The financial landscape has been undergoing a significant transformation, marked by the emergence of two distinct paradigms: Decentralized Finance (DeFi) and Traditional Banking. These two systems represent different approaches to managing financial transactions and services, each with its unique characteristics, advantages, and challenges.

Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, refers to a financial ecosystem that operates on blockchain networks. It aims to create a decentralized and trustless environment where transactions are executed through smart contracts, eliminating the need for intermediaries.

Key Features:

- Accessibility: DeFi platforms are accessible to anyone with an internet connection, promoting financial inclusion.

- Transparency: All transactions are recorded on a public blockchain, ensuring transparency and accountability.

- Control: Users have complete control over their assets, and transactions are immutable.

- Innovation: DeFi’s decentralized nature fosters continuous growth and adaptability.

Challenges:

- Complexity: DeFi can be complex for new users, requiring a learning curve.

- Security: Smart contract vulnerabilities and limited regulatory frameworks can pose risks.

Traditional Banking

Traditional banking has been the cornerstone of the financial system for centuries. It involves a network of banks and financial institutions acting as intermediaries, offering services like deposits, loans, and investments.

Key Features:

- Trust and Reliability: Established trust through physical branches and regulatory protection.

- Services: Wide range of financial services, including personalized support.

- Global Reach: Widespread network, although may face limitations in remote regions.

Challenges:

- Accessibility: Exclusion of individuals without access to traditional banking services.

- Efficiency: Operational inefficiencies, susceptibility to fraud, and security breaches.

| Feature | DeFi | Traditional Banking |

|---|---|---|

| Accessibility | Internet-based, globally accessible | Requires physical branches, limited accessibility |

| Transparency & Control | Transparent, user-controlled | Less transparent, controlled by intermediaries |

| Innovation | Highly innovative, adaptable | Slower to implement innovative solutions |

| Security & Regulation | Cryptographic security, limited regulation | Regulated, established security measures |

| Complexity & User Friendliness | Complex for new users, steep learning curve | Established trust, personalized support |

Understanding DeFi (Decentralized Finance)

Decentralized Finance, commonly known as DeFi, represents a radical shift in the world of finance. It’s a term that encompasses a variety of financial applications in cryptocurrency or blockchain geared toward disrupting traditional financial intermediaries. This section delves into the core aspects of DeFi, exploring its definition, principles, advantages, and potential challenges.

Definition and Principles

DeFi refers to a decentralized financial ecosystem that operates on blockchain networks. Unlike traditional banking, which relies on centralized authorities like banks and regulatory bodies, DeFi platforms are decentralized and trustless.

Core Principles:

- Open Access: Anyone with an internet connection and a digital wallet can access DeFi platforms, regardless of geographical location.

- Decentralization: DeFi operates without a central authority, using smart contracts to execute transactions.

- Interoperability: DeFi applications are often built on public blockchains, allowing seamless interaction between different applications.

- Transparency: All transactions are publicly recorded on the blockchain, ensuring full transparency.

Advantages and Benefits

DeFi offers numerous advantages over traditional banking, some of which include:

Financial Inclusion

DeFi promotes financial inclusion by providing services to the unbanked and underbanked populations worldwide.

Peer-to-Peer Transactions

DeFi enables peer-to-peer transactions, reducing processing delays and costs associated with intermediaries.

User Control

Users have complete control over their assets, and the transparent nature of blockchain ensures security and immutability.

Innovation and Flexibility

The decentralized nature of DeFi fosters innovation, allowing developers to create new financial products and services.

Challenges and Potential Drawbacks

Despite its advantages, DeFi is not without challenges:

Complexity: The decentralized nature of DeFi can be complex and intimidating for new users.

Smart Contract Vulnerabilities: If not properly audited, smart contracts can have vulnerabilities that may be exploited.

Regulatory Uncertainty: The lack of a clear regulatory framework can lead to legal uncertainties and potential compliance issues.

Scalability Issues: Some DeFi platforms may face challenges in scaling to accommodate a large number of users.

Traditional Banking: An Overview

Traditional banking, often referred to as conventional banking, has been the backbone of the global financial system for centuries. It encompasses a network of banks and financial institutions that provide a wide range of financial services to individuals, businesses, and governments. This section explores the definition, functions, strengths, and weaknesses of traditional banking.

Key Functions:

- Accepting Deposits: Banks provide a safe place for individuals and businesses to deposit their money.

- Providing Loans: They lend money to individuals, businesses, and governments for various purposes, such as buying a home or expanding a business.

- Investment Services: Banks offer investment products like mutual funds, bonds, and stocks.

- Payment Services: They facilitate payments through methods like wire transfers, credit cards, and online banking.

- Foreign Exchange Services: Banks provide currency exchange and international financial services.

Strengths and Advantages

Traditional banking has several strengths that have contributed to its enduring presence:

- Trust and Reliability: Established trust through years of operation, physical branches, and regulatory oversight.

- Diverse Services: A wide array of financial services catering to different needs.

- Personalized Support: Physical branches offer face-to-face interaction and personalized customer support.

- Regulatory Protection: Compliance with regulations ensures consumer protection and financial stability.

Limitations and Challenges

Despite its strengths, traditional banking faces some inherent limitations:

Accessibility: Limited accessibility in remote areas and potential exclusion of unbanked populations.

Operational Inefficiencies: Traditional banking systems can be slow and cumbersome, leading to delays in transactions.

Susceptibility to Fraud: Vulnerable to fraud and security breaches, despite established security measures.

Higher Costs: Operational costs and profit motives may lead to higher fees and interest rates.

| Feature | Traditional Banking | Modern Alternatives (e.g., DeFi) |

|---|---|---|

| Accessibility | Requires physical branches, limited accessibility | Internet-based, globally accessible |

| Customer Support | Face-to-face support, personalized | Often online, less personalized |

| Security & Regulation | Regulated, established security measures | Cryptographic security, limited regulation |

| Innovation | Slower to implement innovative solutions | Highly innovative, adaptable |

| Costs & Fees | May have higher fees and interest rates | Often lower fees due to reduced intermediaries |

DeFi vs. Traditional Banking: A Comparative Analysis

The financial world is witnessing a transformative phase with the emergence of Decentralized Finance (DeFi) alongside the long-established Traditional Banking system. Both systems have unique characteristics, advantages, and challenges. This section provides a comparative analysis, diving deep into various aspects to understand their differences and potential synergies.

Accessibility and Inclusivity

DeFi:

- Global Reach: DeFi platforms are accessible to anyone with an internet connection, regardless of geographical location.

- Inclusivity: Promotes financial inclusion, especially for unbanked and underbanked populations.

Traditional Banking:

- Physical Branches: Requires physical branches, which may limit accessibility.

- Exclusion: May exclude individuals without access to traditional banking services.

Intermediaries and Control

In the realm of DeFi, transactions operate without intermediaries as they are carried out via smart contracts, effectively cutting out the middlemen. This setup not only streamlines processes but also grants users a remarkable degree of authority over their financial matters. On the contrary, traditional banking leans heavily on intermediaries such as banks, which tends to result in prolonged transaction durations. Furthermore, financial power within the domain of traditional banking often rests within the hands of centralized entities, standing in contrast to the user empowerment that DeFi seeks to provide.

Transparency and Security

DeFi:

- Transparency: All transactions are recorded on a public blockchain, ensuring transparency.

- Security: Utilizes robust cryptographic techniques, making it highly secure.

Traditional Banking:

- Less Transparent: May lack the same level of transparency as DeFi.

- Established Security Measures: While secure, traditional banking may be susceptible to fraud and breaches.

Interest Rates and Fees

In the context of DeFi, it frequently presents more attractive interest rates for both savings and loans, bolstering its appeal as a financial option. Additionally, DeFi’s exclusion of intermediaries results in diminished fees, further enhancing its cost-effectiveness. Conversely, traditional banking tends to come with elevated rates and fees due to the presence of operational expenses, which can impact the overall financial equation for individuals.

Innovation and Adaptability

DeFi:

- Rapid Innovation: Decentralized nature promotes rapid innovation and adaptability.

- Flexible Platforms: Developers can build new financial products on existing platforms.

Traditional Banking:

- Slower Innovation: More regulated and centralized, may take longer to implement new solutions.

- Less Flexibility: Traditional structures may limit adaptability to new financial trends.

| Aspect | DeFi | Traditional Banking |

|---|---|---|

| Accessibility | Internet-based, globally accessible | Requires physical branches, limited accessibility |

| Intermediaries & Control | No intermediaries, user-controlled | Relies on intermediaries, institution-controlled |

| Transparency & Security | Transparent, cryptographic security | Less transparent, established security measures |

| Interest Rates & Fees | Competitive rates, lower fees | Higher rates and fees due to operational costs |

| Innovation & Adaptability | Highly innovative, adaptable | Slower to innovate, less flexible |

Pros and Cons of DeFi and Traditional Banking

Decentralized Finance (DeFi) and Traditional Banking are two significant components of the financial ecosystem. While they share some common goals, they also have distinct characteristics that lead to specific advantages and disadvantages. This section explores the pros and cons of both DeFi and Traditional Banking.

DeFi’s Advantages and Drawbacks

Pros:

- Financial Inclusion: DeFi promotes financial inclusion by providing services to unbanked and underbanked populations.

- Transparency: All transactions are publicly recorded on the blockchain, ensuring full transparency.

- User Control: Users have complete control over their assets, and transactions are immutable.

- Innovation: DeFi’s decentralized nature fosters innovation, allowing developers to create new financial products.

Cons:

- Complexity: DeFi can be complex for new users, requiring a learning curve.

- Smart Contract Vulnerabilities: If not properly audited, smart contracts can have vulnerabilities.

- Limited Regulatory Framework: Lack of clear regulations can lead to legal uncertainties.

- Scalability Issues: Some DeFi platforms may face challenges in scaling to accommodate large numbers of users.

Traditional Banking’s Strengths and Weaknesses

Traditional banking boasts established trust, diverse services, and personalized support, backed by regulatory compliance. However, it falters in limited accessibility, operational inefficiencies, higher costs, and susceptibility to fraud despite security measures.

Comparison in DeFi and Traditional Banking

In a comparative analysis, DeFi offers the advantages of financial inclusion, transparency, user control, and innovation. On the other hand, it faces challenges related to complexity, vulnerabilities, limited regulation, and scalability issues. In contrast, traditional banking excels in established trust, providing diverse services, personalized support, and regulatory protection. However, it falls short in terms of limited accessibility, operational inefficiencies, higher costs, and susceptibility to fraud.

The Future of DeFi and Traditional Banking

The financial landscape is at a crossroads with the coexistence of Decentralized Finance (DeFi) and Traditional Banking. Both paradigms are evolving, and their future is a subject of great interest to investors, regulators, and financial enthusiasts. This section provides a step-by-step analysis of the future prospects, challenges, and opportunities for DeFi and Traditional Banking.

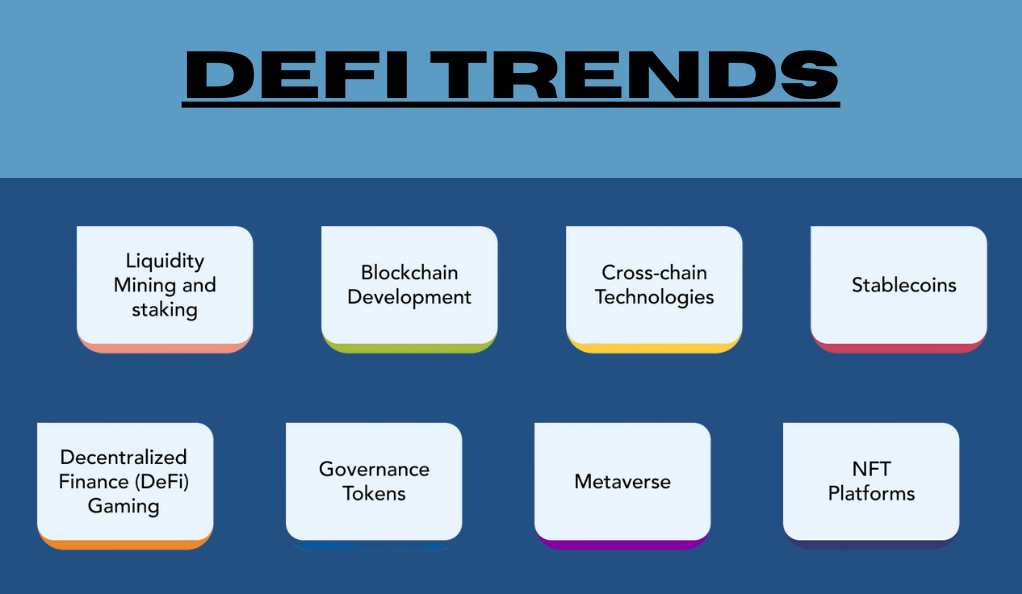

Predictions and Trends

DeFi:

The trajectory of DeFi’s growth is anticipated to persist, with an increasing influx of users and capital drawn to its ecosystem. This expansion is poised to bring forth innovative products and a diversification of services, effectively broadening the scope of DeFi’s offerings. Furthermore, the potential for mainstream adoption is on the horizon, as DeFi could experience heightened acceptance both within traditional financial institutions and among retail users seeking more accessible and versatile financial solutions.

Traditional Banking:

The ongoing digital transformation within the realm of traditional banking is expected to persist, as banks actively integrate digital technologies to bolster efficiency and elevate the overall customer experience. A noticeable shift toward collaboration with fintech companies is also on the horizon, with partnerships likely to become more prevalent, thereby propelling innovation within the industry. Moreover, a heightened emphasis on environmental, social, and governance (ESG) factors is anticipated to feature prominently in banking operations, highlighting a growing commitment to sustainable practices and responsible business conduct.

Integration of DeFi in Traditional Banking

- Hybrid Models: The future may see the development of hybrid models that combine the strengths of DeFi and Traditional Banking.

- Interoperability: Traditional banks may adopt blockchain technology to enhance interoperability with DeFi platforms.

- Collaborative Innovation: Collaboration between DeFi developers and traditional financial institutions could foster innovation and create new financial products.

The Role of Regulations

Regulatory Clarity for DeFi: Clear and supportive regulations could foster DeFi’s growth, ensuring consumer protection and legal compliance.

Adaptation by Traditional Banks: Traditional banks may need to adapt to new regulations that accommodate emerging financial technologies.

Balancing Innovation and Security: Regulators will face the challenge of balancing innovation with security and consumer protection.

Challenges and Opportunities

- Education and Accessibility: Both DeFi and Traditional Banking must address challenges related to accessibility and user education.

- Security and Trust: Building trust and ensuring security will be crucial for the continued success of both paradigms.

- Global Reach and Inclusion: Leveraging the global reach of DeFi and the established trust of Traditional Banking could promote financial inclusion.

Comparative Table: Future Prospects

| Aspect | DeFi | Traditional Banking |

|---|---|---|

| Predictions & Trends | Growth, innovation, mainstream adoption | Digital transformation, fintech collaboration, sustainability focus |

| Integration | Potential for hybrid models, interoperability | Collaboration with DeFi, embracing blockchain |

| Regulations | Need for clarity, balancing innovation | Adaptation to new tech regulations, consumer protection |

| Challenges & Opportunities | Education, security, global reach | Accessibility, trust-building, financial inclusion |

Interesting Gap: Complexity and Learning Curve in DeFi

Decentralized Finance (DeFi) has emerged as a revolutionary force in the financial landscape. However, one of the most intriguing and challenging aspects of DeFi is its complexity and the steep learning curve it presents to new users. This section provides a step-by-step analysis of this interesting gap, exploring the underlying factors, challenges, and potential solutions.

Understanding the Complexity

Technical Nature: DeFi’s underlying technology, including blockchain and smart contracts, can be complex and intimidating for non-technical users.

Diverse Ecosystem: The DeFi ecosystem consists of various platforms, tokens, and financial products, each with unique features and requirements.

Security Considerations: Managing private keys, understanding wallet security, and navigating decentralized exchanges require careful attention and understanding.

The Learning Curve Challenge

- Barrier to Entry: The complexity of DeFi can act as a barrier to entry for many potential users, especially those unfamiliar with cryptocurrencies and blockchain.

- Risk of Mistakes: Lack of understanding can lead to costly mistakes, such as sending funds to the wrong address or misusing a financial product.

- Need for Education: There is a pressing need for comprehensive education to guide users through the complexities of DeFi.

Opportunities for User Education

Educational Platforms: Creating platforms and resources dedicated to educating users about DeFi concepts, security practices, and platform navigation.

Community Engagement: Leveraging community forums, social media, and influencers to provide support, tutorials, and insights.

Collaboration with Institutions: Partnering with educational institutions to integrate DeFi education into financial literacy programs.

Bridging the Knowledge Gap

- User-Friendly Interfaces: Developing more intuitive and user-friendly interfaces can make DeFi platforms more accessible to newcomers.

- Guided Onboarding: Implementing guided onboarding processes with tutorials and tooltips can help users navigate the complexities of DeFi.

- Customer Support: Providing responsive customer support, including live chat and FAQs, can assist users in real-time.

Comparative Table: Complexity and Solutions

| Aspect | Complexity in DeFi | Potential Solutions |

|---|---|---|

| Understanding Complexity | Technical nature, diverse ecosystem, security considerations | Educational platforms, community engagement, collaboration with institutions |

| Learning Curve Challenge | Barrier to entry, risk of mistakes, need for education | User-friendly interfaces, guided onboarding, customer support |

Conclusion

The exploration of Decentralized Finance (DeFi) and Traditional Banking has unveiled a multifaceted landscape where innovation, accessibility, complexity, and integration converge. From the revolutionary principles of DeFi to the enduring trust in Traditional Banking, the financial ecosystem is at a transformative juncture. The future promises a dynamic interplay between these paradigms, with opportunities for hybrid models, educational initiatives, regulatory clarity, and technological advancements. Navigating this complex terrain requires a nuanced understanding, collaborative efforts, and a commitment to inclusivity and transparency, setting the stage for a more robust and diversified financial future.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More