencies, and individual trading strategies can all influence the ideal choice. As always, conducting personal research and due diligence is paramount.

The Rise of Decentralized Exchanges (DEX)

In the ever-evolving landscape of cryptocurrency trading, decentralized exchanges (DEXs) have emerged as a compelling alternative to traditional centralized platforms. Unlike their centralized counterparts, DEXs allow peer-to-peer trades without intermediaries.

Benefits of DEXs:

- Security: Without a central point of failure, DEXs are less vulnerable to large-scale hacks.

- Privacy: Most DEXs don’t require user registration or identity verification, ensuring more private transactions.

- Control: Users retain control of their funds, reducing the risk of exchange insolvencies.

Challenges of DEXs:

- Usability: The decentralized nature can make DEXs less user-friendly, especially for newcomers.

- Liquidity: DEXs often have lower trading volumes, which can result in less favorable prices.

- Speed: Trades can sometimes be slower due to the reliance on blockchain confirmations.

While DEXs offer numerous advantages, they also come with their own set of challenges. As the crypto industry matures, it’s likely that the line between centralized and decentralized platforms will blur, leading to hybrid solutions that combine the best of both worlds.

Security Tips for Cryptocurrency Trading

The allure of the digital currency world is undeniable, with its promise of high returns and revolutionary technology. However, this burgeoning space is not without its pitfalls. Security remains a paramount concern for traders, given the decentralized and digital nature of cryptocurrencies. Here, we’ll delve into essential security measures every trader should adopt.

Two-Factor Authentication (2FA)

- What is it? A security process where users provide two different authentication factors to verify their identity. Typically, this involves something they know (password) and something they have (a code sent to a phone or a hardware token).

- Why it matters: 2FA significantly reduces the risk of unauthorized access, even if someone knows your password.

Using Hardware Wallets

- What is it? A physical device that stores users’ private keys in a secure hardware device, isolated from internet-connected devices.

- Why it matters: Hardware wallets are immune to viruses and hacks that can compromise software wallets, offering an added layer of security for your assets.

Beware of Phishing Attempts

- What is it? Fraudulent attempts to obtain sensitive information by disguising oneself as a trustworthy entity, often through emails or fake websites.

- Why it matters: Falling for a phishing scam can lead to the loss of funds or personal information. Always double-check URLs and be skeptical of unsolicited communications.

Regularly Update Software

- What is it? Keeping your software, especially wallets and operating systems, updated to the latest versions.

- Why it matters: Developers regularly release updates to patch vulnerabilities. Using outdated software can expose you to known security risks.

Avoid Using Public Wi-Fi for Transactions

- What is it? Refraining from conducting cryptocurrency transactions when connected to public or unsecured Wi-Fi networks.

- Why it matters: Public networks are more susceptible to man-in-the-middle attacks, where hackers can intercept data being sent between your device and the network.

Backup Your Wallet

- What is it? Creating backup copies of your wallet, including private keys and transaction data.

- Why it matters: Backups ensure that you can recover your funds if you lose access to your primary device or if it fails.

In the world of cryptocurrency trading, security should never be an afterthought. The decentralized and irreversible nature of blockchain transactions means that once assets are lost, they’re gone for good. By adopting the measures outlined above and staying informed about the latest security threats and best practices, traders can significantly reduce their risk and trade with confidence.

Conclusion

In the expansive domain of cryptocurrencies, the X11 algorithm carves a niche with its unique multi-hash approach, offering enhanced security and energy efficiency. This innovation is embodied in X11-based cryptocurrencies like Dash and CannabisCoin, among others. However, the essence of leveraging these innovative cryptocurrencies lies in the choice of trading platforms. Renowned platforms like Kraken and Coinbase, along with decentralized exchanges like Bisq, offer varied experiences, each with its own set of advantages and challenges. The right platform can provide traders with essential liquidity, security, and user-friendly interfaces, making the trading of X11-based cryptocurrencies a more accessible and secure endeavor.

As the cryptocurrency landscape continues to evolve, the emergence of decentralized exchanges (DEXs) heralds a new era of trading, offering enhanced privacy and control, albeit with challenges in usability and liquidity. Moreover, the paramount importance of security in trading cannot be overstated, with measures like Two-Factor Authentication and hardware wallets being crucial for safeguarding assets. The journey through the world of X11-based cryptocurrency trading is a blend of technological acumen, strategic platform selection, and vigilant security measures, all of which are essential for navigating the exciting yet often unpredictable waters of digital currency trading.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More