Blockchain technology has emerged as a game-changer in various industries, and its impact on financial markets has been revolutionary. The decentralized nature of blockchain allows for secure, transparent, and efficient transactions, eliminating the need for intermediaries and boosting trust among participants. This article explores the role of blockchain in financial markets and how it is fueling sustainable evolution.

Understanding the Role of Blockchain in Financial Markets

Blockchain technology acts as a distributed ledger that records and verifies transactions across multiple computers, creating an immutable and transparent record. In financial markets, this technology enables the digitization of assets and the creation of digital tokens that represent ownership. Traditional financial systems often involve intermediaries such as banks, brokers, and clearinghouses, which add complexity, cost, and time to transactions. With blockchain, these intermediaries are replaced by a decentralized network that validates and settles transactions directly between participants, reducing costs and increasing efficiency.

Furthermore, blockchain enhances transparency and trust in financial markets. Every transaction recorded on the blockchain is time-stamped, immutable, and visible to all participants, creating an auditable and tamper-proof record. This transparency reduces the risk of fraud and enables regulators to monitor market activities more effectively. Additionally, the decentralized nature of blockchain eliminates single points of failure, making it highly resilient to cyber-attacks, ensuring the security and integrity of financial data.

Unleashing Sustainable Growth: Blockchain’s Transformative Influence

The adoption of blockchain technology in financial markets has the potential to unleash sustainable growth by democratizing access to financial services. Traditional financial systems often exclude a significant portion of the global population, particularly those in developing countries who lack access to banking services. With blockchain, individuals can have direct ownership of digital assets, access to decentralized lending platforms, and the ability to participate in global markets, enabling financial inclusion and economic empowerment.

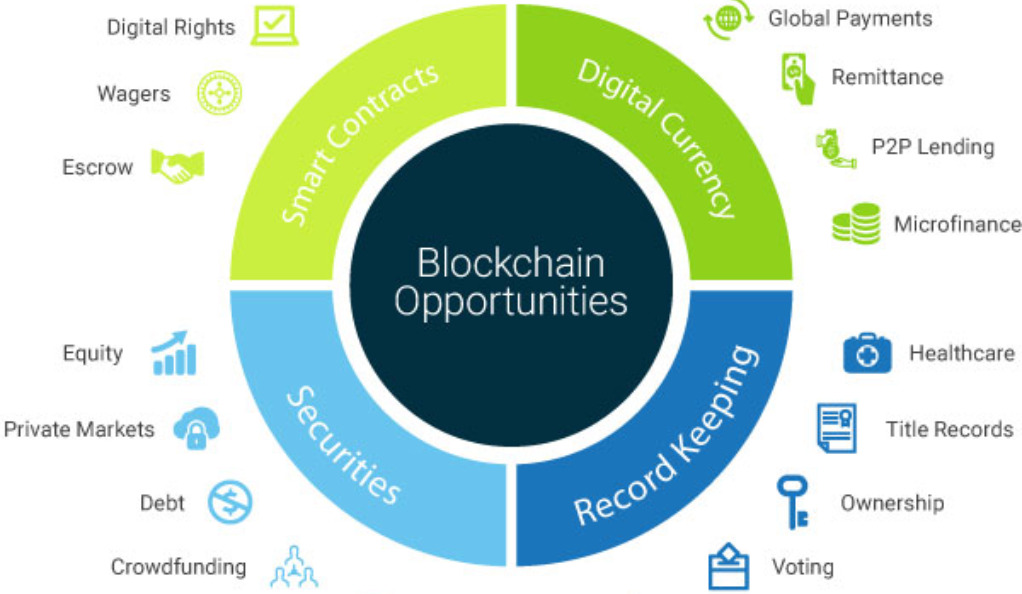

Moreover, the efficiency and cost-effectiveness of blockchain technology can streamline complex financial processes. Smart contracts, self-executing agreements encoded on the blockchain, automate and enforce contractual terms, reducing the need for intermediaries and eliminating potential errors. This automation not only saves time and resources but also improves accuracy and eliminates the risk of human error. By removing inefficiencies and reducing costs, blockchain has the potential to boost economic growth and enhance the resilience of financial markets.

Blockchain technology is poised to revolutionize financial markets, unleashing sustainable evolution by transforming the way transactions are conducted, assets are managed, and financial services are accessed. The decentralized, transparent, and secure nature of blockchain enhances trust among market participants and reduces reliance on intermediaries, ultimately streamlining processes and increasing efficiency. As blockchain continues to mature and gain wider adoption, its potential to revolutionize financial markets and fuel sustainable growth becomes increasingly evident. Embracing this transformative technology is crucial for the financial industry to evolve, adapt, and thrive in the digital age.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More

+ There are no comments

Add yours