Dash, operating on the X11 algorithm, stands out as a prominent player in the vast cryptocurrency landscape. Its unique design prioritizes the user experience, evident in features like InstantSend, which facilitates quick transactions, and PrivateSend, ensuring transactional privacy. These features, combined with a robust market capitalization, historical price data, and strategic partnerships, highlight Dash’s commitment to innovation and user-centricity. The technological advancements associated with Dash further underscore its potential for growth and its ability to address challenges in the ever-evolving crypto space.

The organizational structure of Dash is another testament to its forward-thinking approach. The Decentralized Autonomous Organization (DAO) structure ensures that decision-making is a collective process, emphasizing the best interests of the community. This decentralized model not only promotes transparency but also fosters a sense of collective ownership and responsibility among its members. A closer look at Dash’s financial health, including its assets, liabilities, and earnings from various partnerships or ventures, paints a comprehensive picture of its market standing, solidifying its position as a cryptocurrency worth watching.

Brief Overview of X11 Cryptocurrencies

The X11 algorithm, introduced by Evan Duffield for the cryptocurrency Dash, is known for its energy efficiency and enhanced security. Unlike the traditional SHA-256 (used by Bitcoin) or Scrypt algorithms, X11 employs a chain of eleven scientific hashing algorithms. This not only bolsters its defense against potential threats but also makes it a more environmentally friendly option in the crypto mining world.

| Algorithm | Cryptocurrency | Key Features |

|---|---|---|

| SHA-256 | Bitcoin | High energy consumption, ASIC mining |

| Scrypt | Litecoin | Memory-intensive, ASIC resistant |

| X11 | Dash | Energy efficient, Enhanced security, ASIC resistant |

Importance of Fundamental Analysis in the Crypto World

While the crypto market is often seen as highly volatile, driven by news, speculation, and sentiment, fundamental analysis offers a grounded approach to understanding a cryptocurrency’s true value. It delves deep into the economic, industry-specific, and company-related factors that influence a cryptocurrency’s price. For X11 cryptocurrencies, this means looking at the broader economic indicators, the state of the crypto industry, and the specifics of the cryptocurrency in question. By doing so, investors can make informed decisions, unswayed by the market’s often erratic behavior.

We will embark on a journey to unravel the complexities of X11 cryptocurrencies, exploring their economic indicators, industry landscape, and company specifics. Armed with the insights from fundamental analysis, readers will be better equipped to navigate the dynamic world of X11 cryptocurrencies and make informed investment decisions.

Understanding Fundamental Analysis

Fundamental analysis stands as a cornerstone in the world of investment, offering a systematic approach to evaluating the intrinsic value of an asset. Whether it’s stocks, commodities, or cryptocurrencies, this method delves deep into the economic, financial, and other qualitative and quantitative factors that influence an asset’s value.

Definition and Significance

At its core, fundamental analysis seeks to determine an asset’s actual value by examining related economic, financial, and other qualitative and quantitative factors. For cryptocurrencies, this means evaluating the overall health of the coin or token, its market position, technological advancements, team strength, partnerships, and more. By understanding these elements, investors can ascertain whether a cryptocurrency is undervalued or overvalued, guiding their investment decisions.

Distinction between Fundamental, Technical, and Quantitative Analysis

While all three forms of analysis aim to guide investment decisions, they differ in their approaches and focus areas:

- Fundamental Analysis: Focuses on evaluating an asset’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. It answers the question: “What is the asset truly worth?”

- Technical Analysis: Relies on studying price charts and using statistical measures to predict future price movements. It’s more about identifying patterns and trends in price data and trading volumes. The primary question it seeks to answer is: “What do the past market patterns suggest about future prices?”

- Quantitative Analysis: Uses mathematical and statistical modeling, measurement, and research to understand behavior. In the context of cryptocurrencies, it might involve algorithms, machine learning, or other computational techniques to predict price movements.

The X11 Algorithm: A Primer

The cryptocurrency landscape is a vast and intricate domain, characterized by a myriad of digital coins, each underpinned by its distinct algorithmic foundation. These algorithms not only dictate the operational mechanics of the coins but also influence their security, efficiency, and overall appeal. Within this diverse ecosystem, the X11 algorithm emerges as a notable contender, distinguishing itself through a set of unique features that set it apart from its counterparts.

This algorithm is the driving force behind Dash, a cryptocurrency that has managed to carve a niche for itself in the competitive digital currency market. Dash’s association with the X11 algorithm not only enhances its technical robustness but also positions it as a cryptocurrency that balances innovation with user-centric functionalities.

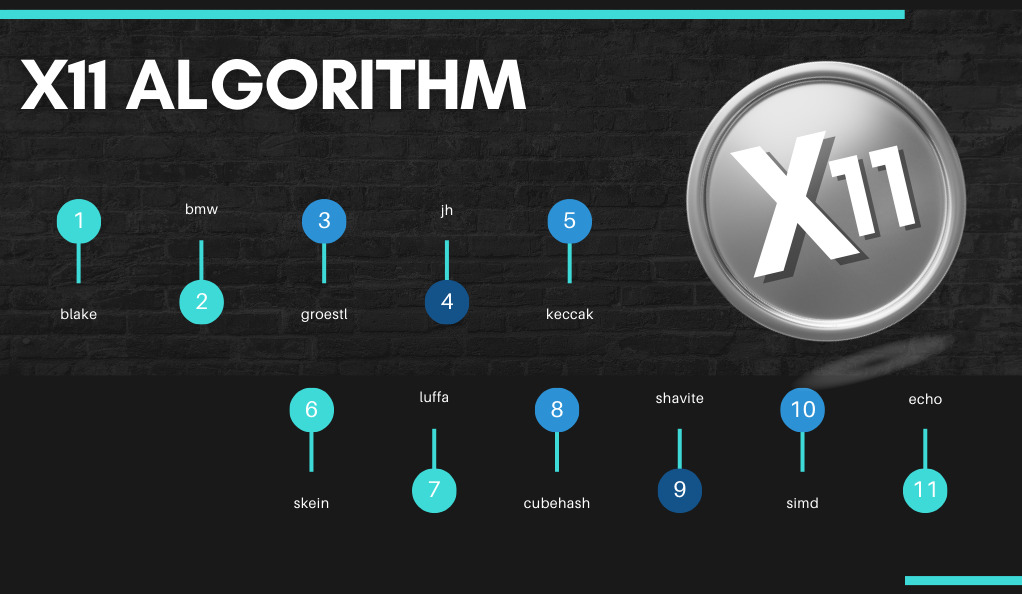

History and Development of the X11 Algorithm

Introduced by Evan Duffield for Dash, the X11 algorithm was designed to address some of the shortcomings of earlier cryptographic algorithms. Unlike the more traditional SHA-256 or Scrypt, X11 doesn’t rely on a single hashing function. Instead, it employs a chain of eleven scientific hashing algorithms. This design choice was driven by a desire for greater security and energy efficiency in crypto mining.

Key Features and Benefits of X11 Cryptocurrencies

- Energy Efficiency: One of the standout features of the X11 algorithm is its energy efficiency. By using a combination of eleven hashing functions, it reduces the power load and heat generation, making it more environmentally friendly and cost-effective for miners.

- Enhanced Security: The chained hashing approach provides a higher degree of security against potential threats. Even if one or two of the eleven hashing functions were to be compromised, the entire network would remain secure.

- ASIC Resistance: The complexity of the X11 algorithm makes it resistant to ASIC (Application-Specific Integrated Circuit) mining, ensuring a more decentralized and equitable mining process.

- Faster Transactions: Cryptocurrencies like Dash, which use the X11 algorithm, often boast quicker transaction times compared to some of their counterparts.

Economic Indicators and X11 Cryptocurrencies

Cryptocurrencies don’t exist in a vacuum. They’re influenced by a myriad of economic factors, from global GDP growth rates to inflation and interest rates.

Role of GDP, Inflation, and Interest Rates

Economic indicators play a pivotal role in the valuation of any asset, including cryptocurrencies. A robust GDP growth rate can indicate a thriving economy, which can boost investor confidence in assets associated with that economy. Similarly, inflation rates can influence the purchasing power of a currency, and interest rates can impact borrowing costs and investment yields.

For X11 cryptocurrencies, these indicators can provide context. For instance, in an economy experiencing high inflation, cryptocurrencies might be seen as a hedge, potentially driving up demand.

Impact of Global Economic Conditions on X11 Crypto Values

Global events, such as economic downturns, political unrest, or significant policy changes, can influence the value of cryptocurrencies. Investors might flock to digital assets like X11 cryptocurrencies during times of uncertainty as a safe haven. Conversely, positive global economic news can lead to increased risk appetite, potentially driving investors towards more traditional assets and away from cryptocurrencies.

Industry Analysis: The Crypto Landscape

The cryptocurrency industry is vast and ever-evolving, with new players entering the scene and existing ones constantly innovating. To truly understand the value and potential of X11 cryptocurrencies, it’s essential to grasp the broader landscape of the crypto industry.

Current Market Players and Their Influence

The crypto industry is dominated by a few major players like Bitcoin, Ethereum, and Binance Coin. However, there are hundreds of altcoins, each with its unique value proposition. X11 cryptocurrencies, particularly Dash, have carved out a niche for themselves, offering features like enhanced security and faster transaction speeds. The influence of major players can often dictate market trends, but the consistent innovation from altcoins keeps the industry dynamic and competitive.

Potential Threats and Opportunities in the Crypto Industry

Like any industry, the crypto world faces its share of challenges and opportunities. Regulatory changes, technological advancements, and market sentiment can all pose threats or open doors for X11 cryptocurrencies.

For instance, increased regulatory scrutiny can pose challenges, but it can also legitimize and stabilize the market. Technological advancements, like quantum computing, might threaten existing cryptographic methods but can also lead to more robust and secure algorithms.

Company Analysis: Spotlight on Leading X11 Cryptos

To make informed investment decisions, it’s crucial to delve into the specifics of the leading X11 cryptocurrencies.

In-depth Look at Top X11 Cryptocurrencies

| Aspect | Details |

|---|---|

| Cryptocurrency | Dash (X11 Algorithm) |

| Key Features | – Focus on user experience<br>- InstantSend for quick transactions<br>- PrivateSend for private transactions |

| Analysis Points | – Market capitalization<br>- Historical price data<br>- Partnerships<br>- Technological advancements |

| Organizational Structure | Decentralized Autonomous Organization (DAO) |

| Management Insights | Decisions are made collectively, prioritizing the community’s best interests |

| Financial Health Indicators | – Assets<br>- Liabilities<br>- Earnings from partnerships or ventures |

Intrinsic Value vs. Market Price

Every asset, whether tangible or digital, has an intrinsic value – its true, inherent worth. In the realm of cryptocurrencies, understanding the difference between this intrinsic value and the current market price is crucial for making informed investment decisions.

Determining the True Value of X11 Cryptocurrencies

The intrinsic value of a cryptocurrency is derived from various factors, including its utility, scarcity, demand, and the security of its underlying technology. For X11 cryptocurrencies, the energy efficiency, enhanced security features, and faster transaction speeds contribute to their intrinsic value. Additionally, the strength and activity of its community, the adaptability of its underlying technology, and its real-world applications can also play a significant role.

Factors Influencing the Market Price

- Intrinsic Value vs. Market Price:

- Intrinsic value is based on fundamental factors.

- Market price is influenced by various elements, both speculative and emotional.

- Media Coverage:

- Positive or negative media coverage can lead to short-term price fluctuations.

- Example: A positive news article about Dash’s adoption might cause a temporary price spike.

- Public Perception:

- The general public’s view of a cryptocurrency can influence its market price.

- Positive perception can drive demand, while negative perception can deter potential investors.

- Regulatory News:

- Announcements of regulatory changes or government stances on cryptocurrencies can impact prices.

- Regulatory acceptance can boost confidence, while crackdowns or bans can lead to price drops.

- Market Manipulation:

- Activities like pump-and-dump schemes can artificially inflate or deflate prices.

- Supply and Demand Dynamics:

- A significant sell-off by holders can increase supply, leading to a price drop.

- A surge in demand, perhaps due to positive prospects, can lead to a price rise.

For an investor, it’s essential to strike a balance between the intrinsic value of a cryptocurrency and the realities of the market. While it’s beneficial to understand the true worth of a cryptocurrency, being aware of market sentiments and external influences can help in timing investments more effectively. For instance, if the market price of an X11 cryptocurrency is significantly below its intrinsic value, it might present a buying opportunity. On the other hand, if it’s overvalued, it might be a signal to exercise caution.

Conclusion

In the intricate tapestry of the cryptocurrency world, X11 cryptocurrencies, particularly Dash, have carved a distinctive niche, offering a blend of security, efficiency, and speed. As the digital currency landscape continues to evolve, the importance of a comprehensive understanding, grounded in both fundamental analysis and broader economic contexts, becomes paramount. Investors equipped with this knowledge are better positioned to navigate the volatile crypto markets, making informed decisions that align with both their short-term goals and long-term visions. As with all investments, while the potential for reward is significant, it’s essential to approach the realm of X11 cryptocurrencies with diligence, research, and a keen awareness of the ever-shifting dynamics of the digital asset world.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More