In the rapidly evolving world of cryptocurrency, the importance of compliance cannot be overstated. As digital currencies gain mainstream acceptance and become integral to global financial systems, ensuring that trading platforms adhere to regulatory standards is paramount. This not only safeguards the interests of investors but also bolsters the credibility of the crypto industry as a whole.

The Rise of Cryptocurrency and the Need for Compliance

Cryptocurrencies, once a niche market, have exploded in popularity over the past decade. With this surge in interest and investment, there’s been a corresponding increase in the number of trading platforms. These platforms serve as intermediaries, facilitating the buying and selling of digital assets. However, with great power comes great responsibility. As gatekeepers to the crypto world, these platforms must ensure that they operate within the bounds of the law.

Growth of Cryptocurrency Over the Years

| Year | Number of Active Cryptocurrencies | Total Market Cap |

|---|---|---|

| 2010 | 1 (Bitcoin) | $0.06 Billion |

| 2015 | 550+ | $4.3 Billion |

| 2020 | 5,000+ | $250 Billion |

| 2023 | 10,000+ | $1.5 Trillion |

X11 Crypto Trading Platforms: A New Frontier

Among the myriad of cryptocurrencies available, those based on the X11 cryptographic algorithm have garnered significant attention. X11, known for its energy efficiency and security features, has led to the creation of several unique digital currencies and corresponding trading platforms. However, the distinct nature of X11 also presents unique challenges when it comes to compliance. As these platforms grow in number and influence, ensuring they meet regulatory standards becomes even more crucial.

Understanding the Basics of Compliance in Crypto

The realm of cryptocurrency, while revolutionary, is not without its complexities. To navigate this intricate landscape, understanding the foundational pillars of compliance is essential. These pillars not only ensure the legitimacy of transactions but also protect users from potential fraud and illicit activities.

Defining KYC and AML in the Crypto Context

- KYC (Know Your Customer): At its core, KYC is a process that businesses employ to verify the identity of their clients. In the crypto world, this typically involves collecting personal information from users, such as their name, address, and photographic identification. This process ensures that platforms are not inadvertently facilitating transactions for individuals involved in illegal activities.

- AML (Anti-Money Laundering): AML measures are designed to prevent the conversion of illegally obtained funds into legitimate assets. For crypto trading platforms, this means monitoring transactions to detect and report suspicious activities. By doing so, platforms can play a pivotal role in curbing financial crimes like money laundering and terrorist financing.

The Role of Regulatory Bodies

Across the globe, various regulatory bodies oversee the operations of crypto trading platforms. Their primary objective is to ensure that these platforms adhere to established financial laws and regulations. Some of the most prominent regulatory bodies include:

- SEC (U.S. Securities and Exchange Commission): In the United States, the SEC is responsible for regulating securities markets. They have issued guidelines indicating that certain cryptocurrencies may be classified as securities, thus falling under their jurisdiction.

- FCA (Financial Conduct Authority): The UK’s FCA has been proactive in setting guidelines for crypto assets, ensuring that platforms operate transparently and protect consumer interests.

- ASIC (Australian Securities and Investments Commission): In Australia, ASIC provides guidance on the legal responsibilities of crypto trading platforms, emphasizing the importance of AML and KYC procedures.

Challenges and Opportunities

While compliance might seem like a daunting task, especially given the decentralized nature of cryptocurrencies, it presents numerous opportunities. Adhering to regulations not only minimizes legal risks but also instills trust among users. A platform known for its stringent compliance measures is more likely to attract and retain users, ultimately fostering long-term growth and stability.

The Unique Challenges of X11 Crypto Trading Platforms

The world of cryptocurrency is vast, with each cryptographic algorithm bringing its own set of advantages and challenges. X11, in particular, has been a topic of interest for many, given its distinctive features. But what makes X11 so special, and why does it present unique compliance challenges?

Introduction to X11 as a Cryptographic Algorithm

X11 is not just a single algorithm but a chain of eleven different hashing functions. This combination makes it one of the most secure cryptographic sequences in the crypto domain. Its multi-layered structure ensures that even if one function is compromised, the entire chain remains secure.

Why X11 Platforms Require Special Attention

The X11 algorithm stands out for its energy efficiency, especially compared to Bitcoin’s SHA-256. This efficiency has boosted mining activities, demanding enhanced compliance monitoring. Additionally, X11-based cryptocurrencies often prioritize user privacy, sometimes offering advanced anonymity. While beneficial for users, this poses verification challenges for platforms. Given X11’s benefits, its rapid adoption means trading platforms must quickly adapt to diverse compliance needs.

Navigating the Compliance Maze

For X11 crypto platforms, compliance hinges on two main pillars: consistent internal audits and proactive engagement with regulatory bodies. Regular audits ensure up-to-date software and accurate transaction monitoring, especially for X11-specific anomalies. Meanwhile, dialogues with regulators provide clarity on compliance norms, considering X11’s unique characteristics.

Best Practices for Robust Cryptocurrency Compliance

Ensuring compliance is not a one-time task but an ongoing commitment. For X11 crypto trading platforms, this commitment translates into a series of best practices that can guide their operations.

- Risk Assessment: Before implementing any compliance measures, platforms should conduct a thorough risk assessment. This involves identifying potential vulnerabilities, from software glitches to gaps in user verification processes.

- Continuous Monitoring: With the dynamic nature of the crypto market, continuous monitoring is essential. Platforms should invest in advanced tools that can automatically flag suspicious transactions or patterns.

- User Education: Compliance is a shared responsibility. By educating users about the importance of security measures, platforms can foster a culture of compliance. This includes providing resources on safe trading practices and the implications of regulatory non-compliance.

- Transparency: In the world of crypto, transparency is key. Platforms should maintain clear records of all transactions and be open to audits. This not only ensures regulatory compliance but also builds trust among users.

- Collaboration: Joining industry associations or forums can provide platforms with insights into emerging compliance trends. Collaborating with peers can lead to the development of standardized practices that benefit the entire industry.

Potential Pitfalls and How to Avoid Them

Even with the best intentions and practices in place, X11 crypto trading platforms can encounter challenges that might jeopardize their compliance efforts. Recognizing these potential pitfalls early on and taking proactive measures is the key to maintaining a robust compliance framework.

Common Mistakes Made by Crypto Trading Platforms

- Overlooking Regional Regulations: Cryptocurrencies are global, but regulations are often regional. Platforms might adhere to international standards but overlook specific requirements set by local regulatory bodies.

- Inadequate User Verification: While the allure of quick sign-ups can be tempting, skimping on user verification can lead to significant compliance issues down the line, especially with X11’s emphasis on privacy.

- Reliance on Outdated Technology: The crypto landscape evolves rapidly. Platforms using outdated technology might not detect newer forms of fraudulent activities or security threats.

- Lack of Employee Training: Compliance isn’t just about technology; it’s also about people. Employees unfamiliar with the latest compliance standards can inadvertently cause breaches.

- Not Preparing for Audits: Regular audits are a reality for crypto trading platforms. Not maintaining clear and transparent records can lead to complications during these reviews.

Proactive Measures to Ensure Continuous Compliance

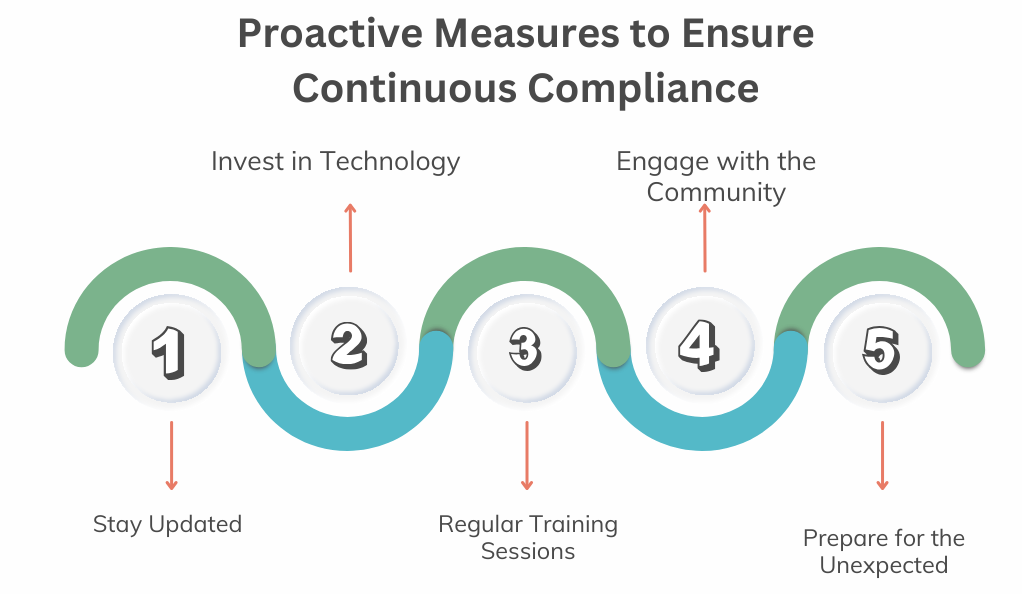

To ensure continuous compliance in X11 crypto trading platforms, several proactive measures should be taken.

Firstly, it’s essential to stay updated by regularly reviewing and enhancing the platform’s understanding of both local and international regulations, which may necessitate hiring legal experts or collaborating with regulatory authorities.

Secondly, allocating resources for technological advancement is crucial. This involves upgrading the platform’s technology stack, including security measures, transaction monitoring tools, and user verification processes.

Thirdly, organizing regular training sessions for employees is vital to keep them abreast of the latest compliance standards and best practices.

Additionally, engaging actively with the crypto community through forums, industry associations, and seminars can offer valuable insights into emerging compliance challenges and solutions.

Lastly, always having a contingency plan in place is imperative, as it prepares the platform for unforeseen events such as data breaches or regulatory interventions, thereby mitigating potential damages.

The Future of Compliance in X11 Crypto Trading Platforms

As we look ahead, the world of X11 crypto trading is poised for further growth and evolution. With this growth comes the inevitable evolution of compliance standards and practices.

Predictions and Trends for the Future

- Stricter Regulations: As the crypto market matures, regulatory bodies worldwide are likely to implement more stringent and detailed regulations to protect consumers and maintain financial stability.

- AI and Machine Learning in Compliance: Advanced technologies like AI and machine learning will play a pivotal role in monitoring transactions, detecting fraudulent activities, and ensuring compliance.

- Global Collaboration: As crypto transcends borders, there will be a push towards global standardization of compliance practices. This might involve international regulatory bodies working in tandem to set common standards.

- User-Centric Compliance: With growing awareness among users about their rights and the importance of security, platforms will shift towards more user-centric compliance measures. This includes clearer communication, transparency, and user-friendly verification processes.

Conclusion

The journey of ensuring compliance in X11 crypto trading platforms is continuous and ever-evolving. By staying informed, being proactive, and prioritizing user trust and security, platforms can navigate this journey successfully, setting the stage for a future where crypto is not just a niche market but an integral part of the global financial ecosystem.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More