In the vast realm of cryptocurrency, the X11 algorithm has emerged as a distinctive player, offering a unique approach to hashing and mining. Named for its use of eleven different cryptographic algorithms, X11 has garnered attention not just for its technical intricacies but also for the opportunities it presents to traders. As with any financial market, staying updated with the latest news, trends, and insights is paramount for success. This is especially true for X11 traders, given the algorithm’s evolving landscape and the dynamic nature of its associated cryptocurrencies.

What is the X11 Algorithm?

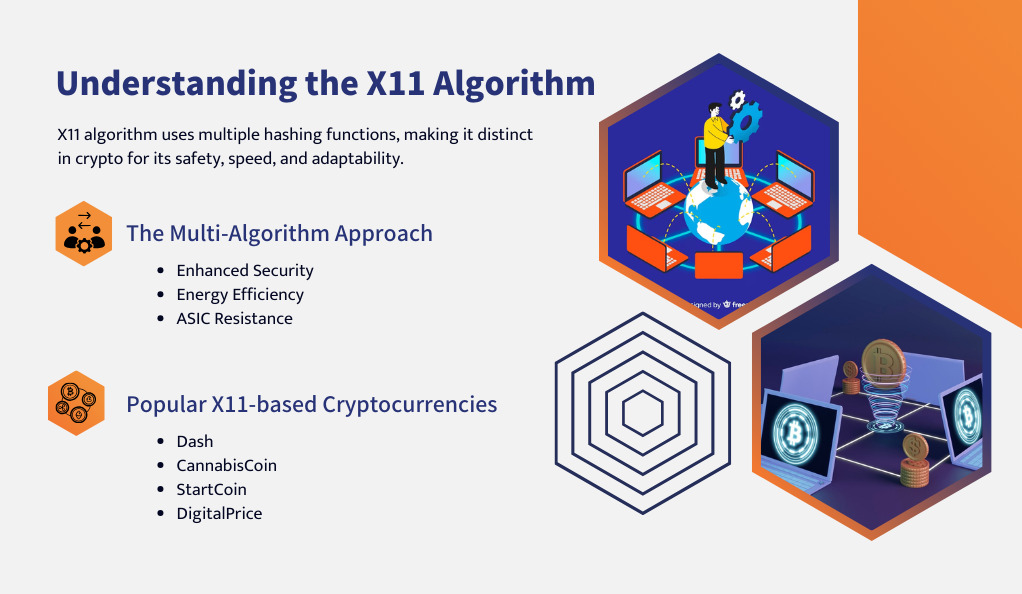

The X11 algorithm is a hashing function used in the world of cryptocurrencies. Unlike traditional algorithms that rely on a single hashing function, X11 employs eleven different cryptographic algorithms in sequence. This multi-pronged approach enhances security, making it more resistant to potential vulnerabilities. Additionally, the use of multiple algorithms makes X11 more energy-efficient, addressing concerns about the environmental impact of cryptocurrency mining.

| Feature | Description |

|---|---|

| Hashing Functions | 11 different cryptographic algorithms |

| Popular Coins | Dash, CannabisCoin, StartCoin, DigitalPrice |

| Energy Efficiency | More energy-efficient compared to single-hash algorithms like Bitcoin’s SHA-256 |

| ASIC Resistance | Initially designed to resist ASIC mining, though ASICs for X11 have since been developed |

| Security | Multi-hash approach provides a higher degree of security against potential vulnerabilities |

Why Staying Updated Matters

The world of cryptocurrency is fast-paced, with prices, trends, and news changing almost by the minute. For traders, staying updated is not just a matter of staying informed—it’s a matter of staying competitive. With the right information at their fingertips, traders can make more informed decisions, spot opportunities, and avoid potential pitfalls.

For X11 traders, this is even more crucial. Given the unique nature of the algorithm and the coins associated with it, understanding the nuances of the market can make a significant difference in trading outcomes. Whether it’s news about a new platform supporting X11-based coins, regulatory changes, or technological advancements in the algorithm itself, every piece of information can be a potential game-changer.

Understanding the X11 Algorithm

The X11 algorithm, while complex in its design, is rooted in a simple yet innovative idea: why rely on one hashing function when you can benefit from multiple? This multi-layered approach has set X11 apart in the cryptocurrency landscape, offering a blend of security, efficiency, and adaptability.

The Multi-Algorithm Approach

At the heart of the X11 algorithm is its use of eleven distinct cryptographic algorithms chained together. This chaining is sequential, meaning that the output of one algorithm becomes the input for the next. The eleven algorithms that make up X11 are: blake, bmw, groestl, jh, keccak, skein, luffa, cubehash, shavite, simd, and echo.

This approach offers several distinct advantages:

- Enhanced Security: By utilizing multiple algorithms, X11 reduces the risk of vulnerabilities. If one algorithm were to be compromised, the others would still provide layers of protection, ensuring the integrity of the data.

- Energy Efficiency: X11 is notably more energy-efficient than algorithms like Bitcoin’s SHA-256. This efficiency is particularly appealing given the growing environmental concerns surrounding cryptocurrency mining.

- ASIC Resistance: Originally, X11 was designed to resist specialized mining hardware known as ASICs (Application-Specific Integrated Circuits). While ASICs tailored for X11 have since been developed, the multi-hash nature of X11 still provides a level of resistance, ensuring a broader distribution of mining power and reducing the risks associated with centralization.

Popular X11-based Cryptocurrencies

The unique features of the X11 algorithm have given rise to several cryptocurrencies, each with its own set of attributes and value propositions:

- Dash: Perhaps the most recognized X11 cryptocurrency, Dash (formerly known as XCoin and later Darkcoin) emphasizes both speed and privacy with features like InstantSend and PrivateSend.

- CannabisCoin: Specifically tailored for the cannabis industry, CannabisCoin aims to streamline transactions in medical marijuana dispensaries, offering a niche yet valuable use case.

- StartCoin: This digital currency is designed to promote and support crowdfunding campaigns, integrating the world of crypto with grassroots fundraising efforts.

- DigitalPrice: With a focus on fast transactions and minimal fees, DigitalPrice stands out as a practical X11-based coin for everyday use.

As the cryptocurrency landscape continues to evolve, so too does the world of X11-based coins. Traders and investors looking to delve into this market should conduct thorough research to understand the unique features, challenges, and opportunities each coin presents.

Criteria for Evaluating Trading Platforms

In the dynamic world of cryptocurrency trading, not all platforms are created equal. The choice of a trading platform can significantly influence a trader’s experience, success, and security. For those trading X11-based cryptocurrencies, understanding the criteria for evaluating platforms is crucial. Here’s a comprehensive guide to help traders make informed decisions:

Security Measures and Protocols

- Two-Factor Authentication (2FA): A fundamental yet vital feature, 2FA adds an extra layer of security by requiring two types of identification before granting access.

- Cold Storage: Platforms that store a significant portion of their assets offline, in cold storage, reduce the risk of large-scale hacks and unauthorized access.

- Encryption: A platform should use high-level encryption techniques to safeguard user data, transaction details, and funds.

- History of Security Breaches: While past performance isn’t always indicative of future results, platforms with a history of breaches might warrant extra caution. It’s essential to research any past security issues and how the platform addressed them.

User Experience and Interface

A platform’s user experience can greatly influence a trader’s efficiency and satisfaction. An intuitive design ensures that both novices and seasoned traders can navigate the platform with ease. In today’s digital age, having a mobile app is almost a necessity, allowing traders to monitor and execute trades on the go. Furthermore, efficient and knowledgeable customer support can be invaluable, especially when traders face challenges or have pressing queries.

Fees and Transaction Costs

Financial considerations are at the heart of trading, and understanding a platform’s fee structure is essential. Trading fees can vary widely, with some platforms offering tiered structures based on volume, while others might have flat rates. Additionally, traders should be aware of deposit and withdrawal fees, as these can impact overall profitability. Transparency is key, and traders should be wary of any hidden costs or conditions.

Supported Cryptocurrencies

For those specifically interested in X11-based coins, it’s crucial to choose a platform that supports a broad range of these cryptocurrencies. However, even if X11 is the primary focus, having access to a diverse range of other altcoins can provide traders with more opportunities and flexibility in their trading strategies.

Mobile Capabilities and Accessibility

In an era where everything is mobile-centric, a platform’s mobile capabilities can’t be overlooked. Traders should seek platforms that offer seamless mobile trading, allowing them to execute trades, monitor their portfolios, and access real-time market data from their smartphones or tablets. Additionally, the reliability of the platform, especially its uptime during peak trading hours, can influence trading outcomes and opportunities.

Top Platforms for X11-based Cryptocurrency Trading

In the ever-expanding universe of cryptocurrency trading platforms, several have distinguished themselves as particularly well-suited for trading X11-based cryptocurrencies. Here’s a closer look at some of the top platforms in the industry:

1. Kraken

- Overview: Established in 2011, Kraken is one of the oldest and most reputable cryptocurrency exchanges. It offers a wide range of cryptocurrencies, including several X11-based coins.

- Security: Kraken places a strong emphasis on security, with features like 2FA, cold storage, and encrypted databases.

- Fees: Kraken operates on a tiered fee structure, with rates decreasing as trading volume increases. It’s known for its competitive fees in the industry.

- User Experience: With a user-friendly interface and a robust mobile app, Kraken offers a seamless trading experience for both beginners and seasoned traders.

2. Coinbase

- Overview: As one of the most popular cryptocurrency exchanges globally, Coinbase boasts a vast user base and offers a range of X11-based coins.

- Security: Coinbase uses a combination of cold storage and encrypted hot wallets. It also offers insurance for funds stored on the platform.

- Fees: While Coinbase’s fees can be on the higher side compared to other platforms, its user-friendly interface and reputation often justify the costs for many traders.

- User Experience: Known for its intuitive design, Coinbase is particularly beginner-friendly, making it an excellent choice for those new to cryptocurrency trading.

3. Crypto.com

- Overview: Crypto.com has rapidly gained popularity due to its comprehensive ecosystem, which includes a trading platform, a mobile app, and a payment card.

- Security: The platform uses military-grade encryption and cold storage to ensure user funds’ safety.

- Fees: Crypto.com offers competitive trading fees and often runs promotions that reduce costs even further.

- User Experience: With a sleek design and a range of tools and features, Crypto.com caters to both novice and experienced traders.

4. Binance

- Overview: Binance is one of the world’s largest cryptocurrency exchanges, known for its vast selection of coins and high trading volumes.

- Security: Binance employs an advanced multi-tier and multi-cluster system architecture for maximum security.

- Fees: Binance’s fee structure is competitive, and users can further reduce fees by using the platform’s native BNB token.

- User Experience: Binance offers a comprehensive trading experience with advanced charting tools, futures trading, and a user-friendly interface.

The Emergence of Decentralized Exchanges (DEXs)

The cryptocurrency landscape is witnessing a paradigm shift with the rise of Decentralized Exchanges (DEXs). Unlike traditional centralized exchanges, where transactions are overseen by a central authority, DEXs operate without a central governing body, offering peer-to-peer trading directly between users.

Benefits of DEXs

Decentralized Exchanges, or DEXs, offer a unique set of advantages that set them apart from traditional centralized platforms. One of the primary benefits is enhanced security. Since DEXs don’t hold user funds in a centralized location, they are less vulnerable to large-scale hacks. Additionally, they often provide a higher degree of privacy, as many DEXs don’t require rigorous KYC (Know Your Customer) procedures. This ensures that users can trade with more anonymity compared to centralized exchanges. Moreover, DEXs give users full control over their funds, which means they aren’t reliant on a third party to execute trades, reducing the risks associated with exchange insolvencies or malpractices.

Challenges of DEXs

While DEXs offer numerous advantages, they aren’t without their challenges. One of the main issues users face is usability. Many DEXs, especially the earlier ones, can be complex and might not offer the user-friendly experience that some centralized platforms provide. Liquidity can also be a concern. Centralized exchanges often benefit from higher trading volumes, which can lead to better liquidity. In contrast, some DEXs might struggle with lower trading volumes, which can result in price slippages. Transaction speeds can also be slower on DEXs, especially during times of high network congestion. Lastly, while centralized platforms might offer a range of advanced trading tools and features, DEXs can sometimes be more limited in this regard.

Popular DEXs for X11-based Cryptocurrencies

While DEXs cater to a wide range of cryptocurrencies, a few have gained prominence for trading X11-based coins:

- Uniswap: Built on the Ethereum blockchain, Uniswap is one of the most popular DEXs. It uses an automated market maker system, allowing users to trade without the need for order books.

- Sushiswap: A fork of Uniswap, Sushiswap offers a similar experience but with added features and a community-driven approach.

- Balancer: This DEX allows users to create liquidity pools with multiple tokens, offering more flexibility in trading.

- Kyber Network: Known for its liquidity protocol, Kyber Network facilitates seamless token swaps in a decentralized manner.

Essential Security Tips for X11 Traders

In the exhilarating world of cryptocurrency trading, security remains paramount. The decentralized nature of cryptocurrencies, while offering numerous advantages, also presents unique challenges in terms of safeguarding assets. For X11 traders, understanding and implementing robust security measures can make the difference between safeguarding investments and facing potential losses.

Importance of Two-Factor Authentication (2FA)

- What is 2FA? Two-Factor Authentication is a security measure that requires users to provide two distinct forms of identification before accessing their accounts. This typically involves something they know (like a password) and something they possess (like a code sent to a mobile device).

- Benefits: 2FA significantly enhances account security. Even if a malicious actor obtains a user’s password, they would still need the second form of authentication to access the account.

Using Hardware Wallets

- Overview: Hardware wallets are physical devices that store a user’s private keys offline. They are considered one of the safest options for storing cryptocurrencies.

- Benefits: Since hardware wallets are not connected to the internet, they are immune to online hacking attempts. Transactions are signed on the device and then broadcast, ensuring private keys never leave the device.

Regular Software Updates

- Significance: Keeping software, especially wallets and trading applications, updated is crucial. Developers regularly release updates to patch vulnerabilities and enhance security.

- Best Practices: Always download updates from official sources. Be wary of unsolicited emails or messages prompting software updates, as these can be phishing attempts.

Avoiding Phishing Attempts

- What is Phishing? Phishing is a malicious attempt to obtain sensitive information by disguising as a trustworthy entity. In the crypto world, this often involves fake websites or emails impersonating legitimate exchanges or services.

- Prevention: Always double-check URLs before entering sensitive information. Be skeptical of unsolicited communications requesting personal details or private keys.

Backup, Backup, Backup!

- Significance: Regularly backing up wallet data ensures that even in the event of device failures or other unforeseen issues, access to funds remains intact.

- Best Practices: Store backups in multiple secure locations. Consider using encrypted USB drives or even paper backups stored in safe deposit boxes.

Conclusion

The dynamic world of X11 cryptocurrency trading offers a blend of opportunities and challenges, with its unique algorithmic approach and the rise of diverse trading platforms. As the cryptocurrency landscape evolves, the importance of security and staying updated becomes paramount. Traders must navigate this realm with diligence, leveraging the right tools and knowledge to safeguard their investments and capitalize on market opportunities.

The journey in X11 trading, while promising, demands continuous learning and vigilance. As we venture deeper into the digital age, X11 trading stands as a testament to the future of decentralized finance – a world that’s transparent, boundless, and ripe with potential. Armed with insight and a proactive approach, traders can embrace the vast possibilities that lie ahead in the X11 domain.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More