Cryptocurrency mining is a fascinating and intricate process that forms the backbone of many digital currencies, most notably Bitcoin. At its core, mining involves solving complex mathematical problems to validate and record transactions on a blockchain. But there’s much more to it than meets the eye. Let’s delve deeper.

What is Cryptocurrency Mining?

Cryptocurrency mining is the process by which transactions are verified and added to the public ledger, known as the blockchain. It’s also the means through which new coins are introduced into the existing circulating supply. Miners use powerful computers to solve cryptographic puzzles; if they successfully solve a puzzle, they get the right to add a new block to the blockchain. For their efforts, they are rewarded with a certain number of coins.

How Does Mining Work?

Proof of Work (PoW):

Most cryptocurrencies, like Bitcoin, use a consensus mechanism called Proof of Work (PoW). Here’s a step-by-step breakdown:

- Transaction Verification: Miners select pending transactions from the mempool and verify their legitimacy.

- Block Creation: Verified transactions are bundled into a block.

- Puzzle Solving: Miners compete to solve a cryptographic puzzle. This involves guessing a number (called a nonce) and hashing the block’s content until a specific condition is met.

- Block Addition: The first miner to solve the puzzle broadcasts the block to the network for verification. Once verified, the block is added to the blockchain.

- Reward: The successful miner receives a certain number of coins as a reward, known as the “block reward.”

Mining Hardware Evolution

| Generation | Hardware Type | Pros | Cons |

|---|---|---|---|

| 1st | CPU (Central Processing Unit) | Easily accessible | Not very powerful |

| 2nd | GPU (Graphics Processing Unit) | More powerful than CPUs | Higher electricity consumption |

| 3rd | ASIC (Application-Specific Integrated Circuit) | Extremely powerful, optimized for mining | Expensive, not versatile |

Mining Pools

As the difficulty of mining increased, individual miners found it challenging to mine blocks and earn rewards. This led to the creation of mining pools, where miners combine their computational power to increase their chances of mining a block. They then split the block reward in proportion to the computational power each miner contributed.

Energy Consumption and Environmental Concerns

Cryptocurrency mining, especially Bitcoin mining, is energy-intensive. The total energy consumption of the Bitcoin network rivals that of some countries. This has raised environmental concerns, especially when the energy used is sourced from non-renewable sources.

Alternatives to PoW Mining

Proof of Stake (PoS):

In PoS, validators or “forgers” are chosen to create new blocks based on the number of coins they hold and are willing to “stake” or lock up as collateral. It’s seen as a less energy-intensive alternative to PoW.

The Evolution of Mining: From CPUs to ASICs

Cryptocurrency mining has undergone significant transformations since the inception of Bitcoin in 2009. The computational power required to mine and the sophistication of the technology used have both escalated dramatically. This evolution has been driven by the increasing difficulty of mining tasks and the lucrative rewards associated with successful mining. Let’s journey through the progression of mining hardware, from the humble beginnings with CPUs to the specialized world of ASICs.

The Dawn of Mining: CPUs

Central Processing Units (CPUs) were the first tools used by early Bitcoin enthusiasts. A CPU is the primary unit of a computer responsible for executing most of the processing inside the computer.

- Advantages:

- Accessibility: Almost every computer has a CPU, making it easy for early adopters to start mining.

- Versatility: CPUs are designed to handle a variety of tasks, making them suitable for the initial simple mining algorithms.

- Drawbacks:

- Limited Power: CPUs are not optimized for repetitive tasks, making them relatively slow as the mining difficulty increased.

- Inefficiency: Higher electricity consumption compared to the mining rewards received.

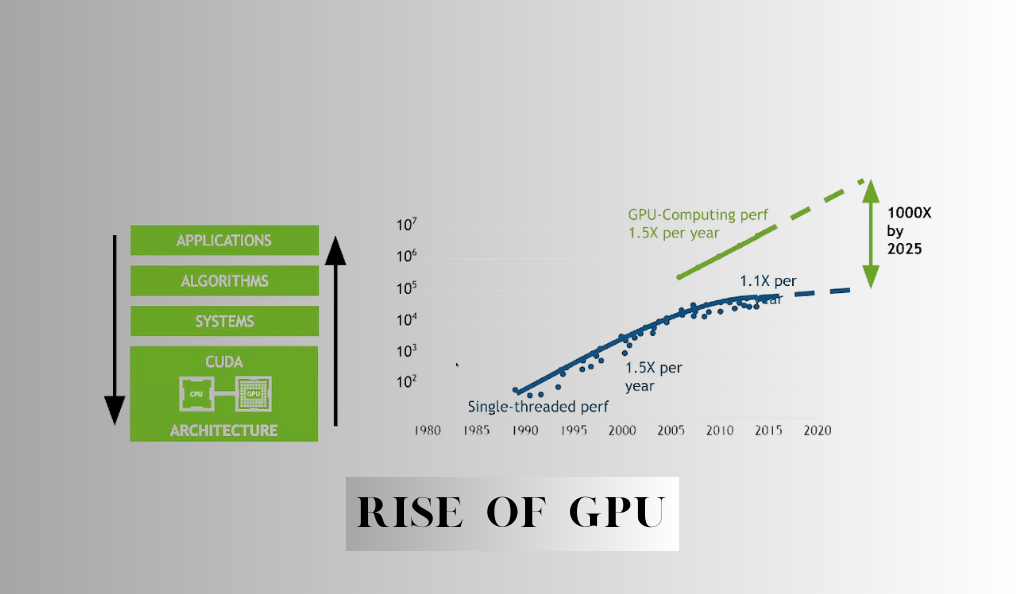

The Rise of GPUs

As the limitations of CPUs became evident, miners transitioned to Graphics Processing Units (GPUs). These are designed to handle repetitive tasks and are used primarily for rendering graphics in video games.

GPUs offer several advantages when it comes to mining. Firstly, they can handle more calculations per second than CPUs, making them more effective for this purpose. Additionally, they are capable of parallel processing, which means they can manage multiple tasks at the same time, thereby increasing the chances of solving the cryptographic puzzle. However, there are also drawbacks to using GPUs. One of the main concerns is their higher energy consumption. Even though they are more efficient than CPUs, GPUs still use a significant amount of electricity. Furthermore, they tend to produce more heat compared to other components, necessitating the need for additional cooling mechanisms.

The Reign of ASICs

Application-Specific Integrated Circuits (ASICs) represent the pinnacle of mining technology. These are chips designed specifically for one task: mining a particular cryptocurrency.

- Advantages:

- Optimized Performance: ASICs are tailored for specific mining algorithms, offering unparalleled efficiency and speed.

- Energy Efficiency: Consumes less power per hash (mining calculation) compared to CPUs and GPUs.

- Drawbacks:

- Lack of Versatility: Each ASIC is designed for a specific cryptocurrency’s algorithm, making it unsuitable for other tasks or coins.

- High Initial Cost: ASIC miners can be expensive to purchase initially.

The Implications of Hardware Evolution

The shift from CPUs to ASICs reflects the increasing professionalization and commercialization of mining. While early Bitcoin mining was accessible to average individuals with standard computers, the rise of ASICs has led to the dominance of large-scale mining operations. These entities can invest in vast amounts of specialized equipment, benefit from economies of scale, and access cheap electricity sources.

Proof of Work: The Heartbeat of Bitcoin Mining

Bitcoin, the pioneer of cryptocurrencies, operates on a consensus mechanism known as Proof of Work (PoW). This system is integral to the security, integrity, and functionality of the Bitcoin network. But what exactly is PoW, and why is it so crucial to Bitcoin mining? Let’s delve into the intricacies of this mechanism and understand its pivotal role.

Understanding Proof of Work (PoW)

Proof of Work (PoW) is a consensus algorithm that is employed by Bitcoin and numerous other cryptocurrencies. This algorithm mandates that participants, commonly referred to as miners, carry out a designated amount of computational work prior to adding a new block of transactions to the blockchain. The fundamental objective of PoW is to act as a deterrent against malicious activities. By making any potential attacks both expensive and time-intensive, it guarantees that participants invest resources, such as computing power and electricity, to make meaningful contributions to the network.

The Mining Process in PoW

Step 1: Transaction Collection

Miners gather pending transactions from the network’s mempool, aiming to include them in the next block.

Step 2: Problem Solving

A complex cryptographic puzzle is presented to miners. This puzzle is essentially a mathematical problem that miners must solve using their computational power.

Step 3: Solution Broadcasting

Once a miner successfully solves the puzzle, they broadcast the solution (and the new block of transactions) to the entire network.

Step 4: Verification

Other nodes in the network verify the solution. If a majority agrees that the solution is correct, the new block is added to the blockchain.

Step 5: Rewarding

The successful miner receives a reward, known as the “block reward.” This reward consists of newly minted Bitcoin and transaction fees from the transactions included in the new block.

The Role of Difficulty in PoW

The “difficulty” in Bitcoin mining ensures that blocks are added to the blockchain approximately every 10 minutes. As more miners join the network and the total computational power increases, the difficulty of the cryptographic puzzle adjusts upwards. Conversely, if miners exit the network and the computational power decreases, the difficulty adjusts downwards.

Advantages of PoW

- Security: The computational work required makes it prohibitively expensive for attackers to alter any information on the blockchain.

- Decentralization: Anyone with the necessary hardware can participate in mining, promoting a decentralized network.

- Incentivization: Miners are rewarded for their efforts, ensuring continuous participation and network security.

Criticisms of PoW

- Energy Consumption: PoW mining, especially Bitcoin mining, is known to consume vast amounts of electricity, leading to environmental concerns.

- Centralization Risks: Over time, large mining pools have emerged, controlling significant portions of the network’s total computational power. This concentration poses potential risks to the decentralized ethos of the network.

The Environmental Impact: Energy Consumption and Criticisms

Cryptocurrency mining, especially Bitcoin mining, has garnered significant attention not just for its financial implications but also for its environmental footprint. The energy-intensive nature of the Proof of Work (PoW) consensus mechanism has sparked debates and concerns about its sustainability. Let’s delve into the environmental impact of cryptocurrency mining and address the criticisms it faces.

The Energy Demands of Mining

Cryptocurrency mining, especially for coins that utilize the Proof of Work (PoW) consensus mechanism, demands immense computational power. This power is harnessed to decipher intricate cryptographic puzzles, a crucial step in the validation and recording of transactions on the blockchain. When it comes to electricity consumption, high-end mining equipment, notably ASICs (Application-Specific Integrated Circuits), draws substantial amounts of power. In fact, the cumulative energy consumption of the Bitcoin network has been likened to the energy expenditures of entire nations.

Carbon Footprint and Emissions

The environmental impact isn’t just about the sheer amount of energy consumed, but also the source of that energy.

- Non-Renewable Energy Sources: Many mining operations, especially large-scale ones, are located in regions where electricity is cheap, often derived from non-renewable sources like coal. This reliance contributes to higher carbon emissions.

- Emission Comparisons: The carbon footprint of the Bitcoin network has been likened to that of some sizable global cities or even entire nations.

Electronic Waste

Mining requires specialized hardware that has a limited effective lifespan.

- Hardware Turnover: As newer, more efficient mining equipment is developed, older models become obsolete and are discarded.

- E-Waste Production: This continuous cycle of hardware turnover contributes to electronic waste, further exacerbating the environmental concerns.

Criticisms and Concerns

Unsustainable in the Long Run:

Critics argue that the current energy consumption rates, especially for Bitcoin, are not sustainable in the long term and could lead to more significant environmental degradation.

Centralization in Coal-Reliant Regions:

A significant portion of mining activities is centralized in regions reliant on coal-based energy, amplifying the carbon footprint.

Opportunity Cost:

Some believe that the energy and resources dedicated to cryptocurrency mining could be better utilized for other, more productive societal needs.

Efforts Towards Sustainable Mining

Despite facing criticism, the crypto community is actively taking steps to address environmental concerns. For instance, several mining operations are making a shift towards renewable energy sources, including hydroelectric, solar, and wind power. Additionally, there’s a growing interest in alternative consensus mechanisms, such as Proof of Stake (PoS), to diminish energy consumption. Ethereum is a notable example, as it’s transitioning to a PoS system with its Ethereum 2.0 upgrade. Beyond these measures, various crypto projects and miners are also investing in carbon offset initiatives, aiming to counterbalance their environmental footprint.

Mining Beyond Coin Creation: Securing the Network

While the primary allure of cryptocurrency mining might be the generation of new coins, its role extends far beyond mere coin creation. Mining is the linchpin that ensures the security, integrity, and robustness of many cryptocurrency networks, especially those operating on a Proof of Work (PoW) consensus mechanism. Let’s delve deeper into the indispensable role of mining in safeguarding and stabilizing the network.

Transaction Verification and Validation

At its core, mining serves as the mechanism to validate and verify transactions.

- Double-Spending Prevention: One of the primary concerns in digital currencies is the risk of double-spending, where a user might try to spend the same digital coin more than once. Mining ensures that each transaction is unique and prevents such fraudulent activities.

- Immutable Record: Once transactions are verified and added to a block, and that block is added to the blockchain, altering it becomes computationally impractical. This ensures the permanence and immutability of transactions.

Decentralization and Trust

Mining plays a pivotal role in fostering decentralization, which is a foundational principle of cryptocurrencies. The inherent decentralized aspect of mining ensures that the transaction history is dispersed and stored across an extensive network of computers, forming what is known as a distributed ledger system. This system is crucial as it guarantees that there isn’t a singular point of vulnerability or failure. Moreover, the presence of a multitude of independent miners, all working to verify transactions, instills confidence in users. They can place their trust in the cryptocurrency system without the need to depend on a centralized authority. This sense of trust emerges from the collective consensus achieved by the entire network.

Network Security and Defense Against Attacks

Mining plays a pivotal role in securing the network against potential threats.

- Protection Against 51% Attacks: For someone to maliciously alter transaction history, they would need to control more than 50% of the network’s total computational power, a feat made challenging and costly due to the decentralized nature of mining.

- Economic Incentives: The rewards from mining (newly minted coins and transaction fees) act as an economic incentive for miners to act honestly. Malicious activities would likely devalue the cryptocurrency, making any potential gains from such activities self-defeating.

Network Participation and Growth

Mining incentivizes participation, which in turn contributes to the growth and robustness of the cryptocurrency network.

- New Entrants: The potential rewards from mining attract new participants, leading to a more extensive and more secure network.

- Network Health: A higher number of miners increases the overall hash rate (computational power) of the network, ensuring faster transaction verification and enhanced security.

Evolution of Mining’s Role

As the world of cryptocurrencies continues to mature and evolve, the role and dynamics of mining are also experiencing significant shifts. One notable change is the reduction in block rewards. Over the years, many cryptocurrencies, including Bitcoin, have reduced the rewards miners receive for adding new blocks. For example, Bitcoin undergoes periodic “halving” events, during which the block rewards are cut in half, ensuring that there’s a limited supply of the cryptocurrency. As these block rewards diminish, transaction fees are set to take center stage. These fees will become increasingly crucial in providing incentives for miners, ensuring they remain engaged and, in turn, maintaining the security and stability of the network.

The Shift in Mining Power: From China to the World

For years, China dominated the cryptocurrency mining landscape, leveraging its abundant and relatively cheap electricity to power vast mining farms. However, recent regulatory crackdowns in the country have led to a seismic shift in the global distribution of mining power. This transition has profound implications for the cryptocurrency ecosystem. Let’s explore the evolution of mining power from its concentration in China to its dispersion across the globe.

China’s Dominance in Cryptocurrency Mining

Historically, China has been the epicenter of cryptocurrency mining for several reasons:

- Cheap Electricity: Regions like Sichuan and Inner Mongolia offered low electricity prices, making them attractive hubs for mining operations.

- Manufacturing Prowess: China is home to major mining hardware manufacturers, such as Bitmain, ensuring easy access to equipment.

- Scale: The combination of factors allowed for the establishment of large-scale mining farms, further driving down costs through economies of scale.

The Chinese Crackdown

In mid-2021, the Chinese government intensified its crackdown on cryptocurrency activities, including mining.

Regulatory Measures: Several provinces issued bans on crypto mining, leading to the shutdown of numerous mining farms.

Environmental Concerns: Part of the crackdown was attributed to environmental concerns, as many mining operations relied on coal-powered electricity.

Financial Stability: The Chinese government cited concerns over financial stability and speculative risks associated with cryptocurrencies.

Global Redistribution of Mining Power

With the exodus from China, miners sought friendlier shores, leading to a redistribution of mining power.

North America:

Countries like the USA and Canada have seen a surge in mining activities, with states like Texas becoming particularly attractive due to deregulated power markets and abundant renewable energy sources.

Central Asia and Russia:

Regions like Kazakhstan have become popular destinations for relocating Chinese miners due to their relatively lax regulations and affordable electricity.

Europe:

Some miners have also ventured into European countries that offer renewable energy sources and crypto-friendly regulations.

Implications of the Shift

The migration of mining power from China has several profound implications:

- Decentralization: The dispersion of mining activities promotes a more decentralized network, reducing the potential influence of any single country or entity.

- Green Mining: As miners relocate to regions with abundant renewable energy, there’s potential for more environmentally friendly mining practices.

- Innovation and Competition: The shift has spurred innovation in mining technology and practices, as regions compete to attract miners.

The Future Landscape of Mining

In the nascent stages of the post-China mining era, several discernible trends are beginning to take shape. Firstly, countries that offer transparent and favorable regulatory frameworks are poised to become magnets for mining operations. Secondly, there’s a mounting emphasis on green and sustainable mining practices. This shift is propelled not only by environmental considerations but also by tangible economic incentives. Lastly, the global landscape of mining power is on a trajectory towards further diversification. This spread ensures enhanced resilience and stability within the broader cryptocurrency ecosystem.

The Future of Mining: Proof of Stake and Beyond

The world of cryptocurrency mining is in a state of flux. As concerns about energy consumption and environmental impact take center stage, the crypto community is exploring alternatives to the traditional Proof of Work (PoW) consensus mechanism. One of the most discussed and anticipated alternatives is Proof of Stake (PoS). But what does the future hold for mining, and how will these changes shape the cryptocurrency landscape? Let’s delve into the horizon of mining’s future.

The Limitations of Proof of Work (PoW)

Before diving into the future, it’s essential to understand the challenges with the current predominant system:

- Energy Consumption: PoW, especially for major cryptocurrencies like Bitcoin, requires vast computational power, leading to significant energy use.

- Environmental Concerns: The carbon footprint of large-scale mining operations, particularly those relying on non-renewable energy sources, has drawn criticism.

- Centralization Risks: The capital-intensive nature of modern mining has led to the emergence of large mining pools, potentially threatening the decentralized ethos of cryptocurrencies.

Enter Proof of Stake (PoS)

Proof of Stake (PoS) is rapidly gaining traction as a favored alternative to the traditional Proof of Work (PoW) mechanism, with numerous cryptocurrencies either already embracing it or contemplating a transition. Unlike PoW, PoS operates on a distinct principle: validators are selected to generate new blocks based on the quantity of coins they possess and are prepared to ‘stake’ or set aside as collateral. This approach effectively sidesteps the energy-intensive process of solving cryptographic puzzles inherent in PoW. The benefits of PoS are manifold. Not only does it drastically reduce energy consumption, but it also mitigates the potential for centralization and facilitates swifter transaction validation.

Ethereum’s Transition to PoS

Ethereum, which holds the distinction of being the second-largest cryptocurrency by market capitalization, is currently undergoing a monumental shift from the Proof of Work (PoW) mechanism to Proof of Stake (PoS) through its Ethereum 2.0 upgrade. The primary objective of Ethereum 2.0 is to tackle challenges related to scalability, security, and sustainability, with the transition to PoS being a pivotal aspect of this upgrade. The implications of this move are profound. Ethereum’s decision to embrace PoS is viewed as a significant endorsement of this consensus mechanism, potentially serving as a catalyst for other cryptocurrencies to contemplate analogous transitions.

Beyond PoS: Exploring Other Consensus Mechanisms

While PoS is the most discussed alternative, the crypto community is exploring other consensus mechanisms:

- Delegated Proof of Stake (DPoS): A variation of PoS where coin holders vote for a small number of delegates who validate transactions and create new blocks.

- Proof of Space (PoSpace): Validators show they have a specific amount of disk space, reducing energy consumption.

- Proof of Burn (PoB): Coins are sent to an unspendable address, “burning” them to earn the right to mine on the network.

The Broader Implications for the Crypto Ecosystem

The shift in consensus mechanisms has broader implications:

Sustainability: A move away from energy-intensive mechanisms can position cryptocurrencies as more sustainable and environmentally friendly.

Adoption: Enhanced scalability and reduced transaction times can drive broader adoption of cryptocurrencies.

Regulatory Landscape: As the environmental impact decreases, regulators might view cryptocurrencies in a more favorable light, potentially leading to more accommodating regulations.

Conclusion

Cryptocurrency mining, once a niche hobby undertaken by tech enthusiasts, has transformed into a sophisticated industrial activity influenced by technological advancements, regulatory shifts, and market dynamics. As the crypto landscape matures, mining continues to adapt, reflecting the industry’s resilience and innovation. This constant evolution underscores the adaptability of the crypto ecosystem, ensuring its relevance and sustainability in an ever-changing digital frontier.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More

+ There are no comments

Add yours