In the vast and intricate world of cryptocurrencies, there are certain digital assets that distinctly shine, each weaving its own unique and influential pattern. Among this diverse array, X11 coins have carved a special niche. Their allure isn’t just rooted in their technological advancements, but also in the myriad opportunities they unfurl for traders and investors.

As we stand on the precipice of exploring advanced trading instruments tailored for these coins, it becomes essential to first understand the foundational essence of X11 coins, grasping their evolution and the pivotal role they play in the ever-evolving crypto cosmos.

Decoding the X11 Algorithm: A Crypto Cornerstone

In the sprawling ecosystem of cryptocurrencies, certain algorithms emerge as pillars, underpinning the success and security of numerous coins. The X11 algorithm is one such pillar, renowned not just for its complexity but also for the distinct advantages it offers. As we venture into the realm of X11 coins, it’s essential to grasp the foundational role this algorithm plays, its historical trajectory, and the coins that champion its use.

What Sets X11 Apart?

The X11 algorithm is a unique concoction of eleven cryptographic algorithms. This multi-algorithm approach is not just a show of complexity but serves a dual purpose:

- Robust Security: By chaining together eleven different hashing functions, X11 ensures that potential attackers must find vulnerabilities in all eleven functions to compromise the system, a feat that’s exponentially more challenging than breaching a single-function system.

- Efficiency and Sustainability: X11 is designed to be more energy-efficient than its counterparts like SHA-256. This efficiency translates to a reduced carbon footprint, making X11 coins more environmentally friendly—a growing concern in the crypto community.

X11’s Flagbearers: Leading Coins Using the Algorithm

While several coins have adopted the X11 algorithm, a few have risen to prominence:

- Dash: Perhaps the most well-known X11 coin, Dash has introduced features like InstantSend and PrivateSend, setting it apart from many other cryptocurrencies. Its focus on privacy and speed has garnered a significant user base.

- CannabisCoin: Targeted at the cannabis industry, this coin aims to simplify transactions in jurisdictions where marijuana is legal.

- StartCoin: A digital currency that focuses on crowdfunding, StartCoin aims to incentivize users to support and propagate projects they believe in.

Historical Trajectory of X11 Coins:

The journey of X11 coins has been marked by both meteoric rises and challenging troughs. For instance, Dash experienced a phenomenal growth rate in 2017, only to face corrections in subsequent years. However, the resilience of these coins, backed by the robustness of the X11 algorithm, has ensured their continued relevance in the crypto market.

Basics of Crypto Futures and Options

The world of cryptocurrency trading is vast, offering a plethora of instruments that traders can leverage to maximize their gains or hedge against potential losses. Among these instruments, futures and options stand out due to their complexity and potential for high returns. Let’s demystify these advanced trading tools and understand their significance in the crypto realm.

Futures vs. Options: What’s the Difference?

At their core, both futures and options belong to the family of financial derivatives, meaning their value is derived from an underlying asset—in this case, a cryptocurrency like an X11 coin. However, they function differently:

- Futures: A futures contract is a binding agreement between two parties to buy or sell an asset at a specified future date for a price specified today. It’s worth noting that both parties are obligated to fulfill the contract on the expiration date.

- Options: An options contract gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a set time frame. The seller, in return, receives a premium from the buyer for this right.

Why Are Futures and Options Important in Crypto Trading?

- Leverage: These instruments allow traders to control a larger position with a relatively small amount of capital. This can amplify gains, but it’s essential to remember it can also magnify losses.

- Hedging: Traders and investors can use futures and options to protect their portfolios against adverse price movements. For instance, if one anticipates a drop in the price of an X11 coin, they could purchase a put option to potentially offset some of the losses.

- Diversification: Adding futures and options to a trading strategy can provide diversification, as these instruments can behave differently than simply holding the underlying asset.

- Price Discovery and Stability: Futures markets can assist in determining the future price of an asset. They can also contribute to stabilizing price fluctuations, especially in volatile markets like crypto.

How Futures and Options Work with X11 Coins

The intricacies of futures and options become even more fascinating when applied to the dynamic world of X11 coins. Given the unique characteristics and volatility patterns of these coins, these advanced trading instruments can offer both challenges and opportunities.

Tailoring Futures and Options for X11 Coins

- Contract Specifications: Futures and options contracts for X11 coins might have different specifications compared to those for more mainstream cryptocurrencies. These can include contract size, expiration dates, and tick sizes. It’s crucial for traders to familiarize themselves with these details before entering a trade.

- Liquidity Concerns: While major cryptocurrencies like Bitcoin and Ethereum enjoy high liquidity in their futures and options markets, X11 coins might not always have the same level of liquidity. This can lead to wider bid-ask spreads and potential challenges in entering or exiting positions.

- Price Dynamics: The price behavior of X11 coins can be influenced by factors distinct from the broader crypto market, such as updates to the X11 algorithm, regulatory news affecting one of the X11 coins, or technological advancements in one of the coins like Dash. These dynamics can impact the pricing and volatility of futures and options contracts.

Potential Benefits and Risks

- Benefits:

- Strategic Flexibility: Futures and options allow X11 coin traders to employ a range of strategies, from basic hedging to more complex speculative plays.

- Enhanced Returns: With the ability to leverage positions, traders can achieve higher returns relative to their investment.

- Risk Management: Options, in particular, allow traders to define their risk. For instance, the maximum loss for a purchased option is limited to the premium paid.

- Risks:

- Leverage-Induced Losses: While leverage can amplify gains, it can also magnify losses, potentially leading to significant financial setbacks.

- Complexity: Futures and options are sophisticated instruments. A lack of understanding can result in poor trading decisions.

- Cost Implications: Trading these instruments can involve various costs, including premiums for options, margin requirements for futures, and potential fees.

Real-World Scenarios with X11 Coins

Imagine a scenario where there’s an upcoming technological upgrade in the Dash network, expected to enhance transaction speeds. A trader, anticipating this upgrade will lead to a surge in Dash’s price, might buy a futures contract. If Dash’s price rises as expected, the trader stands to gain. Conversely, if there’s unexpected negative news, like regulatory clampdowns on X11 coins, the trader could face losses.

In another scenario, an investor holding a substantial amount of StartCoin might be wary of short-term price volatility due to market rumors. To protect their position, they could purchase a put option, ensuring they have the right to sell at a predetermined price, even if the market price drops significantly.

Navigating the world of futures and options in the X11 coin market requires both knowledge and vigilance. By understanding the nuances of these instruments and the specific dynamics of X11 coins, traders can position themselves to make informed decisions and optimize their trading strategies.

Popular Platforms for Trading X11 Coin Futures and Options

In the vast crypto trading arena, several platforms have risen to prominence, offering futures and options trading for a variety of cryptocurrencies, including X11 coins. Selecting the right platform can be pivotal, as it impacts the trading experience, potential returns, and the range of tools at a trader’s disposal.

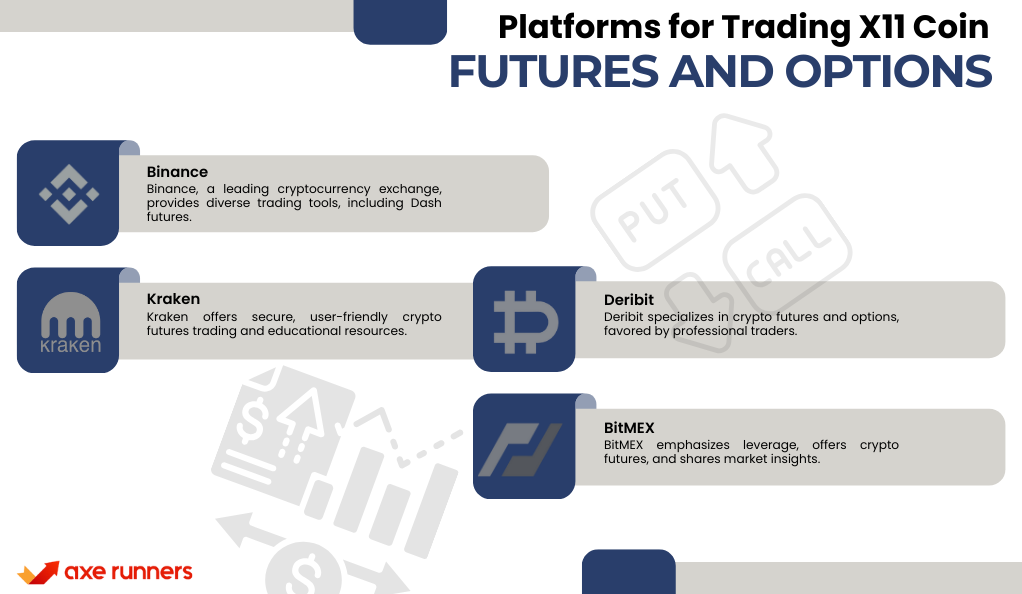

Leading Platforms in the Spotlight

- Binance: As one of the world’s largest cryptocurrency exchanges, Binance offers a comprehensive suite of trading instruments, including futures and options. While it primarily focuses on major cryptocurrencies, its futures market occasionally features contracts for prominent X11 coins like Dash.

- Kraken: Known for its security features and user-friendly interface, Kraken provides futures trading for a select group of cryptocurrencies. Their educational resources can be particularly beneficial for those new to futures and options trading.

- Deribit: Exclusively dedicated to futures and options trading for cryptocurrencies, Deribit is a favorite among many professional traders. Its platform is designed to handle the complexities and demands of derivative trading.

- BitMEX: With a strong focus on leverage and advanced trading, BitMEX offers futures contracts for a range of cryptocurrencies. Their research and analysis section provides valuable insights into market trends.

Features to Consider When Choosing a Platform

- Liquidity: Higher liquidity ensures tighter bid-ask spreads, making it easier to enter and exit positions.

- Security: Given the risks associated with digital assets, choosing a platform with robust security measures, including two-factor authentication and cold storage, is crucial.

- User Experience: A user-friendly interface, coupled with efficient customer support, can significantly enhance the trading experience.

- Fees: Understanding the fee structure, including trading fees, withdrawal fees, and any hidden charges, is essential to ensure profitability.

- Educational Resources: For traders looking to deepen their understanding of futures and options, platforms offering webinars, articles, and tutorials can be invaluable.

The X11 Coin Advantage

While many platforms offer futures and options for mainstream cryptocurrencies, only a select few provide these services for X11 coins. This exclusivity can sometimes result in unique trading opportunities. For instance, news or updates specific to the X11 algorithm or one of its prominent coins can lead to price movements that aren’t mirrored in the broader crypto market. Traders attuned to these nuances can leverage these opportunities for potential gains.

While the world of futures and options trading for X11 coins is filled with potential, it’s also fraught with complexities. Choosing the right platform, armed with the necessary knowledge and tools, can be the first step towards a successful trading journey in this niche market.

Strategies for Successful Trading

Trading futures and options, especially in the volatile realm of X11 coins, requires not just knowledge but also a strategic approach. While every trader’s strategy might differ based on their risk appetite, goals, and market outlook, certain foundational principles can guide one towards more informed decisions.

Understanding Market Sentiments

- Technical Analysis: This involves studying price charts and using statistical measures to predict future price movements. Indicators like Moving Averages, Bollinger Bands, and the Relative Strength Index can provide insights into potential price trends for X11 coins.

- Fundamental Analysis: Delve deep into the intrinsic value of the coin. For X11 coins, this could involve understanding developments in the X11 algorithm, adoption rates, technological advancements, and regulatory news.

- Sentiment Analysis: Gauge the mood of the market. Tools like crypto-specific news aggregators or sentiment analysis platforms can help traders understand the prevailing market sentiment.

Risk Management Techniques

- Setting Stop-Losses: Determine a price level at which you’ll sell a coin to prevent further losses. This is especially crucial when trading with leverage, as it can help cap potential losses.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different X11 coins or even diversify across different types of crypto assets.

- Position Sizing: Only invest what you can afford to lose. It’s advisable not to commit too much of your capital to a single trade, especially in highly volatile markets.

Advanced Trading Strategies

- Hedging: If you hold a significant amount of an X11 coin and are concerned about its short-term price movement, you can take an opposite position in a futures contract to hedge your exposure.

- Straddles: In options trading, if you believe an X11 coin will move significantly but are unsure of the direction, you can buy both a call and a put option at the same strike price. This strategy can be profitable if the coin makes a large move in either direction.

- Swing Trading: Given the volatility of the crypto market, traders can capitalize on short- to medium-term price movements by entering and exiting trades based on perceived highs and lows.

Continuous Learning and Adaptation

The crypto landscape, with its rapid developments and shifts, demands continuous learning. Regularly updating oneself with the latest trading tools, market news, and educational resources can provide an edge.

Moreover, it’s essential to periodically review and adapt one’s trading strategies based on market performance and personal experiences. Keeping a trading journal can be beneficial in this regard, allowing traders to reflect on their decisions, understand their mistakes, and refine their strategies.

Regulatory Landscape and Considerations

As the crypto market matures, regulatory bodies worldwide are taking a keen interest in ensuring that the industry operates transparently and fairly. This is especially true for complex financial instruments like futures and options. For traders and investors in X11 coins, understanding the regulatory landscape is not just advisable—it’s essential.

Global Regulatory Overview

- United States: The Commodity Futures Trading Commission (CFTC) oversees futures markets, and it has classified cryptocurrencies as commodities. Any platform offering futures or options on cryptocurrencies, including X11 coins, must register with the CFTC. The Securities and Exchange Commission (SEC) may also have jurisdiction if the crypto assets are deemed securities.

- European Union: The European Securities and Markets Authority (ESMA) has issued various statements and guidelines regarding crypto assets and their derivatives. While the regulatory framework can vary among member states, there’s a general push towards more standardized regulations.

- Asia: Countries like Japan and South Korea have established regulatory frameworks for cryptocurrency trading, including futures and options. In contrast, China has taken a stricter stance, banning crypto derivatives trading altogether.

- Other Regions: From Australia’s proactive approach under the Australian Securities and Investments Commission (ASIC) to the more cautious stance in countries like India, the regulatory landscape is diverse and ever-evolving.

Key Regulatory Considerations

- Licensing and Registration: Ensure that the platform you’re using to trade futures or options on X11 coins is licensed and registered with the appropriate regulatory bodies.

- Consumer Protection: Some jurisdictions mandate that platforms implement specific measures to protect traders, such as maintaining segregated accounts or offering insurance on deposits.

- Tax Implications: Profits and losses from trading futures and options on X11 coins might be taxable events in many jurisdictions. It’s crucial to maintain accurate records and consult with a tax professional.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Procedures: Many platforms will require users to undergo identity verification processes to comply with AML and KYC regulations.

Conclusion

The dynamic landscape of X11 coins, underpinned by their robust algorithm, showcases a promising trajectory in the ever-evolving crypto market. These coins, combined with the strategic depth offered by futures and options, present traders with a myriad of opportunities. However, with these opportunities come challenges, notably the complexities of advanced trading instruments and the ever-shifting regulatory environment. As the crypto sector continues its march forward, a balanced approach—where technological innovation meets judicious trading and regulatory clarity—will be paramount.

In the grand tapestry of cryptocurrency trading, X11 coins and their associated futures and options stand out as vibrant threads, weaving a narrative of potential and resilience. For traders and investors, the key lies in continuous learning, strategic adaptation, and a keen understanding of the market’s nuances. As we look ahead, the fusion of knowledge, strategy, and caution will undoubtedly shape the future of X11 coin trading.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More