The world of cryptocurrencies is vast and ever-evolving, with numerous algorithms and coins emerging to cater to the diverse needs of investors and users. Among these, the X11 algorithm stands out, not just for its unique technical attributes, but also for the range of cryptocurrencies it supports. In this section, we’ll delve deep into the X11 algorithm, its inception, and its significance in the crypto realm.

What is the X11 Algorithm?

X11 is a unique cryptographic algorithm that is used in the Proof of Work (PoW) mechanism of many cryptocurrencies. Unlike traditional algorithms that use a single hash function, X11 is known for its combination of 11 different hashing algorithms. This multi-layered approach enhances security and makes it one of the most advanced hashing algorithms in the cryptocurrency space.

| Hashing Functions in X11 |

|---|

| BLAKE |

| BLUE MIDNIGHT WISH (BMW) |

| Grøstl |

| JH |

| Keccak |

| Skein |

| Luffa |

| CubeHash |

| SHAvite-3 |

| SIMD |

| ECHO |

The Inception of X11

The X11 algorithm was designed by Evan Duffield, the core developer of Dash (previously known as Darkcoin). Dash was the first cryptocurrency to implement the X11 hashing algorithm. Duffield’s primary motivation behind the creation of X11 was to prevent the monopolization of mining by ASIC (Application Specific Integrated Circuit) miners. These powerful machines, designed specifically for mining, were becoming a threat to the decentralized ethos of cryptocurrencies, as they were pushing regular users with GPUs and CPUs out of the mining game.

Significance of X11 in the Crypto World

X11’s multi-algorithm structure not only ensures enhanced security but also offers resistance against potential ASIC dominance. At least, that was the initial intent. The combination of 11 different hash functions made it difficult for ASIC developers to create a single piece of hardware that could efficiently mine X11-based coins. This ensured a more democratic and decentralized mining process, allowing a broader range of participants to contribute to the network’s security.

The Original Purpose of X11

The inception of the X11 algorithm was driven by a vision to create a more equitable and decentralized cryptocurrency ecosystem. But what was the primary reason behind the creation of X11, and how has it influenced the broader crypto landscape?

Preventing ASIC Dominance

ASIC, or Application Specific Integrated Circuit, is a type of hardware designed exclusively for mining specific cryptocurrency algorithms. These machines are incredibly efficient, often outperforming general-purpose hardware like GPUs (Graphics Processing Units) and CPUs (Central Processing Units) in mining tasks. While this might sound like a boon for the crypto mining community, the rise of ASICs brought with it a set of challenges.

The primary concern was the centralization of hashing power. With ASICs being expensive and resource-intensive, only a select few could afford them. This led to a concentration of mining power in the hands of a few, undermining the decentralized ethos of cryptocurrencies. Such centralization could potentially lead to a 51% attack, where a single entity with the majority of the network’s hashing power could double-spend coins and carry out fraudulent transactions.

X11: A Beacon of Hope

Evan Duffield, recognizing the threats posed by ASICs, designed the X11 algorithm to be ASIC-resistant. By combining 11 different hashing functions, X11 was inherently more complex than algorithms like Bitcoin’s SHA-256. This complexity was intended to deter the development of ASICs tailored for X11, ensuring that regular users with GPUs and CPUs could still participate in the mining process without being at a competitive disadvantage.

The Broader Implications

The introduction of X11 was a game-changer. It promised a more sustainable mining ecosystem where the rewards of mining were not just limited to those with deep pockets. By leveling the playing field, X11 hoped to encourage mass participation, ensuring that the mining process remained decentralized and democratic.

However, as with many technological advancements, the crypto community soon realized that staying ahead of ASIC development was a challenging endeavor. But that’s a story for the next section.

The Evolution of X11 Mining

As the crypto landscape continued to evolve, so did the challenges and dynamics of X11 mining. The tug-of-war between ASIC development and ASIC resistance became more pronounced, leading to significant shifts in the mining ecosystem.

The Rise of X11 ASICs

Despite the initial intent of X11 to be ASIC-resistant, the lucrative nature of cryptocurrency mining spurred rapid advancements in ASIC technology. By early 2016, the first ASICs tailored for the X11 algorithm began to emerge. These machines, with their superior mining efficiency, started to dominate the X11 mining space.

Brands like Antminer, Baikal, and Innosilicon released powerful X11 ASIC miners, such as the Antminer D3, Baikal Giant X10, and Innosilicon A5. These machines were capable of outperforming entire farms of GPUs, leading to a significant shift in the mining power dynamics.

Implications for GPU and CPU Miners

The proliferation of X11 ASICs had a profound impact on individual miners who relied on GPUs and CPUs. The higher hash rates offered by ASICs meant that they were more likely to solve the cryptographic puzzles required to add a new block to the blockchain, thereby earning the associated block rewards.

As a result, GPU and CPU miners found their potential earnings dwindling. Many were forced to either invest in ASICs or move to other, more profitable algorithms and coins. This shift further exacerbated the centralization concerns, as those who could afford to operate large farms of ASICs began to command a disproportionate share of the network’s hashing power.

The Community’s Response

The crypto community, always valiant in its defense of decentralization, responded in various ways. Some coins based on the X11 algorithm implemented changes to their code to counter the efficiency of ASICs, thereby restoring some advantage to GPU and CPU miners. Others chose to embrace the new reality, focusing on other methods to ensure network security and decentralization.

There were also efforts to develop more energy-efficient ASICs, addressing another significant concern in the crypto mining space: environmental impact. These newer machines aimed to provide the benefits of ASIC mining without the associated high energy consumption.

A Dynamic Landscape

The story of X11’s evolution is a testament to the dynamic and ever-adapting world of cryptocurrencies. It highlights the continuous interplay between technological advancements and the core principles of the crypto community. While X11 may have lost its original status as an ASIC-resistant algorithm, its legacy and impact on the crypto world remain undeniable.

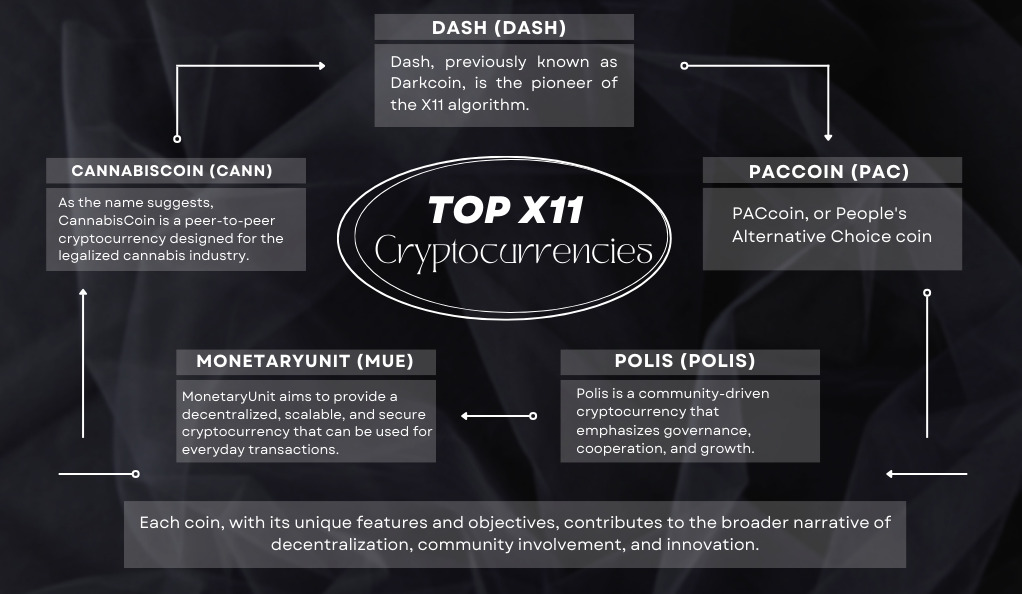

Top X11 Cryptocurrencies

The X11 algorithm, with its unique combination of 11 hashing functions, has been the foundation for several cryptocurrencies. While some have faded into obscurity, others have risen to prominence, making significant impacts in the crypto market. Let’s delve into the top X11 cryptocurrencies and understand their significance.

1. Dash (DASH)

- Overview: Dash, previously known as Darkcoin, is the pioneer of the X11 algorithm. Designed to offer faster transaction speeds and enhanced privacy compared to Bitcoin, Dash has established itself as a leading cryptocurrency.

- Unique Features: Dash introduced the concept of “Masternodes,” which play a crucial role in facilitating instant transactions and private transfers. Additionally, Dash has a unique governance system, allowing the community to vote on proposals and fund development projects.

- Website: Dash Official Website

2. PACcoin (PAC)

- Overview: PACcoin, or People’s Alternative Choice coin, aims to become a user-friendly digital currency with a focus on community-driven charitable projects.

- Unique Features: PACcoin has a low transaction fee and offers fast transaction times. It also emphasizes community involvement, with a portion of its rewards allocated for charitable causes.

- Website: PACcoin Official Website

3. Polis (POLIS)

- Overview: Polis is a community-driven cryptocurrency that emphasizes governance, cooperation, and growth. It aims to create a digital society where community members can make decisions collaboratively.

- Unique Features: Polis operates with a decentralized governance model, allowing users to propose and vote on projects. It also offers fast transactions and a secure environment.

- Website: Polis (POLIS)

4. MonetaryUnit (MUE)

- Overview: MonetaryUnit aims to provide a decentralized, scalable, and secure cryptocurrency that can be used for everyday transactions.

- Unique Features: While it started as an X11 coin, MonetaryUnit transitioned away from the Proof of Work phase, making it no longer mineable. It focuses on providing a user-friendly platform for both merchants and consumers.

- Website: MonetaryUnit Official Website

5. CannabisCoin (CANN)

- Overview: As the name suggests, CannabisCoin is a peer-to-peer cryptocurrency designed for the legalized cannabis industry.

- Unique Features: CannabisCoin allows dispensaries and other cannabis-related businesses to conduct transactions in a decentralized manner. It aims to simplify transactions in regions where cannabis is legal.

- Website: CannabisCoin Official Website

The Broader Perspective

While these are just a few of the top X11 cryptocurrencies, they represent the diverse range of projects and visions within the X11 ecosystem. Each coin, with its unique features and objectives, contributes to the broader narrative of decentralization, community involvement, and innovation.

The Institutional Interest in X11 Cryptocurrencies

The rise of cryptocurrencies has not only caught the attention of individual investors but also of institutional players. These are entities like hedge funds, pension funds, and other large financial institutions that manage vast sums of money. As the crypto market matures, the interest of these institutional players in X11 cryptocurrencies, among others, has grown significantly. Let’s explore why.

1. Diversification of Portfolios

- Overview: One of the primary reasons institutions are eyeing X11 coins is for diversification. Cryptocurrencies, including those based on the X11 algorithm, offer a new asset class that is relatively uncorrelated with traditional markets.

- Significance: By adding X11 cryptocurrencies to their portfolios, institutions can potentially hedge against market downturns in traditional sectors, ensuring more stable returns.

2. Attractive Returns

- Overview: The crypto market, despite its volatility, has shown the potential for high returns. Coins based on the X11 algorithm, like Dash, have seen significant appreciation over the years.

- Significance: For institutions looking to maximize returns for their clients or stakeholders, the potential upside of X11 cryptocurrencies can be an enticing proposition.

3. Technological Advancements

- Overview: The X11 algorithm, with its multi-hash functionality and ASIC resistance (initially), represents a technological advancement in the crypto space.

- Significance: Institutions are always on the lookout for innovative technologies that promise security, efficiency, and scalability. X11 cryptocurrencies, with their underlying tech, fit this bill.

4. Growing Acceptance and Legitimacy

- Overview: As regulatory clarity around cryptocurrencies improves and more businesses start accepting them, their legitimacy in the eyes of institutional investors increases.

- Significance: With X11 coins being used in real-world applications, like Dash’s partnership with various merchants, institutions can see the tangible growth and acceptance of these assets.

5. Community and Governance

- Overview: Many X11 cryptocurrencies emphasize community involvement and decentralized governance, ensuring that decisions are made collectively and transparently.

- Significance: Institutions appreciate assets that are managed transparently and democratically, as it often leads to more sustainable growth and reduces the risk of centralization and manipulation.

Conclusion

The journey of X11, emblematic of the broader cryptocurrency movement, showcases the power of innovation and the importance of community engagement. Born as a response to challenges posed by ASIC dominance, its unique multi-hash structure and the subsequent tug-of-war between decentralization and ASIC miners highlight the crypto community’s adaptability and resilience.

As institutional interest grows, bringing both legitimacy and new dynamics, the crypto world stands at a pivotal juncture. The lessons from X11’s narrative underscore the significance of staying informed, adaptable, and true to the core principles of decentralization and transparency, guiding us towards a future where technology and community converge for a more inclusive and decentralized world.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More