The digital revolution has ushered in an era of unprecedented financial opportunities, with cryptocurrencies at the forefront. As the adoption of digital currencies like Bitcoin, Ethereum, and countless altcoins continues to surge, the importance of securing these assets becomes paramount. Crypto wallets, the digital tools that allow users to store, send, and receive cryptocurrencies, are central to this ecosystem. However, as with any technological advancement, they come with their own set of security concerns. This introduction aims to shed light on the pressing security issues surrounding crypto wallets and offers insights into safeguarding your digital treasures.

A crypto wallet is a digital tool that allows users to interact with blockchain networks. It stores private and public keys, enabling transactions and monitoring balances. Think of it as a digital equivalent of a physical wallet, but instead of paper money, it holds cryptographic keys.

Types of Crypto Wallets

For a clearer understanding, let’s categorize crypto wallets into two main types:

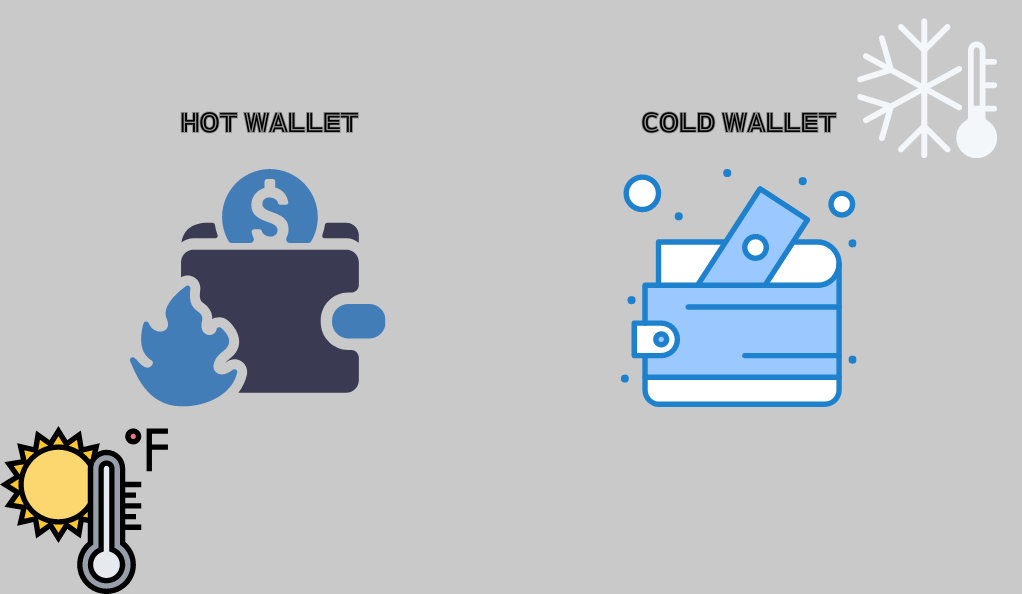

Hot Wallets

Hot wallets are digital wallets that are connected to the internet, providing easy access and convenience for daily transactions. They are considered less secure compared to cold wallets due to their online nature. Examples of hot wallets include:

- Desktop Wallets: These are installed on a personal computer or laptop. They provide control over private keys but are vulnerable to malware and hacking if the computer is compromised.

- Mobile Wallets: These are applications installed on smartphones. They allow users to manage cryptocurrencies on the go but can be at risk if the phone is lost or infected with malicious software.

- Web Wallets: Accessed through web browsers, these wallets are hosted by third-party providers. They are convenient for quick access but rely on the security measures of the hosting service.

Cold Wallets

Cold wallets are offline storage solutions that are not connected to the internet. They are considered more secure as they are less susceptible to online hacking attempts. Examples of cold wallets include:

- Hardware Wallets: These are physical devices like Ledger or Trezor that store private keys offline. They can be connected to a computer to make transactions but remain secure as the keys never leave the device.

- Paper Wallets: These are physical documents with printed keys. They are a simple and secure way to store cryptocurrencies but must be kept safe from physical damage or loss.

| Wallet Type | Pros | Cons |

|---|---|---|

| Hot Wallets | Easily accessible; Suitable for daily transactions | Vulnerable to online attacks; Risk of malware |

| Cold Wallets | Highly secure; Immune to online hacks | Less convenient for regular use; Risk of physical damage or loss |

Key Security Concerns in Crypto Wallets

- Phishing Attacks: Cybercriminals trick users into providing their private keys or login details.

- Malware: Malicious software that can log keystrokes or directly steal funds from hot wallets.

- Weak Passwords: Using easily guessable passwords or not changing default passwords can leave wallets vulnerable.

- Physical Theft: Cold wallets, especially hardware ones, can be stolen if not stored securely.

- Flawed Random Number Generators: Used in key generation, if predictable, can compromise wallet security.

The Importance of Private Keys

The private key is a cryptographic element that allows a user to spend the cryptocurrencies in their wallet. It’s akin to a digital signature, proving ownership of the assets. If someone else gains access to a user’s private key, they can easily transfer all the funds to another wallet, making it crucial to protect.

Safeguarding Your Digital Assets

- Regular Backups: Ensure you back up your wallet regularly and store multiple copies in different locations.

- Use Strong Passwords: Incorporate alphanumeric characters, symbols, and avoid using easily guessable words.

- Two-Factor Authentication (2FA): An additional layer of security where users need to provide two types of identification.

- Keep Software Updated: Ensure your wallet software and the devices they’re on are updated to protect against vulnerabilities.

- Be Wary of Phishing: Always double-check URLs and be cautious of suspicious emails or messages.

The Vulnerability of Libbitcoin Explorer: A Deep Dive into Crypto Wallet Security

The realm of cryptocurrencies is as vast as it is intricate. While the allure of digital currencies has captivated millions worldwide, the underlying technology and tools that support this ecosystem are often overlooked. One such tool, the Libbitcoin Explorer, recently came under scrutiny due to a significant security flaw. This article delves into the vulnerability of the Libbitcoin Explorer, its implications, and the broader concerns it raises for the crypto community.

Libbitcoin Explorer, often abbreviated as BX, is a command-line tool designed for advanced Bitcoin operations. It facilitates a range of functions, from key generation to transaction management, without necessitating a full node. For developers and seasoned crypto enthusiasts, BX is a valuable tool to interact directly with the Bitcoin network.

The Recent Security Flaw

In a startling revelation, security researchers detected a flaw in the Libbitcoin Explorer. This vulnerability, while technical in nature, has far-reaching consequences:

- Entropy Issues: The core of the flaw lies in the generation of private key entropy. Entropy, in cryptographic terms, refers to the randomness used in key generation. A higher entropy ensures that the key is unpredictable and, therefore, secure.

- Compromised Wallets: Due to the flaw, hackers could potentially predict or guess the private keys of wallets generated using the Libbitcoin Explorer. This predictability opens the door for unauthorized access and potential theft of funds.

The Scale of the Problem

The gravity of this flaw becomes evident when considering the number of crypto wallets that rely on the Libbitcoin Explorer for private key entropy:

- Widespread Usage: Many crypto wallets, especially those tailored for developers and advanced users, utilize the Libbitcoin Explorer for its robust features. The exact number is hard to pinpoint, but the potential scale of affected users is significant.

- Potential Fund Loss: With the private key being the gateway to a user’s funds, any compromise in its generation process can lead to unauthorized transactions. In the worst-case scenario, users could lose all their funds stored in the compromised wallets.

The Broader Implications

The vulnerability in the Libbitcoin Explorer is not just an isolated incident. It underscores the broader challenges in the crypto world:

- Trust in Tools: Many users place implicit trust in the tools and software they use. Incidents like this shake that trust and emphasize the need for continuous scrutiny and updates.

- The Need for Transparency: Open-source tools, while beneficial, need a community-driven approach to ensure they remain secure. Regular audits, community feedback, and prompt patching of vulnerabilities are crucial.

The Importance of Entropy in Wallet Security: A Comprehensive Analysis

In the intricate world of cryptocurrencies, the security of digital assets is paramount. While discussions often revolve around blockchain integrity, exchange security, and wallet protection, one fundamental aspect sometimes gets overshadowed: entropy. Entropy, especially in the context of crypto wallet security, plays a pivotal role in ensuring the safety of digital assets. This article delves deep into the concept of entropy, its significance in wallet security, and the potential risks associated with compromised entropy.

Deciphering Entropy in Cryptography

At its core, entropy is a measure of unpredictability or randomness. In the realm of cryptography, it refers to the randomness injected into the process of generating cryptographic keys.

Randomness as a Shield:

The more random a cryptographic key, the harder it is for malicious actors to predict or guess. This randomness acts as a shield against brute-force attacks, where attackers try every possible combination to access a wallet.

Source of Entropy:

Entropy can be derived from various sources, including hardware events, user inputs, or specialized hardware random generators. The quality of the source directly impacts the security of the generated key.

Entropy’s Role in Crypto Wallet Security

Crypto wallets, whether hot or cold, rely on cryptographic keys for their operations. These keys, especially the private key, grant access to the funds within the wallet.

Key Generation:

When a new crypto wallet is created, it generates a pair of cryptographic keys: a public key, which is shared, and a private key, which remains confidential. The randomness or entropy used in this generation process determines the security of the private key.

Seed Phrases:

Many modern wallets use seed phrases, a set of words that can regenerate a wallet’s private key. The randomness in generating these seed phrases is crucial, as any predictability can compromise the wallet.

The Perils of Compromised Entropy

While the concept of entropy might seem abstract, its implications are very tangible:

Predictable Keys:

If the entropy source is compromised or not truly random, the generated keys become predictable. Predictable keys are susceptible to attacks, putting the wallet’s funds at risk.

Historical Incidents:

There have been instances in the crypto world where poor entropy sources led to wallet breaches. These incidents highlight the real-world consequences of overlooking entropy in security protocols.

Reputation Damage:

For wallet providers, compromised entropy can lead to significant reputation damage. Users trust these platforms with their assets, and any breach can erode this trust.

The Dangers of Frail Random Number Generators: A Critical Examination

In the cryptographic landscape, the tools and algorithms that underpin the security mechanisms are as crucial as the security protocols themselves. One such tool, the Random Number Generator (RNG), plays a pivotal role in ensuring the robustness of cryptographic systems, especially in crypto wallets. However, not all RNGs are created equal. The use of frail or weak RNGs can introduce vulnerabilities, compromising the very essence of security they’re meant to uphold. This article delves into the dangers associated with frail RNGs, their impact on wallet security, and the broader implications for the crypto ecosystem.

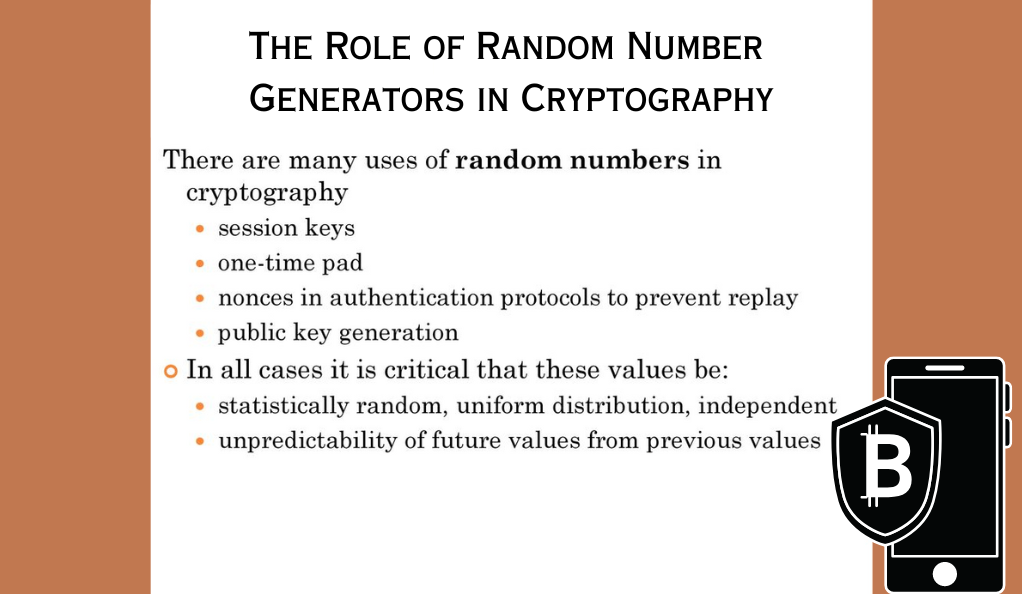

The Role of Random Number Generators in Cryptography

Random Number Generators are algorithms or hardware devices that produce a sequence of numbers that cannot be reasonably predicted better than by random chance.

Key Generation:

RNGs are fundamental in generating cryptographic keys, especially the private keys for crypto wallets. The unpredictability of these keys is vital for ensuring the security of the stored assets.

Nonce Generation:

In cryptographic operations, a nonce (number used once) is often required to ensure the uniqueness of certain operations. RNGs are crucial in generating these nonces.

The Perils of Weak RNGs

A frail or compromised RNG can have dire consequences:

Predictable Outputs:

If an RNG is not truly random, its outputs become predictable. Predictable RNG outputs can lead to predictable cryptographic keys, making them susceptible to attacks.

Reduced Key Space:

A weak RNG might not utilize the full potential key space. For instance, instead of generating keys with 256-bit security, it might only achieve 32-bit security, drastically reducing the number of potential key combinations and making brute-force attacks feasible.

Real-world Implications

The theoretical dangers of weak RNGs have manifested in real-world incidents:

Breached Wallets:

Over the years, the crypto community has witnessed several instances where wallets were compromised. One of the primary reasons behind these breaches has been the use of compromised or insufficiently random RNGs in the key generation process. When the randomness of an RNG is predictable, it becomes a vulnerable point, allowing malicious actors to exploit this weakness and gain unauthorized access to wallets.

Loss of Funds:

The implications of predictable RNG outputs are not just theoretical. In practice, when cryptographic keys become predictable, it opens the door for unauthorized access. Malicious actors, armed with this predictability, can potentially access and transfer funds without the owner’s knowledge. For many unsuspecting users, this has resulted in the complete loss of their stored assets, leading to financial setbacks and a loss of faith in the security of digital currencies.

Erosion of Trust:

Beyond the immediate financial implications, there’s a broader impact on the reputation of crypto platforms and wallet providers. When security incidents, especially those tied to weak RNGs, come to light, they can significantly erode user trust. Users place immense trust in these platforms to safeguard their assets. Any breach or vulnerability can lead to a widespread loss of confidence, making users hesitant about using the platform in the future. This erosion of trust can have long-term repercussions, affecting the platform’s reputation, user base, and overall standing in the crypto community.

The Path Forward

Recognizing the dangers of frail RNGs is the first step. The crypto community and platform providers must:

Audit and Review:

It’s imperative for crypto platforms and organizations to regularly audit their Random Number Generators (RNGs). This involves rigorous testing and review processes to ensure that the RNGs are functioning optimally and producing genuinely random outputs. Regular audits can identify potential vulnerabilities or deviations early on, allowing for timely interventions and ensuring the security of cryptographic processes.

Hardware RNGs:

While software-based RNGs are common, there’s a growing trend towards using hardware-based RNGs. These RNGs derive their randomness from physical processes, such as electronic noise or atomic decay. Because of their reliance on inherently unpredictable physical phenomena, hardware RNGs often offer a higher degree of randomness and unpredictability compared to their software counterparts. For critical applications, especially where large assets are at stake, considering the integration of hardware RNGs can provide an added layer of security.

Stay Updated:

The field of cryptography is dynamic, with researchers continuously exploring new techniques, identifying vulnerabilities, and proposing solutions. As such, it’s crucial for individuals and organizations in the crypto space to stay abreast of the latest research and findings. By staying updated, they can adapt to new threats, patch identified vulnerabilities, and ensure that their RNGs and cryptographic processes remain state-of-the-art. This proactive approach not only safeguards assets but also bolsters user trust and confidence in the platform’s commitment to security.

Historical Breaches and Their Impact: A Retrospective on Crypto Wallet Security

The cryptocurrency landscape, while promising unparalleled financial opportunities, has not been without its share of challenges. One of the most pressing issues has been the security of crypto wallets. Over the years, several high-profile breaches have sent shockwaves through the community, leading to significant financial losses and eroding trust in the ecosystem. This article takes a retrospective look at these breaches, the lessons learned, and how the crypto community has evolved in response to these threats.

Notable Historical Breaches

The cryptocurrency landscape, while promising and revolutionary, has not been without its share of challenges. Over the years, several high-profile breaches have served as stark reminders of the vulnerabilities inherent in the digital realm. These incidents have not only led to significant financial losses but have also shaped the industry’s approach to security and user trust.

Mt. Gox (2014):

Once heralded as the world’s largest Bitcoin exchange, Mt. Gox became synonymous with one of the most infamous breaches in crypto history. In early 2014, the Tokyo-based exchange declared bankruptcy after revealing that hackers had allegedly siphoned off 850,000 Bitcoins from its coffers. At the time, this staggering amount was valued at over $450 million. The Mt. Gox debacle sent shockwaves through the crypto community, leading to widespread panic, plummeting Bitcoin prices, and heightened calls for regulatory oversight. The aftermath of this breach underscored the importance of robust security measures and the vulnerabilities of centralized exchanges.

Bitfinex (2016):

Two years after the Mt. Gox incident, the crypto world was rocked again by a breach at Bitfinex, a prominent Hong Kong-based exchange. Hackers managed to exploit vulnerabilities in the exchange’s multisignature wallet system. This security lapse resulted in the theft of 120,000 Bitcoins, which, at the time, had a combined value of approximately $72 million. The Bitfinex breach highlighted the risks associated with even sophisticated security systems like multisignature wallets and underscored the need for continuous security audits and updates.

Parity Wallet (2017):

Parity, a popular Ethereum wallet, faced a unique challenge in 2017. It wasn’t a typical hack, but a vulnerability in the wallet’s multi-signature contract. An individual accidentally triggered this vulnerability, leading to the freezing of over 513,000 Ether. At the prevailing market rates, this amounted to around $150 million. The funds, locked in the multi-signature wallets, became inaccessible to their owners. This incident brought to the fore the complexities and potential pitfalls of smart contract programming and emphasized the need for rigorous code reviews and testing.

Lessons Learned from the Breaches

Each breach, while devastating, offered valuable lessons:

- Importance of Cold Storage: Exchanges and wallet providers recognized the importance of keeping a significant portion of funds in cold storage, isolated from online threats.

- Multi-Signature Systems: While multi-signature systems add a layer of security, they are not infallible. It’s crucial to regularly audit and update these systems.

- User Education: Many breaches exploited user ignorance or carelessness. There’s been a renewed emphasis on educating users about best security practices.

The Continuous Evolution of Threats

As the crypto ecosystem evolves, so do the threats:

- Sophisticated Phishing Attacks: Attackers have become adept at creating convincing fake websites or communication channels to trick users into revealing sensitive information.

- Smart Contract Vulnerabilities: As the DeFi (Decentralized Finance) sector grows, vulnerabilities in smart contracts have become a new frontier for hackers.

- Ransomware and Cryptojacking: Malicious actors have leveraged ransomware to lock users out of their systems, demanding cryptocurrency as ransom. Similarly, cryptojacking involves using a victim’s computing resources to mine cryptocurrencies without their knowledge.

The Path Forward: Building a Resilient Ecosystem

The world of cryptocurrencies, while filled with potential, has also faced its share of challenges. However, the resilience and adaptability of the crypto community have consistently shone through, especially in the face of security breaches and threats. The community’s proactive and collaborative approach to these challenges offers a blueprint for building a more secure and resilient ecosystem.

Regular Audits:

In the aftermath of high-profile breaches, there’s been a renewed emphasis on security within the crypto space. Exchanges, wallet providers, and other crypto platforms now prioritize regular security audits. These audits, often conducted by third-party experts, delve deep into the platforms’ systems, identifying potential vulnerabilities and weaknesses. By proactively seeking out and rectifying these vulnerabilities, platforms not only enhance their security but also rebuild trust with their user base.

Collaborative Defense:

One of the defining features of the crypto community is its collaborative spirit. In the face of threats, this community often comes together, transcending competitive boundaries. Information about emerging threats, vulnerabilities, and best practices is shared widely, creating a collective defense against malicious actors. This collaborative approach amplifies individual efforts, ensuring that the entire ecosystem benefits from the knowledge and vigilance of its members.

Innovative Solutions:

The crypto world is synonymous with innovation. In response to security challenges, a plethora of innovative solutions have emerged. Hardware wallets, for instance, offer users a way to store their private keys offline, safeguarding them from online hacks. Decentralized exchanges reduce the risks associated with centralized platforms, distributing the trading process across multiple nodes and eliminating single points of failure. As the industry continues to evolve, it’s evident that innovation will remain at the forefront, continuously offering users safer, more efficient ways to manage and trade their digital assets.

Popular Wallets: Are They Safe? A Comprehensive Analysis and User Guide

The rise of cryptocurrencies has led to a proliferation of digital wallets designed to store, manage, and transact these digital assets. Among the myriad options available, certain wallets like MetaMask, Ledger, and Trezor have emerged as popular choices for both novices and seasoned crypto enthusiasts. But with popularity comes scrutiny. How safe are these wallets? This article delves into the safety features of these prominent wallets and offers recommendations for users to maximize their security.

MetaMask: The Browser Extension Wallet

Overview: MetaMask is a browser extension wallet that supports Ethereum and ERC-20 tokens. It integrates seamlessly with popular browsers, facilitating easy access to decentralized applications (dApps).

Safety Analysis:

- Seed Phrases: MetaMask uses a 12-word seed phrase for recovery, ensuring users can always access their funds.

- Encrypted Private Keys: The private keys are encrypted and stored locally on the user’s device, not on a central server.

- Phishing Threats: Being a browser extension, MetaMask users are often targeted by phishing sites. Users must be cautious and ensure they’re on the official MetaMask site or app.

Ledger: The Hardware Titan

Overview: Ledger, with its popular models like Ledger Nano S and Nano X, is a hardware wallet, meaning it stores the user’s private keys on a physical device.

Safety Analysis:

- Cold Storage: Being a hardware wallet, Ledger operates in cold storage, making it immune to online hacks.

- Secure Element: Ledger devices come with a certified secure chip that ensures the private key never leaves the device.

- Physical Verification: Transactions require physical confirmation on the device, adding an extra layer of security.

Trezor: Pioneering Hardware Security

Overview: Trezor, another heavyweight in the hardware wallet category, offers models like Trezor One and Trezor Model T.

Safety Analysis:

- Pin Protection: Trezor devices are protected by a PIN, ensuring that even if the device is lost, funds remain secure.

- Open-Source: Trezor’s software is open-source, allowing for community scrutiny and rapid response to vulnerabilities.

- Recovery Seed: Like Ledger, Trezor uses a seed phrase (12-24 words) for recovery, ensuring users can regain access to their funds even if the device is lost.

Recommendations for Users:

- Backup Regularly: Always backup your wallet, especially after creating new addresses or making significant changes.

- Use Official Sources: Only download wallet software or apps from official websites or trusted app stores.

- Update Firmware: For hardware wallets like Ledger and Trezor, regularly update the firmware to benefit from the latest security enhancements.

- Beware of Phishing: Be cautious of emails, messages, or sites asking for your seed phrase or private keys. Legitimate wallet providers will never ask for this information.

- Multi-Factor Authentication: Where possible, enable multi-factor authentication (MFA) for an added layer of security.

- Physical Security: For hardware wallets, store them in a safe place, preferably in a secure location like a safe.

Best Practices for Ensuring Wallet Security: A Comprehensive User Guide

The dynamic world of cryptocurrencies offers immense opportunities, but it also presents unique challenges, especially when it comes to security. With digital assets becoming increasingly valuable, ensuring the safety of one’s crypto wallet is paramount. While wallet providers incorporate various security measures, users play a crucial role in safeguarding their assets. This article outlines best practices for ensuring wallet security and emphasizes the importance of staying abreast of the latest security updates.

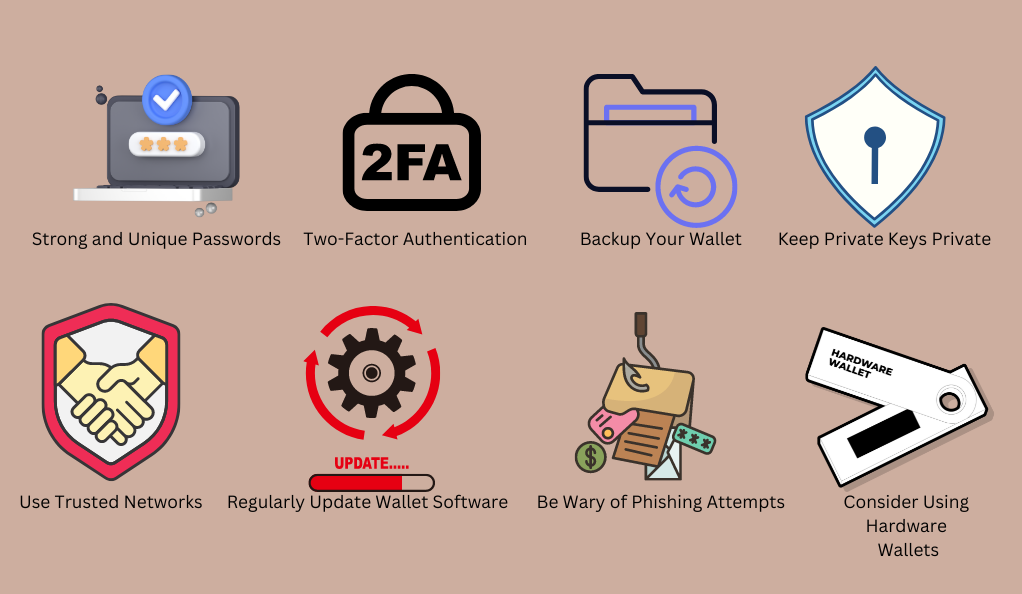

Strong and Unique Passwords

- Complexity: Use a combination of uppercase and lowercase letters, numbers, and symbols to create a strong password.

- Avoid Common Words: Refrain from using easily guessable words or phrases. Consider using a passphrase or a combination of random words.

- Regular Changes: Periodically update your password to reduce the risk of unauthorized access.

Two-Factor Authentication (2FA)

- Additional Layer: 2FA provides an extra layer of security by requiring two types of identification before granting access.

- Authenticator Apps: Use apps like Google Authenticator or Authy, which generate time-sensitive codes, rather than relying solely on SMS-based 2FA, which can be vulnerable to certain attacks.

Backup Your Wallet

- Seed Phrases: Ensure you have a backup of your wallet’s seed phrase. This set of words allows you to recover your wallet if you lose access.

- Multiple Copies: Store multiple copies of your backup in different locations, ensuring at least one is kept offline to prevent digital theft.

Keep Private Keys Private

- Never Share: Your private key is the gateway to your funds. Never share it with anyone or enter it on suspicious websites.

- Offline Storage: Consider storing your private key offline, either written down or on a secure USB drive, away from internet access.

Use Trusted Networks

- Avoid Public Wi-Fi: Refrain from accessing your crypto wallet on public or unsecured Wi-Fi networks, which can be prone to eavesdropping.

- VPN: If you must use a public network, ensure you connect through a trusted VPN to encrypt your data.

Regularly Update Wallet Software

- Latest Features: Wallet updates often come with new features, improved user experience, and enhanced performance.

- Security Patches: More importantly, updates often fix known vulnerabilities. Staying updated ensures you’re protected against these vulnerabilities.

Be Wary of Phishing Attempts

- Check URLs: Always double-check the URL when accessing your online wallet or any crypto-related site. Phishers often create websites that look identical to popular platforms but have slightly altered URLs.

- Suspicious Emails: Be cautious of emails claiming to be from your wallet provider or any crypto service, especially those that ask for personal information or urge immediate action.

Consider Using Hardware Wallets

- Cold Storage: Hardware wallets, like Ledger and Trezor, store your private keys offline, making them immune to online hacks.

- Physical Verification: Transactions on hardware wallets require physical confirmation, adding an extra layer of security.

The Future of Crypto Wallet Security: Challenges and Innovations Ahead

The cryptocurrency landscape is in a constant state of flux, driven by technological advancements, market dynamics, and evolving security threats. As digital assets continue to gain prominence and adoption, the security of crypto wallets becomes even more critical. Predicting the future is always a challenge, but certain trends and innovations are emerging that will shape the future of crypto wallet security. This article delves into the anticipated challenges and the innovations poised to address them.

Anticipated Security Challenges

Sophisticated Phishing Attacks:

The digital age has seen a surge in phishing attacks, where malicious actors attempt to deceive users into revealing sensitive information. As the general public becomes more educated about traditional phishing tactics, attackers are forced to innovate. We’re now witnessing the emergence of highly sophisticated phishing methods. Techniques such as deepfakes, which involve creating hyper-realistic but entirely fake content, or AI-driven communication tools, can be used to impersonate trusted entities or individuals. These advanced methods can be incredibly convincing, making it even more challenging for users to discern genuine communications from malicious ones. It underscores the importance of continuous education and vigilance among users and the need for platforms to implement advanced security measures.

Quantum Computing Threats:

Quantum computing, with its potential to perform complex calculations at speeds unimaginable with today’s computers, also poses significant threats to the world of cryptography. Current cryptographic algorithms, which form the backbone of crypto wallet security, rely on mathematical problems that are hard for classical computers to solve. However, quantum computers could, in theory, solve these problems much more quickly, potentially breaking certain encryption methods that are considered secure today. This looming threat emphasizes the need for the crypto industry to invest in post-quantum cryptography and be prepared for a future where quantum computers are mainstream.

Decentralized Finance (DeFi) Vulnerabilities:

The rise of Decentralized Finance (DeFi) platforms has democratized access to financial services, eliminating intermediaries and offering more inclusive financial solutions. However, this rapid growth and innovation come with new challenges. DeFi platforms, especially those relying on smart contracts, can have vulnerabilities. If these vulnerabilities are exploited, it can lead to significant losses for users. Past incidents, where coding errors or oversights in smart contracts were taken advantage of, have resulted in millions of dollars in losses. These incidents highlight the importance of rigorous smart contract auditing and the need for platforms to prioritize security as much as innovation.

Increased Target on High-Value Wallets:

With the meteoric rise in the value of cryptocurrencies, high-value crypto wallets, often referred to as “whale wallets,” have become attractive targets for malicious actors. These wallets, which hold substantial amounts of digital assets, can be prime targets for coordinated and advanced attacks. Sophisticated hacking groups might employ a combination of techniques, from social engineering to advanced malware, to gain access to these wallets. For individuals and institutions holding large amounts of crypto, this underscores the need for multi-layered security protocols, regular security audits, and heightened vigilance.

Innovations on the Horizon

- Post-Quantum Cryptography: Researchers are already working on cryptographic algorithms that are resistant to quantum computer attacks, ensuring that wallet security remains robust even in a post-quantum world.

- Biometric Security: Future wallets might rely more on biometric verification, such as fingerprints, retina scans, or voice recognition, adding an additional layer of security that’s unique to each user.

- Decentralized Identity Verification: Blockchain-based identity systems can provide a secure way for users to verify their identity without exposing sensitive personal information.

- AI-Powered Threat Detection: Advanced AI algorithms can monitor wallet activities in real-time, detecting and alerting users to any suspicious activities.

The Role of Community and Collaboration

- Open-Source Collaboration: The crypto community’s collaborative spirit, especially in open-source projects, will play a pivotal role in identifying vulnerabilities and developing solutions.

- Security Audits and Bug Bounties: Regular third-party security audits and incentivized bug bounty programs will become standard, encouraging the community to find and report vulnerabilities.

User Education and Empowerment

- Security Workshops: As the user base grows, there will likely be a surge in workshops, webinars, and courses focused on crypto wallet security.

- Integrated Security Tutorials: Wallet providers may integrate interactive security tutorials and simulations within their platforms, ensuring users are aware of best practices.

Conclusion

The realm of cryptocurrency, while brimming with potential and innovation, is not without its challenges, especially in the domain of wallet security. As we gaze into the future, it’s evident that the tug-of-war between security threats and protective measures will intensify. However, the combined forces of technological advancements, community collaboration, and user education paint a hopeful picture. While the road ahead will undoubtedly present hurdles, the crypto community’s resilience and adaptability promise a future where digital assets can be held and transacted with enhanced confidence and robust security. As we navigate this evolving landscape, continuous vigilance, collaboration, and education will be our guiding stars, ensuring that the promise of cryptocurrencies is realized in its fullest, safest potential.

At axerunners.com, our goal is to furnish well-rounded and trustworthy information regarding cryptocurrency, finance, trading, and stocks. Nonetheless, we avoid providing financial advice and instead encourage users to conduct their own research and meticulous verification.

Read More