Copper, often seen as an indicator of global economic health, has faced a lackluster performance recently as China’s economy grapples with challenges. The metal’s prices have stagnated near a seven-week low due to concerns over China’s economic woes and an increase in copper supply. This article examines the reasons behind copper’s downward trend and the implications it may have on the global market.

Copper prices stagnate as China’s economy faces challenges

One of the main factors contributing to copper’s stagnation is China’s struggling economy. The world’s second-largest economy has been hit by a series of setbacks, including slowing growth, increased debt levels, and the ongoing trade tensions with the United States. As China is a major consumer of copper, any signs of weakness in its economy have a significant impact on the metal’s prices. Investors have become increasingly cautious, leading to a lack of demand and subsequently dragging down copper prices.

Moreover, China’s crackdown on speculative trading and environmental regulations has also affected copper prices. The government’s efforts to reduce pollution and curb excessive speculation have resulted in stricter regulations and increased costs for copper producers. This, combined with the overall economic challenges, has created an uncertain environment for copper traders and investors, leading to a lack of enthusiasm in the market.

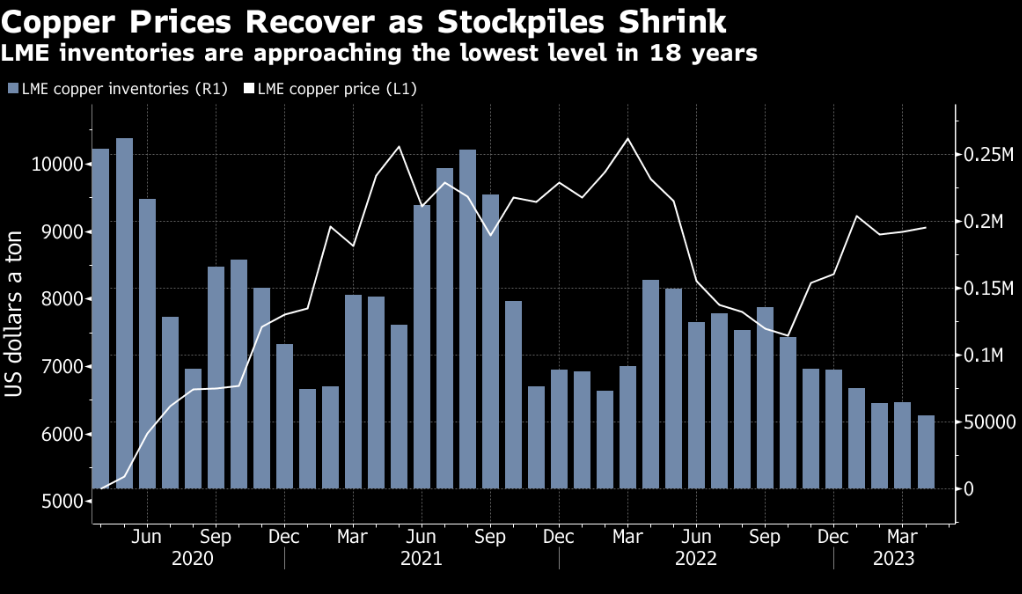

Increased supply adds to concerns of copper’s downward trend

Another factor contributing to copper’s stagnation is the increase in supply. Despite the current uncertainties surrounding the demand for copper, production levels have remained high. Copper mines in major producing countries such as Chile and Peru have continued to operate at full capacity, leading to an oversupply in the market. This excess supply, coupled with the lackluster demand, has put further downward pressure on copper prices.

In addition to increased mine production, there has also been a rise in copper scrap supply. With the push towards sustainable practices and the recycling of materials, the availability of copper scrap has increased. This has further added to the oversupply situation, as recycled copper can be a more cost-effective alternative for certain applications. The combination of excess mine production and higher availability of scrap has intensified concerns about copper’s downward trend.

Copper’s stagnation near a seven-week low can be attributed to China’s economic challenges and the increased supply in the market. The ongoing trade tensions and slowing growth in China have dampened demand for copper, leading to a lack of enthusiasm among investors. Additionally, the oversupply of copper, both from increased mine production and higher availability of scrap, has further weighed down on prices. As China’s economy continues to face challenges and the supply situation remains uncertain, the copper market is likely to experience further volatility. Traders and investors will closely monitor developments in China and the global economy to gauge the future direction of copper prices.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More

+ There are no comments

Add yours