Cryptocurrencies have taken the financial world by storm, offering a blend of investment opportunities and technological advancements. Among the myriad of cryptographic algorithms that power these digital currencies, X11 stands out due to its unique combination of eleven scientific hashing algorithms. This not only enhances its security but also makes it an intriguing subject for traders and investors. To make informed decisions in the volatile world of cryptocurrencies, two primary analytical methods are employed: Fundamental and Technical Analysis. This article delves into these methods, focusing on their applicability and reliability when it comes to X11 coins.

Brief Overview of X11 Coins

X11, as a cryptographic algorithm, was introduced with the launch of Dash (formerly known as Darkcoin). The primary allure of X11 is its energy efficiency and enhanced security, making it resistant to certain types of ASIC (Application-Specific Integrated Circuit) hardware. This resistance ensures a more democratized mining process, leveling the playing field for individual miners.

Coins utilizing the X11 algorithm, often referred to as X11 coins, have seen varying degrees of adoption and success in the market. Dash, as the pioneer, remains the most prominent, but several other coins have also emerged, leveraging the benefits of the X11 algorithm.

| Popular X11 Coins | Launch Year | Notable Features |

|---|---|---|

| Dash | 2014 | InstantSend, PrivateSend, Decentralized Governance |

| CannabisCoin | 2014 | Aimed at the cannabis industry |

| StartCoin | 2014 | Focused on crowdfunding projects |

| MonetaryUnit | 2014 | Low transaction fees, fast confirmations |

Importance of Analysis in Cryptocurrency Trading

The volatile nature of the cryptocurrency market demands a meticulous approach to trading and investing. While the potential for high returns is alluring, the risks are equally significant. This is where Fundamental and Technical Analysis come into play.

- Fundamental Analysis delves deep into the intrinsic value of a coin or token. It evaluates the broader cryptocurrency market, the specific project’s goals, team, technological innovations, partnerships, and competition. For X11 coins, this could involve assessing the coin’s utility, the problem it aims to solve, and its position in the broader market.

- Technical Analysis, on the other hand, is all about patterns and trends. It involves studying past market data, primarily price and volume, to forecast future price movements. For traders of X11 coins, this means analyzing price charts, identifying patterns, and making predictions based on historical data.

Both these methods offer unique insights, and their importance cannot be overstated. As we journey through this article, we’ll explore each method’s nuances, strengths, and weaknesses, specifically in the context of X11 coins.

Understanding Fundamental Analysis

Fundamental Analysis, at its core, is the process of determining the intrinsic value of an asset. In the realm of cryptocurrencies, this involves a thorough examination of both internal and external factors that could influence the value of a coin or token. For X11 coins, understanding these fundamentals is crucial, given the unique technological underpinnings and market dynamics they possess.

Definition and Purpose

Fundamental Analysis seeks to answer one primary question: Is the coin or token undervalued or overvalued based on its current price? To answer this, one must look beyond the price charts and delve into the very essence of the coin – its purpose, technology, team, partnerships, and more.

The purpose of this analysis is to provide investors and traders with a comprehensive view of the coin’s potential growth and risks. It’s about looking at the bigger picture, beyond the immediate price fluctuations.

Main Tools of Fundamental Analysis

When it comes to X11 coins, several tools and metrics can guide an investor in their Fundamental Analysis:

- Whitepapers and Roadmaps: These documents provide insights into the coin’s purpose, technological framework, future plans, and milestones. They are the blueprint of the project and offer a glimpse into the team’s vision and strategy.

- Team and Advisors: A project’s success often hinges on the capabilities and reputation of its team and advisors. Experienced individuals with a track record in blockchain and related industries add credibility.

- Partnerships and Collaborations: Strategic partnerships can play a pivotal role in a coin’s adoption and growth. For X11 coins, collaborations with other tech firms, financial institutions, or even governments can be a positive indicator.

- Community Engagement: A strong, active community can be a testament to the coin’s popularity and trustworthiness. Platforms like Reddit, Telegram, and Discord often host vibrant discussions and can be a gauge of community sentiment.

- Regulatory Environment: The stance of governments and regulatory bodies towards X11 coins can significantly impact their adoption and price. A favorable regulatory environment can boost investor confidence.

- Competitive Analysis: Understanding where the X11 coin stands in comparison to its competitors can offer insights into its unique selling points and potential market share.

How it applies to X11 coins

Given the unique architecture of X11 coins, certain nuances need to be considered. The energy efficiency of the X11 algorithm can be a selling point, especially in a world increasingly conscious of energy consumption. Additionally, the enhanced security features can make X11 coins more resilient to potential cyber threats.

However, it’s also essential to consider the competition. With a plethora of cryptographic algorithms and coins in the market, where does the X11 coin stand? Is there a strong use-case, or is it overshadowed by more prominent players?

In essence, while the fundamental principles of analysis remain consistent, their application to X11 coins requires a tailored approach, considering the specific characteristics and market dynamics these coins present.

Understanding Technical Analysis

While Fundamental Analysis delves into the intrinsic value of a coin, Technical Analysis is primarily concerned with price movements and trading volume. It’s a method that seeks to predict future price actions based on historical data, making it especially valuable for traders looking to capitalize on short-term price fluctuations.

Definition and Purpose

Technical Analysis operates on the principle that all market information, including future price movements, is already reflected in the current price. By studying past market patterns and trends, traders aim to forecast where the price might head next. This form of analysis is particularly prevalent among traders who operate on shorter time frames, from minutes to days or weeks.

The primary purpose of Technical Analysis is to identify and exploit price trends. By recognizing patterns and using various analytical tools, traders can make informed decisions about when to enter or exit a trade.

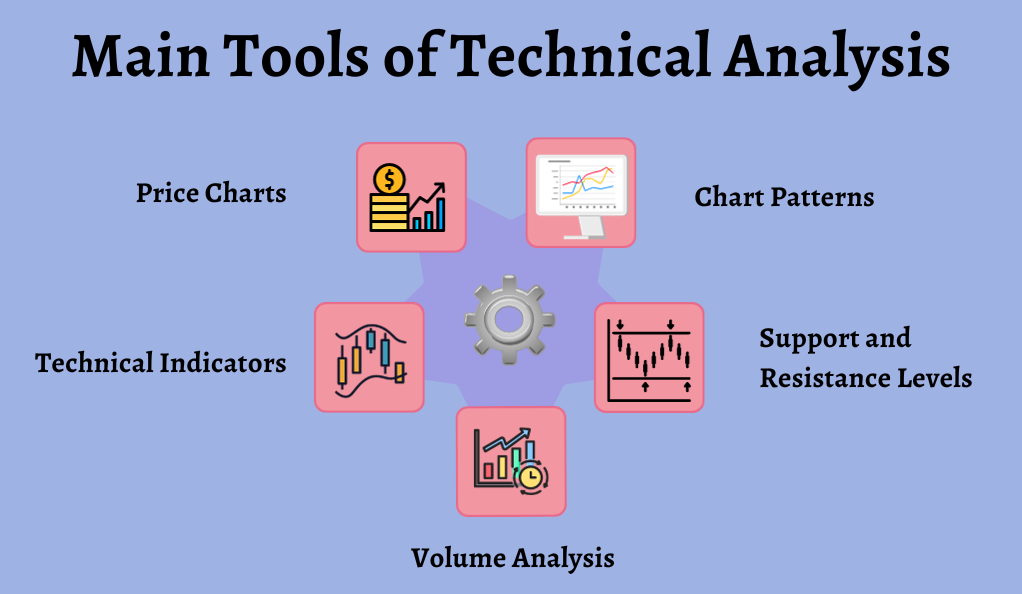

Main Tools of Technical Analysis

Several tools and techniques are at the disposal of those venturing into Technical Analysis:

- Price Charts: The most basic tool, price charts like line charts, bar charts, and the popular candlestick charts, visually represent price movements over specific periods.

- Technical Indicators: These are mathematical calculations based on historical price, volume, or open interest information that help traders predict future price movements. Examples include Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI).

- Volume Analysis: By studying the number of coins traded over a period, traders can gauge the strength or weakness of a price trend.

- Support and Resistance Levels: These are price levels at which a coin tends to find support (doesn’t fall below) or resistance (doesn’t rise above). Identifying these can help traders set profit targets or stop-loss levels.

- Chart Patterns: Patterns like head and shoulders, triangles, and flags can indicate potential future price movements based on historical trends.

Relevance to X11 coin trading

Given the volatility inherent in the cryptocurrency market, Technical Analysis can be a valuable tool for traders of X11 coins. The unique market dynamics of these coins, influenced by technological developments, regulatory news, or macroeconomic factors, can lead to significant price swings. Technical Analysis can help traders navigate these waters, identifying potential breakout or breakdown points.

For instance, if an X11 coin is approaching a known resistance level with increasing volume, it might indicate a potential breakout, signaling a buying opportunity. Conversely, decreasing volume near a support level might suggest a potential price drop.

However, it’s crucial to note that while Technical Analysis provides valuable insights, it’s not foolproof. No prediction method can guarantee future outcomes, and it’s always essential to use Technical Analysis in conjunction with other tools and, importantly, to set appropriate risk management strategies.

Comparing Fundamental and Technical Analysis

In the vast landscape of cryptocurrency trading and investment, the tug-of-war between Fundamental and Technical Analysis is ever-present. Each approach offers a unique lens through which to view and evaluate X11 coins. But how do they stack up against each other? And is one inherently superior?

Key Differences and Similarities

- Basis of Analysis:

- Fundamental Analysis: Focuses on intrinsic value. It evaluates external and internal factors like technology, team, partnerships, and market dynamics.

- Technical Analysis: Concentrates on price movements and trading volume. It’s all about patterns, trends, and historical data.

- Time Horizon:

- Fundamental Analysis: Generally suited for long-term investments. It’s about understanding the long-term potential and growth of a coin.

- Technical Analysis: Typically used for short to medium-term trading. It’s about capitalizing on price fluctuations over shorter time frames.

- Data Sources:

- Fundamental Analysis: Relies on whitepapers, roadmaps, news, regulatory updates, and other qualitative and quantitative factors.

- Technical Analysis: Uses price charts, volume data, and technical indicators.

- Purpose:

- Fundamental Analysis: Aims to determine whether a coin is undervalued or overvalued.

- Technical Analysis: Seeks to predict future price movements based on past patterns and trends.

Pros and Cons of Each Method

Fundamental Analysis:

- Pros:

- Provides a deep understanding of a coin’s value proposition.

- Helps in making informed long-term investment decisions.

- Considers a broad range of factors, from technology to market sentiment.

- Cons:

- Can be time-consuming and requires a comprehensive understanding of the market.

- Might not be the best tool for short-term trading due to its focus on long-term value.

Technical Analysis:

- Pros:

- Offers quick insights into potential price movements.

- Useful for setting entry and exit points in trading.

- Provides visual tools like charts and indicators for easier analysis.

- Cons:

- Relies heavily on past data, which doesn’t always guarantee future performance.

- Can sometimes overlook fundamental shifts in the market.

Which is More Reliable for X11 Coins?

Given the unique nature of X11 coins, with their distinct algorithm and market dynamics, neither Fundamental nor Technical Analysis can claim outright superiority. Instead, their reliability hinges on the trader’s or investor’s goals.

For those looking at long-term investment in X11 coins, believing in their technological promise and market potential, Fundamental Analysis might offer more depth. It provides a comprehensive view of the coin’s value proposition, helping investors understand its potential growth over the years.

On the other hand, traders aiming to capitalize on the short-term price swings of X11 coins might find Technical Analysis more reliable. With its focus on patterns, trends, and historical data, it offers tools to navigate the volatile waters of cryptocurrency trading.

Blending Fundamental and Technical Analyses

In the intricate dance of cryptocurrency trading and investment, relying solely on one analytical method can be limiting. The dynamic nature of the market, especially for unique entities like X11 coins, calls for a more holistic approach. By blending Fundamental and Technical Analyses, traders and investors can harness the strengths of both methods, paving the way for more informed decisions.

Benefits of a Combined Approach

- Comprehensive View: While Fundamental Analysis offers insights into the intrinsic value and potential of a coin, Technical Analysis provides a snapshot of its current market behavior. Together, they present a 360-degree view of the coin’s position.

- Flexibility: Markets are unpredictable. A combined approach allows traders to adapt to varying market conditions, whether it’s a long-term bullish trend or a short-term price correction.

- Risk Management: By understanding both the intrinsic value and market trends, traders can set more accurate stop-loss and take-profit points, minimizing potential losses.

- Optimized Entry and Exit: Fundamental Analysis can highlight undervalued coins with high growth potential, while Technical Analysis can pinpoint the best entry and exit points for maximum profit.

Practical Examples with X11 Coins

Imagine a scenario where a particular X11 coin announces a groundbreaking partnership with a major tech firm. This news, from a fundamental perspective, boosts the coin’s value proposition. Investors might see this as a sign of the coin’s long-term potential. However, the Technical Analysis might reveal that the coin is currently overbought, indicating a potential short-term price drop.

By blending both analyses, an investor could decide to invest in the coin due to its promising future but wait for a more favorable entry point based on technical indicators.

Challenges of a Blended Approach

While combining Fundamental and Technical Analyses offers numerous advantages, it’s not without challenges:

- Time-Intensive: Mastering both analytical methods requires time and effort. Traders need to stay updated with news, trends, and technical indicators constantly.

- Analysis Paralysis: With a plethora of information from both analyses, traders might find themselves overwhelmed, leading to indecision.

- Conflicting Signals: There might be instances where Fundamental and Technical Analyses offer conflicting views. For example, while the fundamentals of an X11 coin might seem strong, technical indicators could signal a bearish trend.

Striking the Right Balance

The key to successfully blending Fundamental and Technical Analyses lies in striking the right balance. It’s about understanding the weightage to give to each method based on current market conditions, personal trading or investment goals, and risk tolerance.

For long-term investors, while technical indicators can guide entry and exit, the emphasis should be on the fundamentals. Conversely, day traders might prioritize Technical Analysis but use Fundamental Analysis to stay aware of significant market-moving events.

Conclusion

The intricate landscape of X11 coins, characterized by its unique cryptographic algorithm and market dynamics, demands a nuanced approach from traders and investors. Both Fundamental and Technical Analyses offer invaluable insights, with the former delving into the intrinsic value and long-term potential, and the latter focusing on real-time price movements and trends. However, neither is foolproof on its own. For optimal success in the volatile realm of X11 coins, a balanced blend of both methods, complemented by continuous education, risk management, and diversification, is essential.

In the ever-evolving world of cryptocurrencies, the key to navigating the complexities of X11 coins lies in preparation and informed decision-making. By staying updated, avoiding emotional decisions, and harnessing the strengths of both analytical approaches, traders and investors can position themselves for success. The journey through the crypto market is filled with challenges and opportunities, and a well-rounded strategy is the compass that guides towards profitable destinations.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More