Decentralized Finance, commonly known as DeFi, represents a seismic shift in the way we understand and interact with financial systems. At its core, DeFi aims to democratize finance by removing traditional intermediaries and offering financial services on a transparent and open platform. Let’s delve deeper into what DeFi is and why it’s becoming a cornerstone of the modern financial landscape.

What is DeFi?

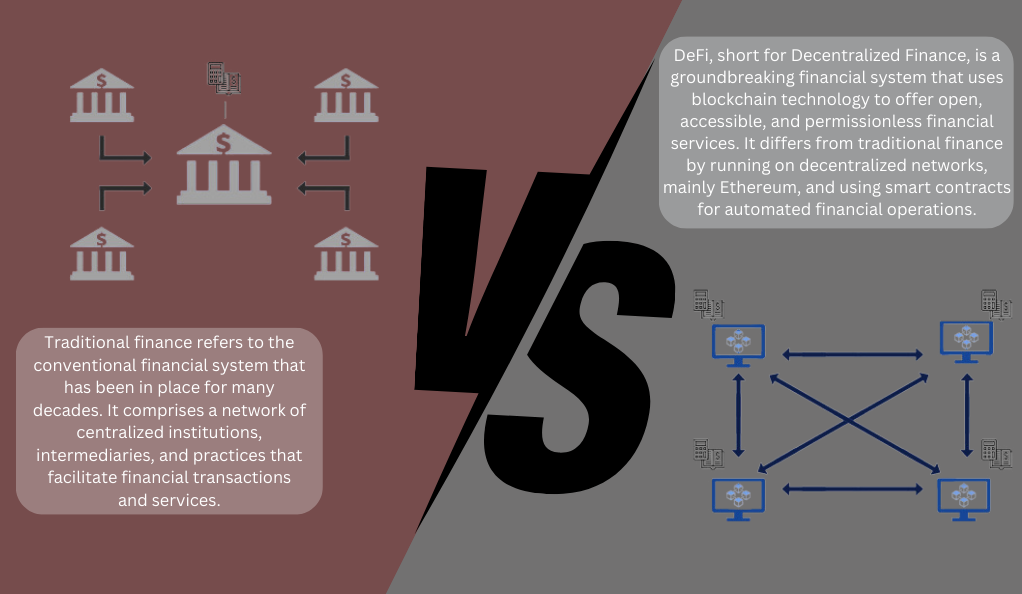

DeFi stands for “Decentralized Finance,” a term that encompasses a range of financial applications built on blockchain technology. Unlike traditional financial systems that rely on centralized entities like banks, brokers, or exchanges, DeFi operates on a peer-to-peer model, facilitated by smart contracts. These smart contracts, primarily built on the Ethereum blockchain, automate and enforce the terms of an agreement without the need for intermediaries.

Why is DeFi Significant?

- Democratization of Finance: DeFi platforms are open to anyone with an internet connection. This inclusivity means that people from all over the world, including those without access to traditional banking systems, can participate in global finance.

- Transparency and Security: All transactions on a DeFi platform are recorded on a public ledger (blockchain), ensuring transparency. Additionally, the decentralized nature of the system reduces the risk of centralized failures or hacks.

- Innovation and Flexibility: DeFi platforms are highly modular, allowing developers to build on top of existing products, leading to rapid innovation. This modularity has given rise to a plethora of financial products and services that were previously unimaginable.

- Interoperability: DeFi products and services are designed to integrate and work seamlessly with one another. This interoperability ensures that users can easily move their assets between different DeFi platforms, creating a cohesive financial ecosystem.

The Role of Blockchain and Smart Contracts

At the heart of DeFi’s revolutionary approach is the use of blockchain technology. A blockchain is a decentralized ledger that records all transactions across a network of computers. This technology ensures that data is transparent, immutable, and secure.

Smart contracts are self-executing contracts where the terms of agreement or conditions are written into lines of code. They automatically enforce and execute the terms of a contract when certain conditions are met. In the context of DeFi, smart contracts play a pivotal role in automating complex financial transactions and ensuring that all parties adhere to the agreed-upon terms.

Historical Context of DeFi

To truly appreciate the revolutionary nature of Decentralized Finance, it’s essential to understand its historical context. The journey of DeFi is intertwined with the broader evolution of blockchain technology and the quest for financial inclusivity.

From Traditional Finance to DeFi

The traditional financial system, as we know it, has been in existence for centuries. Centralized institutions like banks, insurance companies, and stock exchanges have long been the pillars of this system. While they have facilitated economic growth and stability, they also come with inherent challenges:

- Limited Access: Despite technological advancements, a significant portion of the world’s population remains unbanked or underbanked, lacking access to essential financial services.

- Lack of Transparency: Centralized entities often operate behind closed doors, leading to a lack of transparency in their operations and decision-making processes.

- High Fees: Intermediaries in the traditional system often charge high fees for their services, making financial transactions expensive for the end-users.

- Single Points of Failure: Centralized systems are vulnerable to hacks, frauds, and operational failures, posing risks to users’ funds and data.

The 2008 financial crisis further highlighted the vulnerabilities of the centralized financial system, leading to a loss of trust among many. It was in this backdrop that the concept of Bitcoin was introduced in 2009, laying the foundation for decentralized financial systems.

Milestones in the DeFi Journey

- 2009: Introduction of Bitcoin – The world’s first decentralized cryptocurrency, challenging the traditional notions of money and value transfer.

- 2015: Launch of Ethereum – While Bitcoin introduced the concept of decentralized money, Ethereum took it a step further by introducing smart contracts, paving the way for programmable decentralized applications, including DeFi platforms.

- 2016-2018: Birth of DeFi Protocols – Projects like MakerDAO, Compound, and Uniswap were launched, each offering unique decentralized financial solutions, from stablecoins to lending platforms to decentralized exchanges.

- 2020: The Yield Farming Boom – DeFi gained massive popularity with the concept of yield farming, where users could earn returns by providing liquidity or participating in various DeFi protocols.

- 2021 and Beyond: Mainstream Adoption – With increasing institutional interest, technological advancements, and regulatory clarity, DeFi started moving from niche communities to mainstream financial discussions.

The Multi-layered Architecture of DeFi

Decentralized Finance, while seemingly complex, operates on a structured, multi-layered architecture. This architecture allows for modularity, scalability, and interoperability, which are crucial for the rapid innovation and growth we witness in the DeFi space. Let’s break down the layers that constitute the DeFi ecosystem.

Understanding the DeFi Stack

The DeFi stack can be visualized as a pyramid, with each layer building upon the one below it:

- Settlement Layer: This is the foundational layer, primarily consisting of blockchains like Ethereum, Binance Smart Chain, and others. It provides the necessary security and consensus mechanisms, ensuring that transactions are validated and recorded on the decentralized ledger.

- Asset Layer: Built atop the settlement layer, this layer comprises various digital assets, including cryptocurrencies, stablecoins, and tokenized real-world assets. These assets can be traded, lent, or used as collateral within the DeFi ecosystem.

- Protocol Layer: This layer introduces standard protocols and smart contracts that facilitate various financial operations. Protocols like Uniswap, Compound, and Aave define the rules for decentralized exchanges, lending, borrowing, and more.

- Application Layer: The topmost layer consists of user-facing applications, often referred to as DApps (Decentralized Applications). These DApps provide intuitive interfaces for users to interact with underlying protocols, making DeFi accessible to a broader audience.

The Rise of DEX Aggregators

One of the most notable trends in the DeFi space is the emergence of DEX (Decentralized Exchange) aggregators. These platforms source liquidity from multiple DEXes, ensuring users get the best possible trading rates. By scanning various exchanges in real-time, they optimize trades and reduce slippage. Platforms like 1inch and Matcha have gained significant traction, showcasing the demand for efficient and cost-effective trading solutions in DeFi.

Pioneers and Innovators in DeFi

The meteoric rise of Decentralized Finance can be attributed to the visionaries and innovators who dared to challenge the status quo of traditional finance. These pioneers recognized the potential of blockchain technology and smart contracts to create a more inclusive, transparent, and efficient financial system. Let’s spotlight some of the trailblazing projects and their contributions to the DeFi landscape.

MakerDAO and its Significance

MakerDAO stands as one of the earliest and most influential projects in the DeFi space. It introduced the concept of a decentralized stablecoin, DAI, which is pegged to the US dollar. Unlike other stablecoins that maintain their peg through centralized reserves, DAI achieves stability through a system of collateralized debt positions (CDPs) and automated smart contracts. This groundbreaking approach has made DAI a cornerstone of many DeFi applications, from lending platforms to payment systems.

Compound Finance and the Concept of “Yield Farming”

Compound Finance revolutionized the DeFi space by introducing a decentralized lending and borrowing platform. Users can supply assets to earn interest or borrow assets by providing collateral. What set Compound apart was its distribution of governance tokens (COMP) to users, giving them a say in the platform’s future development. This model inadvertently led to the phenomenon of “yield farming,” where users strategically interact with DeFi protocols to maximize their returns. The success of Compound’s model inspired a wave of similar projects, cementing “yield farming” as a defining trend in DeFi.

Uniswap and the Power of Automated Market Makers (AMMs)

Uniswap challenged traditional exchange models by introducing an Automated Market Maker (AMM) system. Instead of relying on order books, Uniswap’s AMM model uses liquidity pools to facilitate trades. This design ensures that trades are executed instantly, regardless of the trade size. Uniswap’s simplicity and efficiency have made it one of the most popular decentralized exchanges, paving the way for numerous other AMM-based platforms.

Yearn.Finance and the Evolution of DeFi Aggregation

Yearn.Finance emerged as a game-changer by offering automated yield optimization strategies. Instead of users manually navigating the complex DeFi landscape, Yearn.Finance’s algorithms automatically allocate funds to the most profitable protocols. This automation not only maximizes returns for users but also simplifies their interaction with the DeFi ecosystem.

Key Characteristics of DeFi

To understand the enduring appeal of Decentralized Finance (DeFi), it’s essential to delve into its key characteristics. These characteristics underpin the core principles and functionalities that set DeFi apart from traditional financial systems. Let’s explore the fundamental elements that define DeFi.

Decentralized Applications (DApps) and Their Role

At the heart of the DeFi movement are Decentralized Applications (DApps). These are software applications built on blockchain platforms like Ethereum, which enable users to interact with financial services without relying on traditional intermediaries. DApps automate processes through smart contracts, making transactions transparent, secure, and trustless. Notable examples of DeFi DApps include lending platforms, decentralized exchanges (DEXs), and yield farming aggregators.

The Power of Smart Contracts and DeFi Protocols

Smart contracts are self-executing agreements with the terms directly written into code. These contracts automatically enforce and execute the terms when predetermined conditions are met. In the context of DeFi, smart contracts are the building blocks that power various financial operations, such as lending, borrowing, trading, and yield farming. Smart contracts eliminate the need for intermediaries, reducing costs and increasing efficiency.

DeFi protocols, on the other hand, are sets of rules and standards that define how transactions should occur within the DeFi ecosystem. These protocols are often open-source, enabling developers to build on top of them and create new financial products and services. Examples of DeFi protocols include Compound for lending and Uniswap for decentralized exchange.

Interoperability and Composability

DeFi’s strength lies in its ability to seamlessly integrate different components within the ecosystem. The concept of interoperability ensures that assets and services from various DeFi platforms can work together. Users can move assets between different DApps and protocols with ease, creating a dynamic and interconnected financial environment.

Composability is the idea that different DeFi protocols and services can be combined, or “composed,” to create entirely new and innovative financial products. This flexibility has led to the rapid development of novel DeFi offerings, such as liquidity pools, yield farming strategies, and decentralized derivatives.

User Ownership and Control

In DeFi, users have full control and ownership of their assets and data. Private keys and digital wallets are the keys to access and manage one’s financial holdings. This level of control empowers individuals to make financial decisions independently, eliminating the need for reliance on third-party institutions.

Global Accessibility and Inclusivity

Perhaps one of the most transformative aspects of DeFi is its global accessibility. Anyone with an internet connection can participate in the DeFi ecosystem, regardless of their location or socioeconomic status. This inclusivity has the potential to bridge the financial divide, offering financial services to the unbanked and underbanked populations around the world.

Transparency and Security

Every transaction in DeFi is recorded on a public blockchain, providing complete transparency. Users can verify transactions and track the movement of assets in real-time. Additionally, the decentralized nature of DeFi reduces the risk of centralized failures, hacks, or fraudulent activities, enhancing security.

Challenges and Risks in DeFi

While Decentralized Finance (DeFi) holds immense promise, it is not without its share of challenges and risks. Understanding these issues is crucial for users, developers, and policymakers to ensure the continued growth and sustainability of the DeFi ecosystem. Let’s explore some of the pressing challenges and risks associated with DeFi.

Coding Errors and Vulnerabilities

Smart contracts are the backbone of DeFi, automating complex financial operations. However, they are not immune to human error. Coding mistakes or vulnerabilities in smart contracts can lead to catastrophic consequences, including the loss of users’ funds. High-profile incidents, such as the DAO hack in 2016 and various flash loan exploits, have highlighted the importance of rigorous code auditing and testing in the DeFi space.

The Threat of Hacks and “Rug Pulls”

DeFi platforms, including decentralized exchanges and lending protocols, are attractive targets for hackers due to the substantial amounts of cryptocurrency assets they hold. Hackers often exploit vulnerabilities in these platforms to steal funds. Additionally, some malicious actors create fraudulent projects, referred to as “rug pulls,” where they attract liquidity from users and disappear with the assets. Users must exercise caution and conduct due diligence before engaging with new DeFi projects.

Regulatory Concerns and the Evolving Legal Landscape

The regulatory environment for DeFi is still in its infancy, with authorities worldwide grappling with how to classify and oversee these innovative financial systems. While DeFi aims to decentralize control, governments are increasingly taking an interest in regulating aspects of the ecosystem, such as stablecoins and decentralized exchanges. Compliance with these evolving regulations is a significant challenge for DeFi projects and users, as non-compliance could lead to legal repercussions.

Liquidity and Market Risks

DeFi relies on liquidity pools and decentralized exchanges to facilitate trading and lending. However, liquidity can be fragile, leading to potential liquidity crises during periods of high volatility or market stress. In such situations, users may struggle to withdraw their assets or face significant slippage in trade execution. Additionally, the DeFi market is relatively small compared to traditional finance, making it susceptible to market manipulation by large players.

Scalability Challenges

As DeFi gains popularity, scalability has become a pressing concern. Many DeFi platforms, particularly those built on the Ethereum blockchain, have faced congestion issues and high gas fees during periods of high demand. This can hinder the user experience and make DeFi less accessible to smaller participants. Solutions like Ethereum 2.0 and layer-2 scaling solutions are being explored to address these scalability challenges.

Privacy and Data Security

While transactions on public blockchains are transparent, user data privacy is a concern. DeFi applications often require users to provide personal information, such as wallet addresses, which can be linked to their real-world identities. Maintaining the balance between transparency and privacy is a complex challenge that DeFi projects must navigate.

Conclusion

Decentralized Finance (DeFi) is not a fleeting trend but a seismic shift in finance. It has evolved from a niche concept to a global force, reshaping how we approach financial systems. The core attributes of DeFi, such as DApps, smart contracts, and global accessibility, have ushered in a new era of financial inclusivity.

While DeFi faces challenges like coding errors and regulatory uncertainties, it has shown resilience and adaptability. The future holds even more promise with innovations like cross-chain compatibility, decentralized identity, and tokenization of real-world assets. Venture capital and tech giants are actively participating, and traditional finance must adapt to stay relevant.

In essence, DeFi is not just a technology; it’s a movement that empowers individuals, disrupts traditional finance, and shapes a more accessible, transparent, and cost-effective financial future.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More