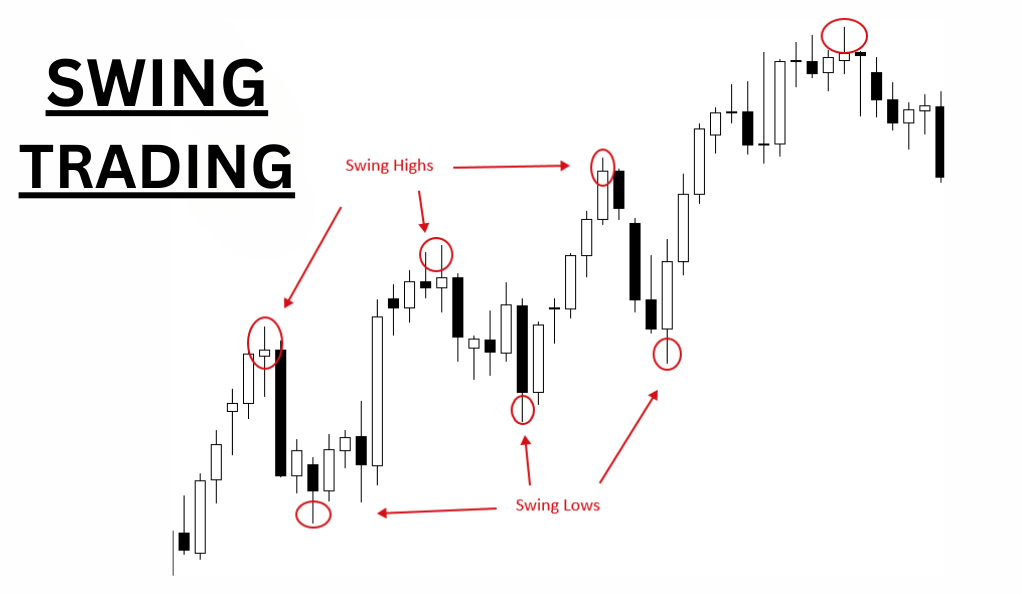

Swing trading is a popular trading strategy that seeks to capitalize on short- to medium-term price movements in the market. Unlike day trading, where positions are opened and closed within the same day, swing traders hold their positions for several days to weeks, aiming to profit from the natural “swing” or oscillation of asset prices.

Why is Swing Trading Popular Among Cryptocurrency Traders?

Swing trading has gained immense popularity among cryptocurrency traders, and several factors contribute to its favor in the crypto realm.

First and foremost, cryptocurrencies are renowned for their inherent volatility, providing traders with abundant opportunities to capitalize on significant price fluctuations. This high volatility allows swing traders to strategically enter and exit positions, aiming for substantial profits.

Moreover, the cryptocurrency market operates 24/7, distinguishing it from traditional stock markets with fixed trading hours. This continuous availability enables traders to react swiftly to market developments and breaking news, facilitating the identification and exploitation of price swings in real-time.

Additionally, major cryptocurrencies like Bitcoin and Ethereum, along with a multitude of altcoins, boast high liquidity, ensuring that traders can execute trades of varying sizes without causing abrupt price movements. This liquidity contributes to smoother and more efficient transactions.

Furthermore, the vast array of cryptocurrencies available in the market provides swing traders with a diverse range of assets to choose from, each exhibiting its unique market behavior. This diversity increases the likelihood of identifying and capitalizing on profitable swing trading opportunities.

Understanding X11 Cryptocurrencies

The world of cryptocurrencies is vast and diverse, with various algorithms underpinning different digital assets. One such algorithm that has garnered attention in the crypto community is the X11 algorithm.

What are X11 Cryptocurrencies?

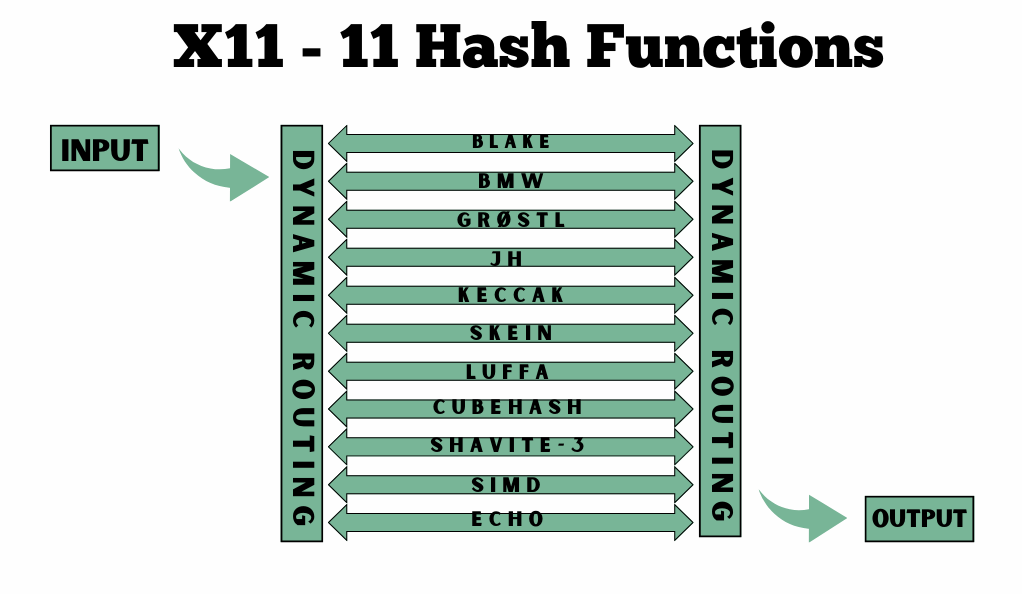

X11 is a unique cryptographic algorithm used by certain cryptocurrencies. It stands out because, unlike most algorithms that use a single hash function, X11 employs 11 different hash functions, making it one of the most secure and complex algorithms in the crypto space. This multi-hash approach not only enhances security but also optimizes the mining process, making it more energy-efficient.

Some popular cryptocurrencies that use the X11 algorithm include Dash, CannabisCoin, and Startcoin, among others.

Key Features and Benefits of X11 Algorithm:

- Enhanced Security: The use of 11 different hash functions means that even if one or a few of them are compromised in the future, the entire algorithm remains secure.

- Energy Efficiency: X11 is known for its energy efficiency, especially when compared to algorithms like SHA-256 used by Bitcoin. This translates to lower electricity costs for miners and a smaller carbon footprint.

- Adaptive Mining: The complexity of the X11 algorithm ensures that the mining difficulty adjusts more smoothly, preventing drastic fluctuations and ensuring a more predictable mining experience.

- ASIC Resistance: Initially, X11 was designed to resist the domination of ASIC miners, promoting decentralization. However, with advancements in technology, ASICs for X11 have been developed, but the algorithm still offers a more level playing field compared to some others.

The Importance of Market Analysis

In the world of trading, knowledge is power. The more informed a trader is about the market’s movements, the better equipped they are to make profitable decisions. This is where market analysis comes into play, serving as a compass to navigate the tumultuous waters of the cryptocurrency market.

Fundamental vs. Technical Analysis

There are two primary methods traders use to analyze the market:

- Fundamental Analysis: This method involves evaluating a cryptocurrency’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. For X11 cryptocurrencies, this could mean looking at factors like technological advancements, regulatory news, market adoption rates, and the overall health of the blockchain ecosystem.

- Technical Analysis: This approach focuses on studying price charts and using statistical measures to predict future price movements. Technical analysts, often called chartists, believe that all necessary information is reflected in the price, making it essential to recognize patterns and trends. For X11 cryptocurrencies, this would involve analyzing price charts, volume, moving averages, and other indicators specific to these digital assets.

Tools and Indicators for Effective Market Analysis

To conduct a thorough market analysis, traders use a variety of tools and indicators. Some of the most popular ones include:

- Price and Volume Charts: These provide a visual representation of a cryptocurrency’s historical and current price movements, helping traders identify patterns and trends.

- Moving Averages: This indicator smoothens price data to create a single flowing line, which makes it easier to identify the direction of the trend.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements and indicates overbought or oversold conditions. An RSI above 70 suggests that a cryptocurrency might be overbought, while below 30 indicates it might be oversold.

- Fibonacci Retracement: This tool helps traders identify potential support and resistance levels. It’s based on the idea that markets will retrace a predictable portion of a move before continuing in the original direction.

- MACD (Moving Average Convergence Divergence): This is a trend-following momentum indicator that shows the relationship between two moving averages of a cryptocurrency’s price.

Top Swing Trading Strategies for X11 Cryptocurrencies

Swing trading, with its focus on short- to medium-term price movements, requires a strategic approach to maximize potential returns. For X11 cryptocurrencies, certain strategies have proven effective in harnessing their unique market dynamics. Let’s delve into some of these top strategies:

1. Trend-following Strategies

Moving Average Crossover and Channel Trading. The Moving Average Crossover involves using two moving averages – a short-term and a long-term one. A buy signal occurs when the short-term average crosses above the long-term average, and a sell signal is generated in the reverse scenario. In contrast, Channel Trading identifies price channels with upper and lower boundaries acting as resistance and support, respectively. Traders buy near the lower boundary and sell when the price nears the upper boundary, taking advantage of price fluctuations within the channel.

2. Counter-trend Strategies

RSI Divergence occurs when a cryptocurrency achieves a new price high, yet the Relative Strength Index (RSI) fails to surpass its previous high, potentially signaling an impending downtrend. This divergence between price and RSI serves as an early indicator of market reversal. Additionally, traders utilize Fibonacci Retracements following substantial price movements to anticipate potential retracement points. These Fibonacci levels act as strategic entry or exit points, particularly for counter-trend trading strategies, enhancing precision in decision-making within the cryptocurrency market.

3. Breakout Strategies

In cryptocurrency swing trading, traders watch for triangle formations and volume breakouts. Triangles on charts suggest price consolidation, and when they break, it can signal significant price movements. Traders align with the breakout direction, anticipating strong trends. They also monitor sudden spikes in trading volume, indicating increased market interest. Breakouts from trading ranges with high volume are seen as potential signs of substantial price movements, guiding trading decisions.

4. Momentum Strategies

In swing trading, traders use technical indicators like MACD and the Stochastic Oscillator for insights. A MACD crossover (MACD line above signal) signals upward momentum, a potential buy. Conversely, a crossover with MACD below the signal indicates downward momentum, a potential sell. The Stochastic Oscillator compares a crypto’s closing price to its range over a period. Values over 80 suggest overbought conditions, potential downside reversals, while values below 20 imply oversold conditions and potential upside reversals. These indicators are crucial for traders to anticipate market moves and make informed decisions.

Risk Management in Swing Trading

While swing trading offers the potential for significant profits in the cryptocurrency market, it also carries inherent risks. Without proper risk management, traders can find themselves exposed to substantial losses. Here’s how you can effectively manage risk in your swing trading endeavors:

- Setting Stop-Loss and Take-Profit Points

In cryptocurrency trading, a stop-loss order acts as a safety net, automatically selling assets when the price reaches a predetermined level to limit losses. Traders often use technical analysis and support/resistance levels to set appropriate stop-loss points. Conversely, take-profit orders are strategically placed price levels where traders sell to secure profits, preventing impulsive decisions driven by greed. Setting multiple take-profit levels allows traders to lock in profits at various stages of a trade.

- Importance of Diversification

Diversification is a key aspect of risk management in swing trading. Instead of putting all your capital into a single cryptocurrency, consider spreading it across a portfolio of assets. This reduces the impact of a poor-performing asset on your overall portfolio and mitigates the risk associated with one asset’s price volatility.

Effective risk management is crucial in swing trading, as it can mean the difference between sustainable success and substantial losses. By implementing stop-loss and take-profit orders and diversifying your portfolio, you can navigate the cryptocurrency market with greater confidence and resilience.

Common Mistakes to Avoid

Even the most seasoned swing traders can fall victim to common pitfalls that can erode profits and hinder success. By being aware of these mistakes, you can better navigate the world of swing trading for X11 cryptocurrencies and increase your chances of achieving your trading goals.

Overtrading and Emotional Decisions

One of the most prevalent errors among traders, both novice and experienced, is overtrading. Overtrading occurs when traders excessively open and close positions, often driven by emotions such as fear and greed. This can lead to higher transaction costs, increased exposure to risk, and emotional burnout.

- Key Takeaway: Maintain discipline and stick to your trading plan. Avoid impulsive decisions based on emotional reactions to short-term price fluctuations.

Ignoring Market News and Updates

In the cryptocurrency market, news and events can have a profound impact on prices. Ignoring relevant news, whether it’s regulatory changes, technological advancements, or market sentiment shifts, can lead to missed opportunities or unexpected losses.

- Key Takeaway: Stay informed by regularly following cryptocurrency news sources and staying up-to-date with developments that may affect your trading positions.

Overlooking Risk Management

Effective risk management is crucial, yet many traders underestimate its significance. Failing to set stop-loss orders, neglecting take-profit levels, or ignoring diversification principles can expose your capital to unnecessary risk.

- Key Takeaway: Prioritize risk management strategies to protect your capital and ensure responsible trading.

Conclusion

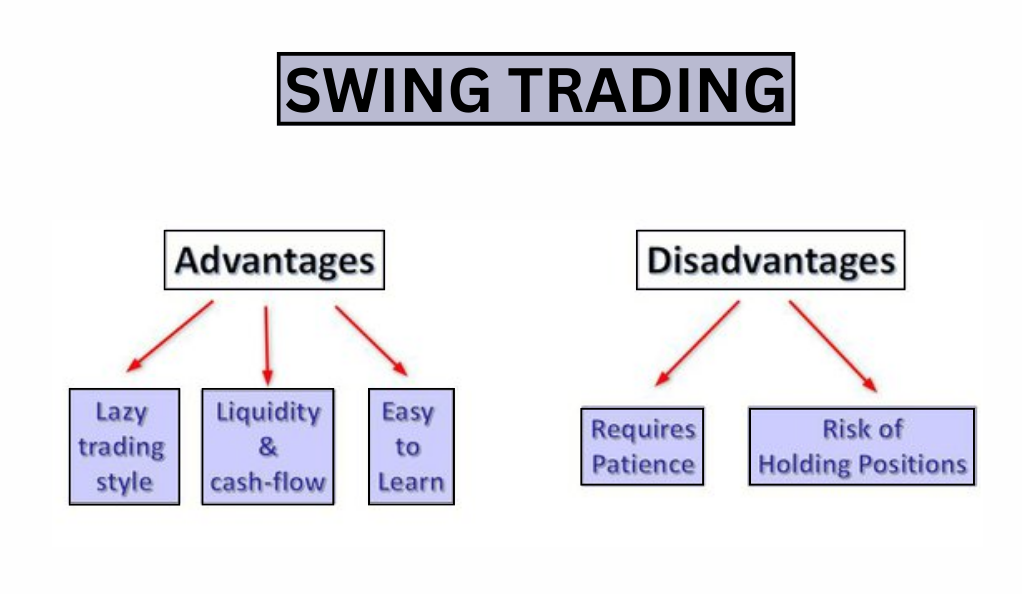

In conclusion, swing trading is a favored strategy among cryptocurrency traders, offering opportunities to profit from short- to medium-term price movements in a market characterized by high volatility. Cryptocurrencies’ 24/7 availability, inherent liquidity, and diverse asset range make them particularly conducive to swing trading.

Successful swing trading hinges on a combination of factors, including robust market analysis, effective risk management through stop-loss and take-profit orders, and vigilance against common trading mistakes like overtrading and emotional decisions.

By applying these principles, traders can navigate the dynamic world of cryptocurrency swing trading with greater confidence and improve their chances of achieving profitable outcomes. Understanding the nuances of X11 cryptocurrencies further enriches a trader’s toolkit, allowing for a more informed and strategic approach to capturing swings in this unique subset of the crypto market.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More