In the ever-evolving world of cryptocurrency, X11 mining has emerged as a significant player, driving discussions and debates around its operational dynamics. At the heart of these discussions lies the tug-of-war between centralization and decentralization, two concepts that, while seemingly opposite, have profound implications for the future of digital currencies.

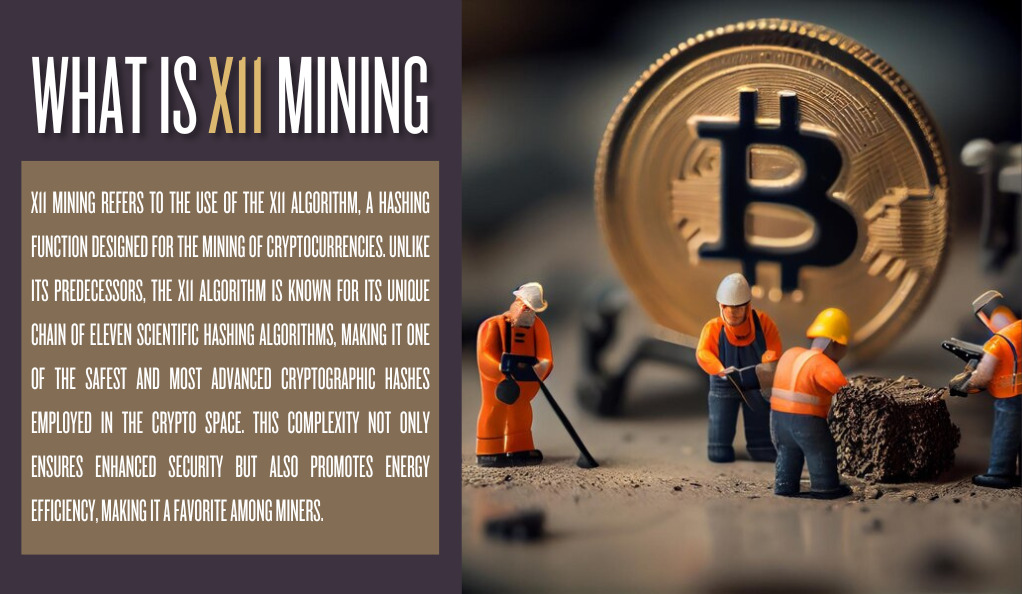

What is X11 Mining?

X11 mining refers to the use of the X11 algorithm, a hashing function designed for the mining of cryptocurrencies. Unlike its predecessors, the X11 algorithm is known for its unique chain of eleven scientific hashing algorithms, making it one of the safest and most advanced cryptographic hashes employed in the crypto space. This complexity not only ensures enhanced security but also promotes energy efficiency, making it a favorite among miners.

Centralization vs. Decentralization: Why Does It Matter?

The terms ‘centralization’ and ‘decentralization’ in the context of mining refer to the distribution of mining power. In a centralized system, the majority of mining power (hashrate) is concentrated in the hands of a few, often leading to monopolistic control. On the other hand, decentralization disperses this power among many miners, ensuring a more democratic and inclusive system.

| Aspect | Centralization | Decentralization |

|---|---|---|

| Control | Concentrated in the hands of a few | Distributed among many participants |

| Security Risks | Higher due to single points of failure | Lower as there’s no central point of attack |

| Decision Making | Faster as fewer entities make decisions | Slower due to the need for consensus among participants |

| Inclusivity | Lower as new entrants face barriers | Higher as the system is open for all |

| Innovation Pace | Can be slower due to monopolistic tendencies | Faster as multiple entities can innovate simultaneously |

The debate between centralization and decentralization in X11 mining is not just a technical one. It touches upon the foundational principles of cryptocurrency: the promise of a decentralized financial system where power and control are distributed. As we delve deeper into this topic in the subsequent sections, we’ll uncover the nuances, challenges, and opportunities that lie ahead in the world of X11 mining.

Understanding Centralization in Mining

The concept of centralization in the realm of cryptocurrency mining is a topic of significant importance, often sparking intense debates among enthusiasts and experts alike. To truly grasp its implications, one must first understand the underlying factors that contribute to this phenomenon.

The Rise of Mining Pools

In the early days of cryptocurrency, individual miners would often operate independently, relying on their computational resources to validate transactions and add new blocks to the blockchain. However, as the complexity of mining algorithms grew, so did the need for more computational power. This led to the formation of mining pools, where individual miners combine their resources to increase their chances of successfully mining a block.

While mining pools offer numerous advantages, such as more consistent rewards and reduced variance, they also inadvertently contribute to the centralization of mining power. Large pools with a significant number of participants can, at times, control a substantial portion of the network’s total hashrate.

Factors Leading to Centralization

Centralization in cryptocurrency mining arises from several key factors. Advanced ASICs offer enhanced mining efficiency but come at a high cost, leading to a concentration of power among wealthier participants. Additionally, the quest for cheaper electricity draws miners to specific regions, like parts of China with affordable hydroelectric power. This convergence, combined with proximity to major hardware manufacturers, amplifies the centralization trend in mining.

The Implications of Centralization

Centralization in mining isn’t just a theoretical concern. It has tangible implications:

- Security Risks: A highly centralized mining landscape can make the network vulnerable to attacks. If a single entity controls more than 50% of the hashrate, they could potentially double-spend or prevent certain transactions from being confirmed.

- Inequitable Distribution of Rewards: With more power concentrated in the hands of a few, the rewards from mining also get unevenly distributed, leading to a disparity in earnings.

- Influence Over Network Decisions: Entities with significant control can influence decisions related to the network, such as protocol changes or forks.

In the subsequent sections, we’ll delve deeper into the dynamics of mining centralization, particularly focusing on the role of Chinese mining pools and the global implications of this concentration of power.

The Chinese Dominance in Mining

China’s prominence in the cryptocurrency mining landscape is undeniable. With a significant portion of the world’s mining operations rooted in its territories, understanding the factors behind this dominance and its implications is crucial for anyone keen on the future of digital currencies.

Why is China a Mining Powerhouse?

Several factors have contributed to China’s rise as a dominant force in the crypto mining world:

- Cheap Electricity: Many regions in China, especially provinces like Sichuan, benefit from abundant hydroelectric power. This cheap and renewable energy source is a boon for miners, significantly reducing their operational costs.

- Proximity to Hardware Manufacturers: China is home to some of the world’s leading ASIC manufacturers, such as Bitmain. This proximity gives Chinese miners an edge in accessing the latest and most efficient mining equipment.

- Supportive Local Governments: Despite the central government’s skeptical stance on cryptocurrencies, some local governments have been more supportive, recognizing the economic benefits that mining operations can bring to their regions.

The Concentration of Hashrate

Recent studies have indicated that Chinese mining pools control a significant portion of the global hashrate. This concentration isn’t merely a reflection of the number of miners but also the advanced infrastructure and resources at their disposal. Such a concentration, while economically beneficial for China, raises concerns about the decentralization ethos of cryptocurrencies.

Beyond Geographical Loyalties

While it’s easy to assume that mining pools based in China would inherently be loyal to Chinese interests, the reality is more nuanced. Mining pools prioritize factors like reward types, fees, and transaction fee policies over geographical or political loyalties. Moreover, miners, who contribute their computational power to these pools, can swiftly shift their allegiance based on changing rewards or policies, ensuring that no single pool can exert undue influence for extended periods.

The Bigger Picture

It’s essential to recognize that while China currently holds a dominant position in the mining landscape, the decentralized nature of cryptocurrencies ensures a dynamic equilibrium. As regulations, technologies, and global sentiments evolve, the epicenter of mining can shift, reflecting the ever-changing nature of the crypto world.

The Myth of Geographical Loyalty

In the intricate tapestry of cryptocurrency mining, geographical loyalty is a concept that often surfaces, especially in discussions around centralization. However, to truly understand the dynamics of mining and the motivations of miners, it’s essential to delve deeper and debunk some common misconceptions.

Mining Pools: Beyond Geographical Boundaries

While mining pools may be based in specific regions, their influence extends globally. Miners prioritize profitability, often choosing pools based on rewards and fees rather than geographical ties. A pool’s location doesn’t necessarily dictate its participants; a China-based pool, for example, might have members from across continents. This global mix challenges the notion of strict geographical loyalty. Moreover, decisions within these pools are typically democratic, with major changes often requiring a consensus, further emphasizing the decentralized nature of their operations.

The Fickle Nature of Loyalty in Mining

The loyalty of miners to a particular pool is not set in stone. Several factors can influence their allegiance:

- Shift in Rewards: If another pool offers better rewards or lower fees, miners might switch to maximize their profits.

- Technical Conditions: Downtimes, inefficient handling of transactions, or security breaches can prompt miners to shift their allegiance.

- Regulatory Changes: If a country where a major pool is based introduces restrictive regulations, it might prompt both the pool and its participants to relocate or realign.

A Global Marketplace

It’s crucial to view the mining landscape as a global marketplace. Miners, irrespective of their location, seek out the best opportunities. Pools, on the other hand, compete in this global market, striving to offer the best terms to attract miners. This dynamic ensures that the mining ecosystem remains vibrant, competitive, and resistant to centralization.

The Global Perspective

While much attention has been given to the dominance of certain regions in the mining landscape, it’s essential to zoom out and view the scenario from a global lens. The world of cryptocurrency mining is not limited to one nation or continent; it’s a global endeavor with diverse players and shifting dynamics.

Mining Beyond China: Challenges and Opportunities

While China’s dominance in the cryptocurrency mining sector is well-established, other regions are not mere bystanders in this arena. North America, for instance, is steadily positioning itself as a significant player, bolstered by stable regulations and a growing number of mining farms. However, the region grapples with relatively higher electricity costs, which can impact profitability. Europe, with countries like Iceland, offers a unique proposition with its abundant geothermal energy.

The supportive regulations in certain European nations further enhance its appeal to miners. Central Asia, particularly regions like Kazakhstan, is also emerging on the mining map, drawing attention with its affordable electricity and miner-friendly regulations. These evolving dynamics underscore the fact that while China currently holds a dominant position, the global mining landscape is fluid and subject to shifts influenced by technological, regulatory, and economic factors.

Decentralization: A Natural Evolution

As the crypto industry matures, there’s a natural inclination towards decentralization. Several factors are driving this trend:

- Regulatory Diversification: Relying on a single region can be risky, given the ever-evolving regulatory landscape. By diversifying operations across multiple countries, miners can mitigate regulatory risks.

- Technological Advancements: Innovations in mining technology are reducing the dependency on regions with cheap electricity. For instance, advances in renewable energy can make mining viable in regions previously deemed unprofitable.

- Global Collaboration: The global crypto community is increasingly collaborating to promote decentralization. Initiatives to set up mining farms in diverse locations, partnerships between countries, and cross-border investments are all testament to this trend.

The Road Ahead

The future of cryptocurrency mining is not set in stone. While certain regions currently dominate, the landscape is ever-evolving. With technological advancements, regulatory shifts, and the inherent ethos of decentralization driving the industry, the coming years might witness a more balanced and distributed mining landscape.

The Role of Stakeholders in Decentralization

Cryptocurrency mining, while often visualized as a realm dominated by powerful machines and their operators, is, in reality, a complex ecosystem with multiple stakeholders. Each of these entities plays a crucial role in maintaining the balance of power and ensuring the decentralization ethos remains intact.

Balancing Powers: Miners, Nodes, and Other Participants

Various stakeholders actively maintain the crypto network’s health and security through a delicate balance of power:

- Miners:

- Role: Validate transactions and secure the network.

- Influence on Decentralization: While they play a crucial role, their power is checked by nodes. Concentration can lead to centralization, but competition and profitability ensure a balance.

- Nodes:

- Role: Validate and relay transactions, maintain blockchain integrity.

- Influence on Decentralization: Their distributed nature ensures decentralization, acting as checks against miner concentration.

- Developers:

- Role: Improve, update, and secure the blockchain protocol.

- Influence on Decentralization: Their decisions can influence miner and node operations, but community consensus is often sought.

- Users:

- Role: Use, trade, and invest in the cryptocurrency.

- Influence on Decentralization: Their adoption and trust in the system are crucial for its success and decentralization.

The Checks and Balances System

The crypto ecosystem operates on a checks and balances system, reminiscent of modern democracies. Miners, while pivotal, are kept in check by nodes that validate their work. If miners were to act against the network’s interests, nodes could reject their blocks, ensuring integrity. On the other hand, the decentralized nature of nodes, spread globally, acts as a safeguard against any single entity controlling the network’s narrative. Additionally, major changes proposed by developers, such as protocol upgrades, often require consensus from both miners and nodes. This intricate balance ensures that no single stakeholder can unilaterally dictate the direction of the cryptocurrency network.

The Path to True Decentralization

Achieving true decentralization is a continuous journey. It requires:

- Regular Audits: To ensure no single entity gains disproportionate control.

- Community Involvement: Engaging the community in major decisions ensures a democratic approach.

- Technological Advancements: Innovations that reduce entry barriers for new miners or node operators can further decentralization.

- Regulatory Clarity: Clear and supportive regulations can encourage more participants, ensuring a diverse and decentralized ecosystem.

Conclusion: Envisioning the Future of X11 Mining

As the cryptocurrency landscape continues to evolve, the future of X11 mining stands at a transformative juncture. While current geographical dominances and hardware centralizations present challenges, the horizon promises shifts driven by regulatory changes, technological advancements, and an increasing emphasis on sustainability. The essence of this future isn’t solely in algorithms or machines but in the global community’s collaborative spirit. Together, they will navigate challenges, ensuring that the core principle of decentralization remains steadfast in the ever-changing world of digital currencies.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More