In the vast and intricate world of cryptocurrency, mining pools have emerged as a beacon of collaboration and shared resources. But what exactly are they, and why have they become so pivotal in the crypto landscape? Let’s delve into the basics.

What is a Mining Pool?

A mining pool is essentially a group of cryptocurrency miners who combine their computational power over a network. This collective effort is aimed at increasing the chances of successfully mining a new block on the blockchain. In simpler terms, think of it as a team of miners working together to find a treasure, and once found, they split the reward based on each member’s contribution.

Why Join a Mining Pool?

The primary reason is the increasing difficulty in mining. As more and more miners join the network and the complexity of the cryptographic puzzles increases, the probability of a single miner successfully mining a block reduces drastically. This could mean that individual miners might go years without earning any reward. Mining pools mitigate this challenge by pooling resources, allowing participants to earn smaller, more frequent rewards.

The Concept of “Shares”

In a mining pool, the term “share” holds significant importance. A share is a valid solution to a cryptographic problem presented by the network. However, not all shares result in a new block. Instead, they represent a miner’s contribution to the pool’s efforts. When the pool successfully mines a block, participants are rewarded based on the number of shares they contributed. This ensures that rewards are distributed fairly, reflecting each miner’s effort.

The Evolution of Mining Pools

The history of mining pools is as dynamic and intriguing as the cryptocurrency world itself. From humble beginnings to dominating the mining landscape, these pools have seen a myriad of changes, challenges, and innovations. Let’s journey through time and explore the milestones that have shaped the world of mining pools.

A Brief Timeline of Mining Pools

- November 2010: The inception of mining pools can be traced back to this year with the launch of Slush’s pool, the very first of its kind. This marked the beginning of a new era where miners realized the benefits of pooling resources.

- 2011-2013: These years witnessed the dominance of deepbit, which at its peak, controlled a staggering 45% of the network’s hashrate. However, as with all things, dominance shifted with time.

- 2013-2014: The introduction of ASIC (Application-Specific Integrated Circuit) miners brought about a significant shift in power. Deepbit’s reluctance to support the newer stratum protocol led to its decline, making way for GHash.IO to become the largest mining pool.

- 2014-2015: F2Pool emerged as a formidable force, overtaking GHash.IO. Launched in May 2013, it quickly rose to prominence and became the largest mining pool of its time.

- 2016-2018: These years marked the rise of Bitmain and its renowned AntPool. Bitmain further expanded its influence by controlling other smaller pools like BTC.com and ViaBTC.

- 2019-2020: The mining landscape saw the introduction of Poolin. Both Poolin and F2Pool held about 15% of the network hashrate during this period, with other smaller pools trailing behind.

- 2020: Major exchanges like Binance launched their mining pools, followed by Huobi and OKex. Additionally, Luxor introduced a US-based mining pool.

- 2022: A significant milestone was the launch of PEGA Pool, the first eco-friendly focused mining pool, highlighting the industry’s shift towards sustainable practices.

Reflecting on the Evolution

The evolution of mining pools mirrors the broader trends and shifts in the cryptocurrency domain. From technological advancements like ASICs to the industry’s increasing focus on sustainability, mining pools have continuously adapted and evolved. Their history is a testament to the ever-changing nature of the crypto world and the relentless pursuit of innovation and collaboration by its participants.

Understanding Mining Pool Shares

In the realm of mining pools, the term “share” is more than just a buzzword. It’s a fundamental concept that determines how rewards are distributed among participants. But what exactly is a share, and how does it influence a miner’s earnings? Let’s dive deep into the intricacies of mining pool shares.

The Essence of a Share

A “share” in the context of mining pools represents a miner’s solution to a specific cryptographic challenge set by the network. However, it’s crucial to understand that not every share will lead to a new block on the blockchain. Instead, shares are indicative of a miner’s contribution to the overall effort of the pool. When the pool successfully mines a block, the reward is then distributed based on the number of shares each participant contributed.

Why Shares Matter

- Fair Distribution: Shares ensure that the distribution of rewards is equitable. Miners are compensated based on their actual contribution, ensuring that no participant is shortchanged.

- Motivation to Contribute: The share-based system incentivizes miners to contribute more computational power. The more they contribute, the more shares they earn, leading to higher rewards.

- Transparency: Shares provide a transparent mechanism for reward distribution. Miners can track their shares and predict their potential earnings.

Types of Shares

In the context of mining pools, shares can be categorized into two main types. A “Valid Share” refers to a solution that aligns with the current difficulty level established by the pool, and it contributes to a miner’s overall input. On the other hand, an “Invalid Share” is a solution that fails to meet the necessary criteria. Reasons for such shares can range from connectivity issues to hardware errors, and they don’t factor into the reward distribution process.

The Role of Shares in Reward Systems

Different mining pools employ various reward systems, but shares play a pivotal role in all of them. Some of the popular reward systems include:

- Pay-per-Share (PPS): Miners receive a fixed reward for each valid share they submit, regardless of whether the pool mines a block.

- Proportional: Miners earn rewards based on the number of shares they contributed relative to the total shares submitted by the pool during a successful block find.

- Pay-per-last-N-shares (PPLNS): Rewards are calculated based on the last N shares, rather than all shares in the round. This system can be more volatile but may offer higher rewards during good rounds.

Different Mining Pool Methods

The world of mining pools is not monolithic. Instead, it’s characterized by a variety of methods, each with its own set of rules and reward systems. These methods have evolved over time, reflecting the changing dynamics of the cryptocurrency landscape and the needs of miners. In this section, we’ll explore the most prominent mining pool methods and their unique attributes.

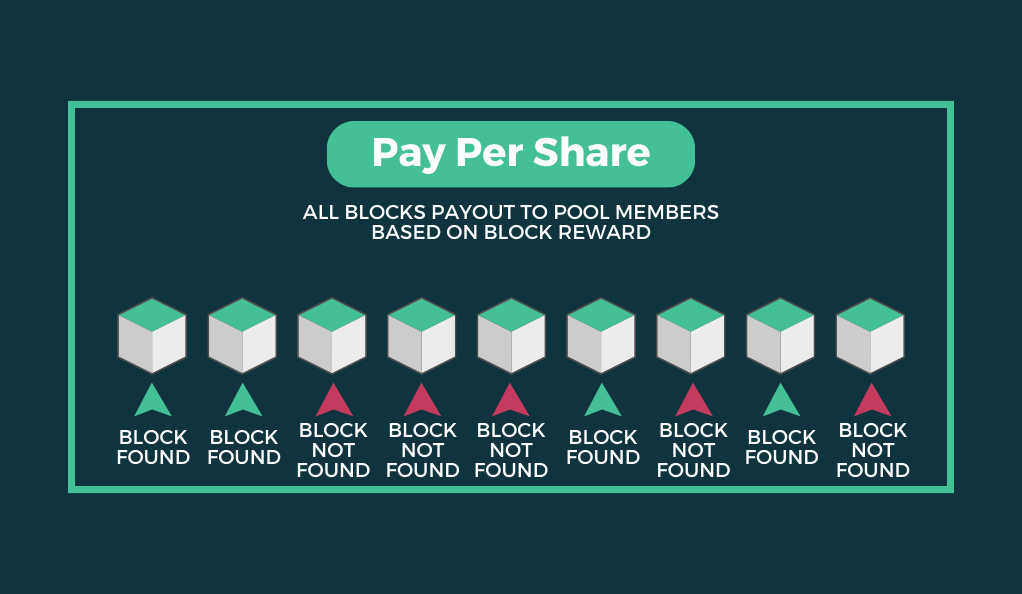

Pay-per-Share (PPS)

Definition: In the PPS method, miners receive a fixed reward for each valid share they submit, irrespective of whether the pool successfully mines a block.

Advantages:

- Predictability: Miners can anticipate their rewards based on the number of shares they contribute.

- Immediate Payouts: Rewards are disbursed instantly, eliminating the need to wait for a block to be mined.

Drawbacks:

- Pool Risk: The pool bears the risk of not finding a block, which might lead to financial challenges if the pool has a streak of bad luck.

Proportional

Definition: Here, miners earn rewards based on the number of shares they contributed relative to the total shares submitted by the pool during a successful block find.

Advantages:

- Fairness: Rewards are directly proportional to a miner’s contribution.

- Collective Success: The entire pool benefits when a block is mined.

Drawbacks:

- Variance: Rewards can be inconsistent, especially if the pool experiences long periods without finding a block.

Pooled Mining (BPM)

Definition: Also known as Bitcoin Pooled Mining, in this method, older shares (from the beginning of the round) have a lower value than newer shares, which reduces the miner’s motivation to switch to another pool after a round has started.

Advantages:

- Loyalty: Encourages miners to stick with a pool for the duration of the round.

- Reduced Pool Hopping: Minimizes the chances of miners jumping between pools to maximize rewards.

Drawbacks:

- Complexity: The system can be a bit complex for new miners to understand.

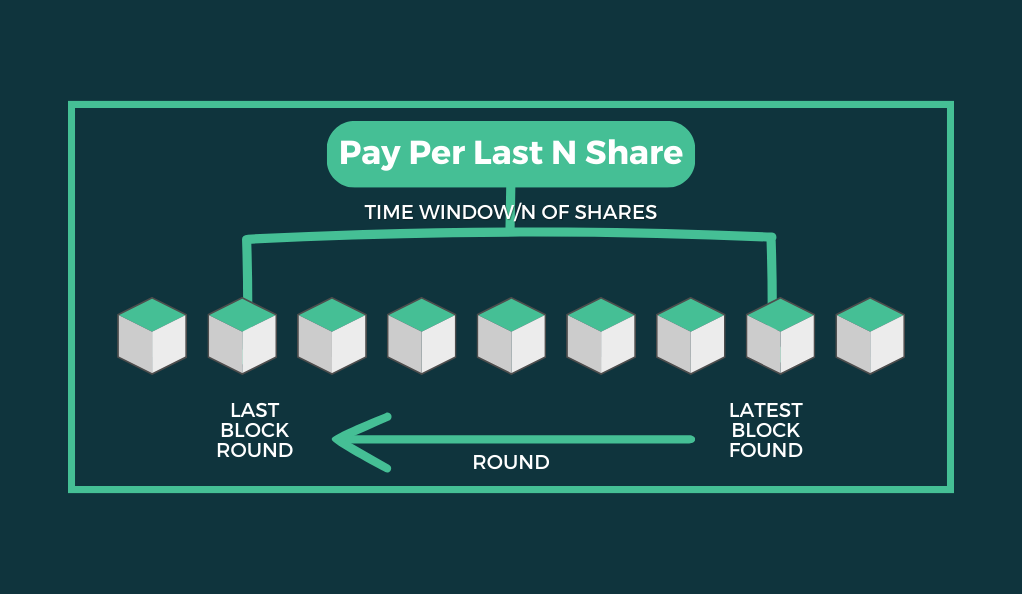

Pay-per-last-N-shares (PPLNS)

Definition: In PPLNS, rewards are calculated based on the last N shares, rather than all shares in the round.

Advantages:

- Potential for Higher Rewards: During good rounds, miners can earn more than other methods.

- Loyalty: Like BPM, it encourages miners to remain with the pool.

Drawbacks:

- Variance: Rewards can be volatile, especially during rounds with fewer shares.

Solo Mining Pool

Definition: In this method, the entire block reward goes to the miner who finds the block. It’s akin to solo mining but within a pool setup.

Advantages:

- Full Reward: The successful miner receives the entire block reward.

Drawbacks:

- High Variance: The chances of finding a block are slim, leading to potential long periods without rewards.

Peer-to-Peer Mining Pool (P2Pool)

Definition: A decentralized mining pool that works by creating a P2P network of miner nodes.

Advantages:

- Decentralization: Eliminates the need for a central pool operator.

- Security: Reduced risk of pool fraud or centralization.

Drawbacks:

- Technical Complexity: Setting up and maintaining a node can be challenging for less tech-savvy miners.

Transaction Fees in Mining Pools

In the intricate ecosystem of cryptocurrency mining, transaction fees play a pivotal role. These fees serve as an incentive for miners to validate and add transactions to the blockchain. Within the context of mining pools, understanding how transaction fees are handled is crucial for miners to gauge their potential earnings and the pool’s overall profitability. Let’s delve into the nuances of transaction fees in mining pools.

What are Transaction Fees?

Whenever a user sends a cryptocurrency transaction, they can opt to pay a fee to miners as an incentive to prioritize and validate their transaction. These fees are in addition to the block reward that miners receive for successfully adding a block to the blockchain.

Why Transaction Fees Matter?

- Incentive for Miners: As the block reward diminishes over time due to halvings (in the case of Bitcoin and some other cryptocurrencies), transaction fees become an increasingly significant source of income for miners.

- Transaction Priority: Miners typically prioritize transactions with higher fees, ensuring they confirm faster.

- Network Health: Fees act as a deterrent against spamming the network with numerous low-value transactions.

How Mining Pools Handle Transaction Fees

Mining pools adopt various policies when it comes to handling transaction fees. Some pools opt to include transaction fees within the block reward, ensuring that they distribute the combined total to miners based on their respective contributions. In contrast, other pools prefer to keep transaction fees separate, establishing distinct distribution policies that might differ from those of block rewards. Additionally, there are pools that view transaction fees as a revenue stream, choosing to retain these fees and compensating miners solely with the block rewards.

The Impact on Miners

The way a pool handles transaction fees can significantly influence a miner’s earnings. For instance:

- Predictability: Pools that combine transaction fees with block rewards offer more predictable earnings, as miners receive a share of the total reward.

- Potential for Higher Earnings: Pools that distribute transaction fees separately might offer higher earnings during times of network congestion when transaction fees soar.

- Transparency: It’s essential for miners to be aware of a pool’s transaction fee policy to ensure they receive their fair share of earnings.

Multipool Mining: Maximizing Profitability

In the ever-evolving landscape of cryptocurrency mining, multipool mining has emerged as a strategy for miners seeking to optimize their earnings. But what is multipool mining, and how does it differ from traditional mining approaches? Let’s delve into this innovative method and its implications for miners.

What is Multipool Mining?

Multipool mining refers to a system where miners can automatically switch between mining different cryptocurrencies based on their current profitability. Instead of being committed to mining a single cryptocurrency, multipool miners can pivot to whichever coin offers the best return on investment at any given time.

The Mechanics of Multipool Mining

- Profitability Calculation: Multipools continuously monitor the profitability of various cryptocurrencies. This is determined by factors like current market price, total hashing power, and block rewards.

- Automatic Switching: Based on real-time data, the multipool will automatically redirect miners’ computational power to the most profitable coin.

- Conversion to Preferred Cryptocurrency: Once mined, the multipool often offers the option to convert the rewards into a preferred cryptocurrency, like Bitcoin, before disbursing it to miners.

Advantages of Multipool Mining

Multipool mining offers several distinct advantages for miners. One of the primary benefits is the potential for optimized earnings, as miners have the flexibility to consistently target the most profitable coin, maximizing their return on investment. This approach also provides a level of diversification, ensuring that miners aren’t solely dependent on the success of a single cryptocurrency, thereby mitigating potential risks. Additionally, the convenience of multipool mining is enhanced by its automated processes. With the multipool handling all the necessary calculations and switching between coins, miners can enjoy a more hands-off experience.

Drawbacks of Multipool Mining

- Market Impact: Multipool mining can lead to frequent sell-offs of less popular coins, potentially driving down their prices.

- Centralization Concerns: Large multipools can control significant portions of the hashing power for smaller cryptocurrencies, leading to centralization concerns.

- Conversion Fees: Converting mined coins into a preferred cryptocurrency might incur additional fees.

The Future of Multipool Mining

With the increasing number of cryptocurrencies entering the market, multipool mining’s relevance is likely to grow. As miners seek to maximize their profits and hedge against market volatility, the flexibility offered by multipools will be invaluable. However, it’s essential for the crypto community to address potential challenges, like market impact and centralization, to ensure a balanced and robust ecosystem.

The Future of Mining: PoC and Environmentally Friendly Options

The world of cryptocurrency mining is undergoing a transformative shift. As concerns about the environmental impact of traditional Proof of Work (PoW) mining methods grow, the industry is exploring more sustainable alternatives. One such promising approach is Proof of Capacity (PoC) mining. In this section, we’ll delve into PoC, its benefits, and the broader movement towards eco-friendly mining practices.

Understanding Proof of Capacity (PoC)

Proof of Capacity (PoC) is a consensus algorithm used in cryptocurrency mining. Unlike PoW, which requires miners to perform complex calculations, PoC relies on the storage capacity of miners’ hardware.

How PoC Works:

- Pre-computation Phase: Miners pre-compute solutions to cryptographic challenges and store them on their hard drives.

- Mining Phase: When a new block is to be added to the blockchain, the network sets a challenge. Miners then search their stored solutions to find a match.

- Validation: The first miner to find a matching solution gets the right to add the block and receive the associated reward.

Benefits of PoC Mining

The benefits of PoC (Proof of Capacity) mining are numerous and noteworthy. Firstly, PoC mining stands out for its energy efficiency, consuming significantly less power than its PoW (Proof of Work) counterpart, positioning it as a more sustainable choice. Additionally, PoC’s reliance on storage over computational power democratizes the mining process. This approach levels the playing field, enabling a broader range of participants to engage in mining without the need for specialized equipment. Furthermore, the reduced computational demands of PoC mean that the hardware endures less wear and tear, often resulting in a longer lifespan for the equipment.

The Rise of Eco-Friendly Mining Pools

With the increasing awareness of the environmental impact of cryptocurrency mining, several initiatives are promoting greener practices:

- Renewable Energy Sources: Many mining operations are transitioning to renewable energy sources like solar and wind to power their rigs.

- Carbon Offsetting: Some mining pools are investing in carbon offset projects to neutralize their carbon footprint.

- Eco-Friendly Pools: The launch of pools like PEGA Pool in 2022, which focuses on sustainable practices, signifies the industry’s commitment to a greener future.

Looking Ahead: A Sustainable Mining Landscape

The shift towards eco-friendly mining practices is not just a trend but a necessity. As the global community becomes more conscious of environmental issues, the crypto industry must adapt to ensure its longevity and social acceptance. With innovations like PoC and the rise of green mining pools, the future of cryptocurrency mining looks promisingly sustainable.

Conclusion

Concluding our deep dive into mining pools, the dynamic and intricate nature of cryptocurrency mining stands out. Mining pools showcase the power of collaboration, enabling miners to tackle mining challenges and earn consistent rewards. The industry’s diverse mining methods, the emergence of multipool strategies, and the shift towards eco-friendly practices demonstrate its adaptability and forward-thinking approach.

Whether you’re an experienced miner or just stepping into the cryptocurrency world, grasping the nuances of mining pools is essential. These pools reveal the crypto community’s collaborative spirit and the industry’s drive for innovation and sustainability. As the crypto world continues to change, mining pools will play a central role in driving this evolution.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More