In a rapidly evolving digital landscape, the rise of cryptocurrencies has captured the attention of both financial enthusiasts and regulatory bodies. These decentralized digital assets, powered by blockchain technology, have the potential to revolutionize traditional financial systems and redefine the way we transact and store value. However, this disruptive potential also brings forth a complex array of challenges for regulators worldwide.

Cryptocurrency regulation is a critical topic that delves into the legal frameworks, guidelines, and oversight mechanisms that govern the issuance, trading, and usage of digital currencies. As governments and regulatory bodies grapple with striking a balance between promoting innovation and safeguarding financial stability, a deep understanding of the key elements of crypto regulation becomes indispensable.

The Global Mosaic of Crypto Regulation

Crypto regulation is not a one-size-fits-all concept; instead, it forms a complex mosaic of diverse approaches across the globe. Different countries have adopted varied stances, ranging from embracing cryptocurrencies as legal tender to outright bans. This diversity is reflective of the varying attitudes toward risk, technological progress, and the need to protect consumers and investors.

A comparison of crypto regulation across selected countries reveals the spectrum of regulatory strategies employed:

| Country | Approach to Regulation |

|---|---|

| United States | Patchwork of federal and state-level regulations |

| Japan | Cryptocurrencies recognized as legal payment instruments |

| China | Prohibition of crypto trading and ICOs |

| Switzerland | Supportive regulatory environment for blockchain innovation |

| India | Ban on financial institutions from dealing with cryptocurrencies |

Safeguarding Investors: Transparency and Security

One of the primary concerns driving crypto regulation is the protection of investors and consumers. The decentralized and pseudonymous nature of cryptocurrencies can expose users to significant risks, such as fraud, hacks, and Ponzi schemes. To counter these risks, regulatory bodies have put forth measures such as:

- Disclosure Requirements: Mandating clear and accurate disclosure of information by crypto projects, allowing investors to make informed decisions.

- Licensing and Registration: Requiring exchanges and other crypto service providers to obtain licenses, subjecting them to regulatory oversight.

- Security Standards: Imposing cybersecurity standards on crypto exchanges and wallet providers to enhance protection against breaches.

Balancing Innovation and Compliance

The allure of cryptocurrencies lies in their potential to revolutionize financial systems, but their disruptive nature also poses challenges for regulators. Striking a balance between fostering innovation and ensuring compliance with existing financial regulations is a delicate endeavor. Some jurisdictions have embraced a regulatory sandbox approach, allowing startups to experiment with new ideas under controlled conditions. This approach encourages innovation while maintaining regulatory oversight.

As the crypto space continues to evolve, regulatory bodies must grapple with new concepts like decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), each of which challenges existing regulatory paradigms.

In the upcoming sections of this comprehensive guide, we will delve deeper into the nuances of crypto regulation, exploring how Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations intersect with cryptocurrencies, identifying gaps in the regulatory landscape, and speculating on the future trajectory of crypto regulation.

Protecting Investors: Investor Safeguards in Crypto Regulation

In the realm of cryptocurrencies, where innovation and potential for growth abound, the need for robust investor safeguards becomes paramount. The decentralized and evolving nature of the crypto market presents unique challenges, making it crucial to implement measures that shield investors from fraud, scams, and unscrupulous practices. This section explores the multifaceted strategies employed in crypto regulation to protect investors, including the pivotal roles of disclosure requirements, consumer protection, and investor education.

Safeguarding Against Fraud and Scams

The anonymous and pseudonymous nature of cryptocurrency transactions creates an environment ripe for fraudulent activities. Unregulated initial coin offerings (ICOs), fake investment schemes, and phishing attacks are just a few of the dangers that investors face. To counter these threats, regulatory bodies have introduced a range of measures:

- Disclosure Requirements: Regulators often require crypto projects to provide comprehensive and transparent information about their operations, team members, technology, and use of funds. This empowers investors to make informed decisions.

- Licensing and Registration: Many jurisdictions mandate that crypto exchanges and other platforms obtain licenses or register with relevant regulatory bodies. This ensures that these entities adhere to certain standards and safeguards.

- Fraud Prevention: Regulators work to identify and shut down fraudulent schemes, protecting investors from falling victim to scams that promise high returns with little risk.

Role of Consumer Protection

Investor protection extends beyond traditional financial markets into the realm of cryptocurrencies. Consumer protection measures aim to ensure fair treatment, accurate information, and adequate avenues for complaint resolution:

- Transparency in Advertising: Regulators may require crypto-related advertisements to be accurate and not misleading. This prevents investors from being enticed by exaggerated claims.

- Anti-Deceptive Practices: Regulatory bodies crack down on deceptive practices that may manipulate or mislead investors, ensuring that they have a clear understanding of the risks involved.

- Refund and Redress: Investors who fall prey to fraudulent schemes or unscrupulous actors may have avenues to seek refunds or redress through regulatory channels.

Empowering Investors through Education

Investor education plays a pivotal role in reducing the vulnerability of investors to scams and misinformation. The complexity of cryptocurrencies and the evolving nature of the market make it imperative to educate potential investors about the risks and rewards:

- Educational Campaigns: Regulatory bodies and industry organizations conduct campaigns to educate the public about the risks associated with investing in cryptocurrencies and the importance of due diligence.

- Guidelines and Resources: Providing accessible guidelines, resources, and information helps investors navigate the complexities of the crypto market and make informed decisions.

- Promotion of Best Practices: Regulators may work with industry players to promote best practices in investor protection and educate users about safe crypto practices.

Cryptocurrencies and AML/KYC Compliance

In the dynamic world of cryptocurrencies, the implementation of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations represents a critical step toward ensuring financial transparency and preventing illicit activities. As digital assets gain prominence, regulators grapple with the challenge of reconciling the decentralized nature of cryptocurrencies with the need for regulatory oversight. This section delves into the intricate interplay between AML/KYC regulations and the crypto industry, exploring both their application and the complexities they introduce.

Applying AML/KYC to the Crypto Industry

Anti-Money Laundering (AML) regulations are designed to deter and detect activities that facilitate money laundering and other financial crimes. Know Your Customer (KYC) procedures involve the verification of the identity of customers to ensure compliance with AML requirements. In the crypto realm, applying AML/KYC measures presents unique challenges due to the decentralized and pseudonymous nature of transactions.

- AML Compliance: Cryptocurrencies provide a certain degree of anonymity, making them attractive for illicit activities. Regulatory bodies require crypto service providers, such as exchanges and wallet providers, to implement AML programs to identify and report suspicious transactions.

- KYC Procedures: Cryptocurrency exchanges are often mandated to collect and verify user information, ensuring that customers’ identities are known and that their transactions can be traced if needed.

Benefits and Challenges of AML/KYC Integration

Integrating AML/KYC measures into the decentralized crypto space has both positive and challenging implications:

Benefits:

- Reduced Illicit Activities: AML/KYC measures deter money laundering, terrorist financing, and other criminal activities that exploit cryptocurrencies’ anonymity.

- Enhanced Legitimacy: Regulatory compliance lends legitimacy to the crypto industry, encouraging institutional participation and investment.

- User Protection: AML/KYC measures safeguard users by reducing the risk of fraud and scams, creating a safer environment for transactions.

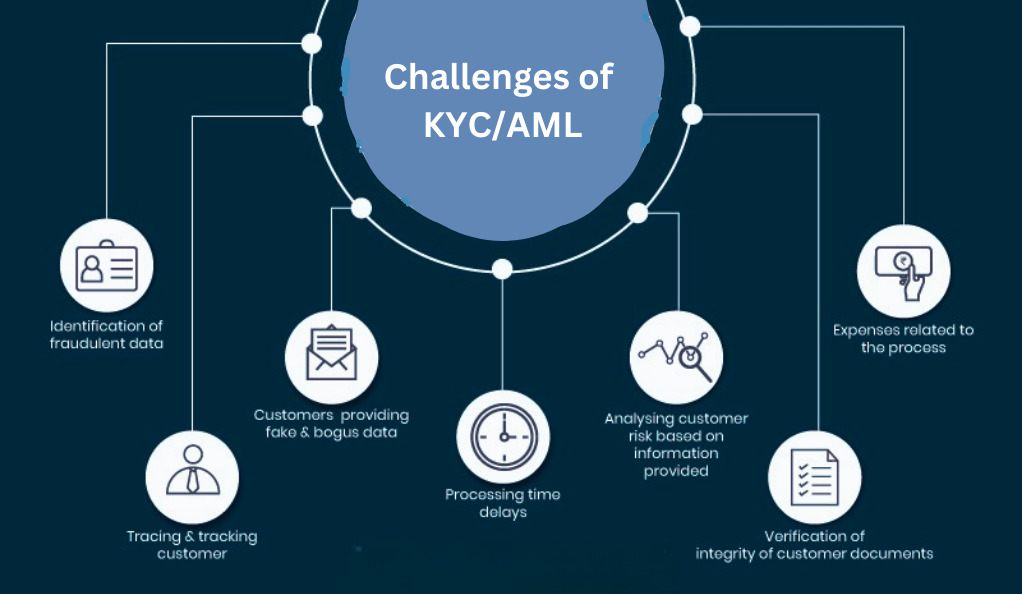

Challenges:

- Privacy Concerns: A key tenet of cryptocurrencies is privacy, and strict KYC can infringe on users’ desire for anonymity and control over their personal information.

- Decentralization Dilemma: Applying AML/KYC to decentralized platforms and peer-to-peer transactions is challenging due to the absence of intermediaries.

- Innovation Impact: Stringent AML/KYC requirements might stifle innovation by imposing heavy compliance burdens on startups and small businesses.

Regulatory Gaps and Emerging Challenges

As the world of cryptocurrencies continues to expand and evolve, it is accompanied by a series of regulatory challenges and gaps that demand attention. The dynamic nature of this digital landscape often outpaces the development of regulatory frameworks, creating vulnerabilities that can be exploited. In this section, we delve into the regulatory gaps that exist in the crypto space and explore emerging challenges, such as the decentralized finance (DeFi) revolution and the proliferation of non-fungible tokens (NFTs).

Identifying Regulatory Gaps

- Lack of Uniformity: The global patchwork of crypto regulations can create confusion and uneven protection for investors and participants.

- Cryptocurrency Classification: The lack of a standardized classification for various types of cryptocurrencies makes it challenging for regulators to apply appropriate rules.

- Cross-Border Transactions: The borderless nature of cryptocurrencies can make it difficult to regulate cross-border transactions, potentially allowing for regulatory arbitrage.

Emerging Challenges in the Crypto Space

Decentralized Finance (DeFi) Platforms:

DeFi has emerged as a transformative force in the crypto ecosystem, offering decentralized alternatives to traditional financial services. However, the rapid growth of DeFi platforms presents regulatory challenges:

- Lack of Intermediaries: DeFi platforms often operate without intermediaries, raising questions about how to enforce regulations and protect consumers.

- Smart Contract Risks: Vulnerabilities in smart contracts powering DeFi protocols can lead to hacks and losses, requiring regulatory responses to ensure security.

- Regulatory Ambiguity: The decentralized and borderless nature of DeFi can lead to regulatory ambiguity, as traditional regulations may struggle to apply to these platforms.

Non-Fungible Tokens (NFTs):

NFTs have taken the art, entertainment, and gaming worlds by storm, offering a new way to tokenize ownership and authenticity. However, they introduce their own set of regulatory considerations:

- Intellectual Property Concerns: NFTs raise questions about ownership and copyright infringement, requiring regulations to address disputes and protect creators’ rights.

- Investment Risks: As NFTs gain value, they can be treated as investment assets. Regulatory bodies may need to consider how securities laws apply to certain NFTs.

- Lack of Standardization: The lack of standardized practices in the NFT space can create challenges in terms of valuation, disclosure, and investor protection.

The Future of Crypto Regulation: Trends and Predictions

In the ever-evolving world of cryptocurrencies, the regulatory landscape is in a constant state of flux, shaped by technological advancements, market dynamics, and global events. As we look ahead, it’s important to anticipate how crypto regulation might evolve based on current trends and developments. This section delves into the potential trajectory of crypto regulation and speculates on the impacts these changes could have on the crypto market and its participants.

Predicting the Evolution of Crypto Regulation

- Global Harmonization: As the crypto market becomes more interconnected, there could be efforts to harmonize regulations across jurisdictions. International collaboration may increase to address cross-border challenges, fostering consistency in regulatory approaches.

- Risk-Based Approaches: Regulatory bodies might adopt risk-based approaches to tailor regulations according to the specific risks posed by different crypto activities. This could reduce compliance burdens on lower-risk entities while focusing on higher-risk areas.

- Balancing Innovation and Stability: Regulators will likely continue to seek a balance between nurturing innovation and maintaining financial stability. Regulatory sandboxes and flexible frameworks may be expanded to accommodate emerging technologies.

- Expanded Investor Protections: The focus on investor protection is expected to intensify. Regulations might become more comprehensive, covering not only traditional crypto assets but also newer forms like NFTs and tokenized assets.

Speculating on the Impacts

- Market Maturation: Clear and predictable regulations could attract institutional investors, leading to greater market maturation and increased liquidity in the crypto space.

- Innovation Trends: Regulatory changes could influence the direction of innovation. Stricter regulations may drive innovation toward privacy-centric solutions, while supportive regulations could encourage new financial products and services.

- Market Entry Barriers: Depending on the stringency of regulations, the barriers to entry for new projects and startups could be affected. Stricter rules may hinder innovation, while clear guidelines may facilitate market entry.

- Investor Confidence: Well-defined regulations can enhance investor confidence by reducing uncertainty and minimizing risks associated with scams and fraud.

- Decentralization Dynamics: Regulations could influence the decentralization of platforms and projects. Stricter requirements may centralize operations for compliance, while adaptable regulations might preserve decentralization.

- Market Fragmentation: Divergent regulatory approaches across countries could lead to market fragmentation, affecting cross-border transactions and global adoption.

- Crypto Adaptation: Regulatory changes could accelerate the acceptance of cryptocurrencies in mainstream finance and payment systems, leading to broader adoption.

Conclusion

Crypto regulation spans diverse global strategies. Safeguarding investors, integrating AML/KYC, and addressing trends like DeFi and NFTs are crucial.

Anticipating the future points to global harmonization, risk-focused rules, and investor protection. Striking innovation-security balance shapes maturity, investments, and decentralization.

A balanced, adaptable framework is vital. It fuels growth, innovation, and trust while shaping crypto’s potential. Maintaining this equilibrium will be key as the crypto landscape unfolds.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More